Investors attracted to the sector should be aware of its numerous current difficulties. For example, Bayer, a German pharmaceuticals company, had widely publicised problems with Lipobay, its anti-cholesterol drug, which led to a sharp decline in its share price.

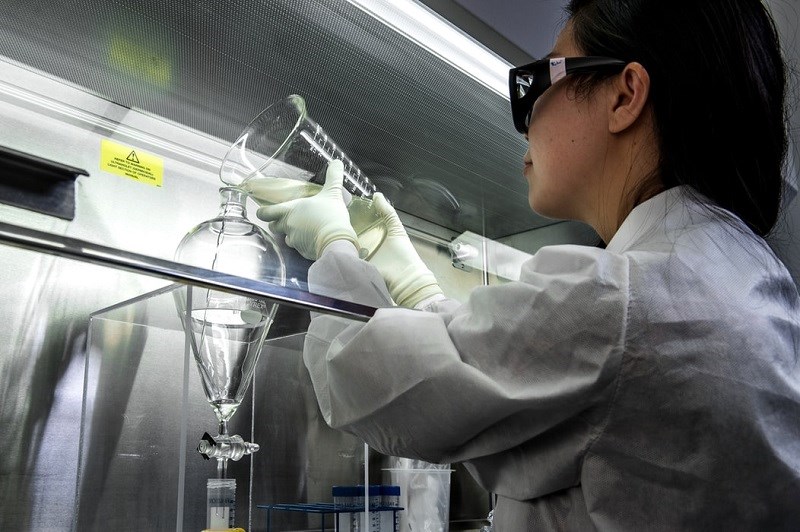

In the US the president has allowed federal funding for stem cell research

but only under strict conditions. He has warned that he will veto any bill that allows the creation of embryos with the sole aim of harvesting stem cells.

Biotechnology shares have also suffered substantial losses. The sector experienced a spectacular bubble in 1999 – the year when the human genome was deciphered and the Nasdaq Biotech index doubled – and through into early 2000. But from its peak in March last year the sector has suffered a sharp decline.

Attractive sector

In spite of its stockmarket performance the biotechnology sector continues to have a strong appeal for investors. Everybody is aware that the sector enjoys a huge growth potential. But unlike some other high growth sectors many biotech firms offer the prospect of substantial profits in the short term. In many cases their products are in the final stages of development or are even already on sale.

Besides, the expectations for the biotechnological sector rest on proven areas of demand. These include the ageing population and the increasing demand for medicines against currently incurable diseases such as Alzheimer’s, AIDS and certain forms of cancer.

In addition, the big pharmaceutical companies have an interest in biotechnology products as they have to launch new medicines every year (as current patents expire). In this respect, biotech firms complement their businesses well.

High risk

But investors who are considering the biotech sector need to be aware of the risks involved. As with all investments the greater the potential reward the higher the risk. These come in several forms within the sector:

- High volatility. For example, from the beginning of year, the MSCI Biotechnology Index has registered an average daily fluctuation of 2 % (on average the index has lost or gained 2 % a day) compared with a daily volatility of 0.8 % for the MSCI Pharmaceutical index. In fact, the biotechnology sector is much more correlated with technology one than with pharmaceuticals. This has some logic since what investors are discounting in the biotechnology sector as well as in the technology one is the potential for future growth (the pharmaceutical sector is more stable in terms of profits so is considered a defensive sector).

- Competitive risk. There is fierce competition between all the main laboratories. Each one is constantly investigating new pharmaceutical processes in an attempt to improve on current ones.

- Regulatory risk. The US Food and Drug Administration (FDA) is particularly important in this respect. FDA approval is necessary for medicines to be developed and sold in the US. So a rejection or postponement of such approval by the FDA usually leads to a sharp fall in the share price of the companies involved.

- Political risk. President Bush’s restrictive attitude towards stem cell research is perhaps the clearest example.

- Financial risk. The discovery of new medicines cost a lot of time and money. Michael Nawrath, the manager of the Credit Suisse Equity Fund Global (Lux) Biotech, estimates that "nowadays it takes between 10 and 12 years for a medicine to be launched on the market with a total cost of $800m (£550m)”.

Dominant companies

A few prominent biotechnology companies dominate the portfolios of funds investing in this area. These include:

- Amgen. Undoubtedly the largest biotech company in the world with well-known products such as Epogen (used to treat anaemia for patients under dialysis) and Neupogen (used to diminish the impact of infections during chemotherapy treatments against cancer). The company increased its profits $322m in the second quarter of this year.

- Biogen. Currently the company sells one product, Avonex, which is used to treat multiple sclerosis. But this product alone delivered a profit of almost $72m in the second quarter of this year. The company also has a product called Amevive, which is used to treat psoriasis, under development.

- Medimmune. The company lost $9m in the second quarter of this year despite the fact that the sales of its best-known product, Synagis (used against infantile respiratory infections), reached $15m.

- Seron. This firm, based in Switzerland, is the largest European biotech operation. Its two best-known products are Rebif (a competitor to Avonex) and Gonal-F (to induce ovulation). It made a profit of $104.2m in the second quarter of this year.

- Gilead Sciences. This company sells Tamiflu, an anti-flu medicine, along with Roche. It is also waiting for FDA approval to launch Tenofovir DF, an anti-AIDS drug. In the second quarter of this year it suffered a loss of $32.4m.

Fund investment

For the vast majority of investors it makes sense to use funds as a vehicle to access the biotech sector. Not only is it risky to invest in individual companies but it is also virtually necessary to be an expert in both finance and medicine to understand their businesses. Investment funds combine the advantages of diversification with expert management.

But it is also important to recognise that not all biotech funds are equal. Although most of them invest largely in American companies there are some with a substantial part of their portfolio in European companies. There are also funds that concentrate on the big names of the sector while others prefer smaller and less well-known companies.

Finally, many biotech funds include established pharmaceutical companies such as Johnson & Johnson, Merck, Novartis, Pfizer and Roche.

Fernando Luque is the senior financial analyst at Morningstar in Spain.