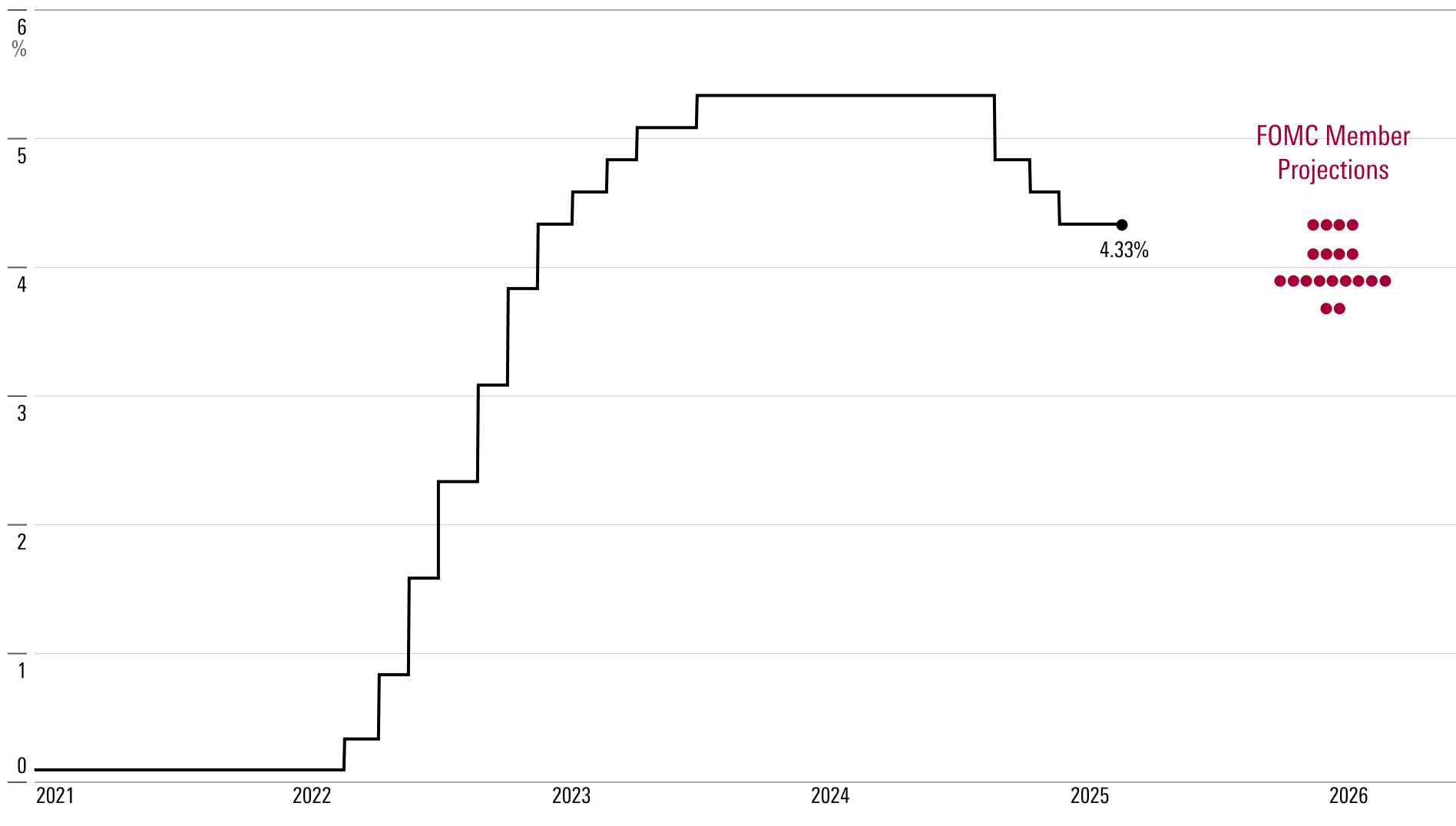

As widely expected, the Federal Reserve kept interest rates unchanged at Wednesday’s meeting. The federal-funds rate has been in the target range of 4.25%-4.50% since last December. The central bank cut by 1 percentage point from September to December 2024. That follows the period from July 2023 to September 2024, when rates were at 5.25%-5.50%. That rise from near 0% during the covid-19 pandemic constituted the largest rate hike in over 40 years.

Even with the downward adjustment last autumn, rates are still well above the prepandemic (2017-19) average of 1.7%. That divergence sets the expectation that the Fed will eventually enact further cuts. If the neutral interest rate is anywhere near its low prepandemic level, continued healthy economic growth will require lower rates.

But the timing of further cuts has been thrown into confusion by sticky inflation, especially the threat of a shock from tariff hikes. Additionally, changes in fiscal policy and regulation could be macroeconomically significant.

The FOMC stuck to its median projection of two rate cuts for 2025, followed by two more in 2026—unchanged from projections released last December. When pressed to substantiate the committee’s thinking, Fed Chair Jerome Powell essentially threw up his hands in exasperation. Given the near impossibility of anticipating where tariff policy will go, he rhetorically quipped, “What would you write down?” He suggested the extreme uncertainty around tariffs led many members to simply default to their existing forecasts.

All this should lead us to treat the FOMC forecast with a grain of salt. If further large tariffs are locked in place, the bank may throw its 2025 plan out the window.

Powell did provide a reasonable justification for the committee’s base case. The prospect of tariffs and some residual inflation stickiness in the opening months of the year have led the expected core PCE inflation in the fourth quarter of 2025 to rise to 2.8% year over year from 2.5%. Meanwhile, expectations for real GDP growth dipped to 1.7% from 2.1%, and the Fed isn’t expecting the inflationary impact of tariffs to persist. Altogether, that calls for an unchanged path for the federal-funds rate.

But as Powell is fully aware, tariffs could have larger, longer-lasting inflationary impacts than current Fed projections incorporate. He acknowledged that it’s “too soon to say” whether tariffs’ impact on inflation could persist beyond a one-time shock, which depends on how much inflationary expectations are unanchored from the Fed’s 2% target.

Our take is that outside of China, the tariff threat should prove more fizzle than pop. Conditional on that, we expect inflation to run below the Fed’s projection in 2025, which is why we call for a full three rate cuts in 2025. Continued deceleration in economic growth and inflation should then lead to four more cuts in 2026.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.