(Alliance News) - London's FTSE 100 opened higher on Friday, with NatWest leading the charge, though gains were largely broad-based ahead of a US inflation reading to come.

The FTSE 100 index traded up 49.48 points, or 0.6%, at 8,235.83. The FTSE 250 rose 68.97 points, 0.3%, at 20,953.32, while the AIM All-Share added 2.01 points, 0.3%, at 775.04.

The Cboe UK 100 was up 0.7% at 822.05, the Cboe UK 250 added 0.4% to 18,369.57, and the Cboe Small Companies rose slightly to 17,017.42.

The CAC 40 in Paris rose 0.5%, while Frankfurt's DAX 40 traded 0.1% lower.

US equities ended mixed on Thursday, with tech once again underperforming. The Dow Jones Industrial Average rose 0.2%, but the S&P 500 lost 0.5% and the Nasdaq Composite shed 0.9%.

In Asia on Friday, the Nikkei 225 ended 0.5% lower, while the S&P/ASX 200 added 0.8%. In China, the Shanghai Composite rose 0.1%. The Hang Seng in Hong Kong was also up 0.1% shortly before the closing bell there.

The pound was quoted at USD1.2868 early Friday, down from USD1.2882 at the time of the London equities close Thursday. The euro was largely unmoved at USD1.0851 from USD1.0860. Against the yen, the dollar rose to JPY154.02 from JPY153.88.

The latest US personal consumption expenditures index is released at 1330 BST. The Fed's preferred inflation gauge is the core personal consumption expenditures. That year-on-year reading is expected to show the rate of inflation eased to 2.5% in June, from 2.6% in May.

Lloyds Bank analysts commented: "Economists are almost evenly divided about whether the headline PCE deflator measure of inflation will be 0.0% month-on-month or 0.1% m/m for June. It is the same story for core – an equal split looking for 0.1% m/m versus the rest anticipating 0.2% m/m. Lloyds economists come down on the side of the lower outturn of 0.0% m/m for headline but the firmer 0.2% m/m outcome for core. That should leave headline PCE at 2.4% year-on-year and core at 2.5% y/y.

"How might markets react to any surprises? A 25bp fed funds cut is fully priced for September now and it feels like it would have to be a big miss to meaningfully alter that. So it is about the pace of cuts thereafter."

The Federal Reserve announces an interest rate decision next week Wednesday. It is expected to maintain the federal funds rate range at 5.25% to 5.50%.

In London, shares in NatWest pushed 7.0% higher. It raised its yearly outlook and announced a deal to acquire a mortgage portfolio from Metro Bank.

The lender reported total income of GBP7.13 billion for the first-half of 2024, down 7.7% on-year from GBP7.73 billion. Net interest income alone dropped 5.6% to GBP5.41 billion.

Pretax profit declined 16% to GBP3.03 billion from GBP3.59 billion. In the second-quarter alone, total income fell 5.0% annually to GBP3.66 billion, but beat company-compiled consensus of GBP3.41 billion. Pretax profit, which declined 14% to GBP1.70 billion, beat consensus of GBP1.26 billion.

NatWest raised its interim dividend by 9.1% to 6.0 pence per share from 5.5p. Looking ahead, it now expects to achieve a return on tangible equity above 14%, its outlook raised from "around 12%". Income excluding notable items to be around GBP14.0 billion, ahead of its previous forecast in the range of GBP13.0 billion to GBP13.5 billion.

NatWest said the deal with Metro Bank will see it snap up a GBP2.5 billion portfolio of prime UK residential mortgages.

Chief Executive Officer Paul Thwaite said: "Following today's announcement, we are acquiring GBP2.5 billion of prime residential mortgages from Metro Bank and, as a result, look forward to welcoming around 10,000 customers to NatWest group.

"This transaction is a further opportunity to accelerate the growth of our retail mortgage book within our existing risk appetite, with attractive returns. It is in line with our strategic priorities and builds on our recent acquisition from Sainsbury's Bank. We are focussed on a smooth transition and have a strong track record of successful integration with Metro Bank, following our previous acquisition of mortgages in 2020."

Metro Bank said the deal will "earnings, net interest margin and capital ratio accretive". Shares in the high street lender were 3.6% higher.

Engineering firm IMI climbed 1.6% on improved half-year earnings and the announcement of a GBP100 million buyback.

It said revenue in the first-half of 2024 rose 1.3% to GBP1.10 billion from GBP1.08 billion. Pretax profit improved 17% to GBP162.5 million from GBP138.5 million. IMI raised its interim dividend by 10% to 10.0p per share from 8.0p.

Miner Anglo American was also among those to climb, adding 1.4% after UBS raised it to 'buy' from 'neutral'.

Shell and BP rose 1.0% and 0.8%, tracking Brent prices higher. Brent oil was quoted at USD82.32 a barrel early Friday, rising from USD81.75 at the time of the London equity market close on Thursday.

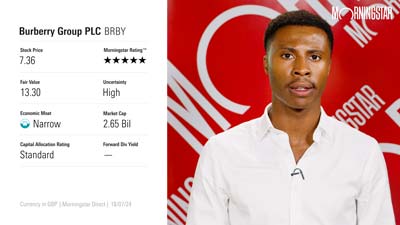

Burberry climbed 1.7%, as a report from Paris-listed post-close Hermes on Thursday helped calm some luxury goods market jitters. Hermes rose 2.1%, with its earnings not following the downturn trend set by the likes of Burberry, LVMH and Kering.

Drax jumped 14% as it announced a GBP300 million share buyback and predicted full-year adjusted earnings before interest, tax, depreciation and amortisation will hit the top end of a consensus range of GBP881 million to GBP996 million.

The electricity generator said its half-year revenue fell 19% to GBP3.16 billion from GBP3.89 billion. Pretax profit, however, shot up 37% to GBP463.2 million from GBP338.1 million.

"Drax has delivered a strong operational performance, playing an important role supporting the UK energy system with dispatchable, renewable power, keeping the lights on for millions of homes and businesses, while supporting thousands of jobs throughout our supply chain," CEO Will Gardiner said.

The firm lifted its interim dividend to 10.4p per share from 9.2p.

Brighton Pier tumbled 20%. It said footfall has suffered due to a wet start to the UK summer. The leisure and entertainment business, which operates Brighton Palace Pier, said footfall for the four weeks to July 21 was down 29% on-year.

"Despite a warm and sunny spell in the last week, and the successful implementation of charging non-residents GBP1 for admission to the pier during peak trading periods (both of which have alleviated some of the trading pressures on the pier), the group now anticipates that full year sales for the pier will be lower than previously expected," it warned. "The group has yet to trade the remaining six weeks of the summer season through to the end of August. This period has typically contributed a significant portion of annual group sales and earnings.

"However, despite the earnings from admission revenue, and the potential for improved weather in August, the group no longer believes the year to date sales and earnings shortfall will be recovered."

It now expects earnings before interest, tax, depreciation and amortisation for the full-year will be below market expectations.

Gold was quoted at USD2,369.48 an ounce early Friday, rising from USD2,366.60 at the time of the European equities close Thursday.

By Eric Cunha, Alliance News news editor

Comments and questions to newsroom@alliancenews.com

Copyright 2024 Alliance News Ltd. All Rights Reserved.