The latest UN Biodiversity Summit or COP16 in Colombia in October was a mixed event. While 119 nations signed up to binding biodiversity targets, the conference ended with a bitter row between rich and developing countries about who pays for damaged ecosystems.

What isn’t in dispute is the urgent need to avoid species extinction and further environmental destruction.

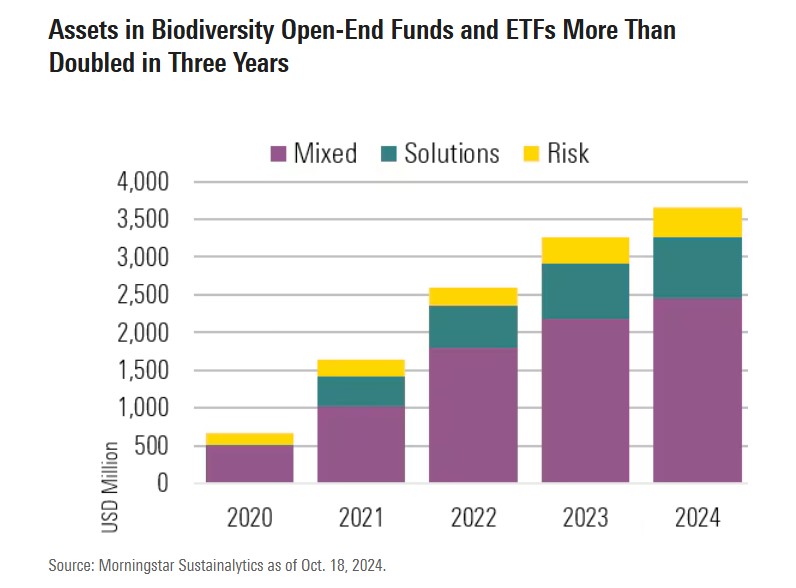

As this awareness grows, preserving biodiversity has become an investable theme. Global assets held in biodiversity open-ended funds and ETFs more than doubled over the last three years to around $3.7 billion [£2.84 billion].

However, according to Morningstar Sustainalytics data, despite its rapid growth, the size of the biodiversity fund universe is minuscule in comparison with the climate fund market, which is worth $520 billion.

“Biodiversity intersects with other themes and with climate change. But climate change is stealing the show when it comes to priority. So, hopefully, COP16 will act as a catalyst in accelerating disclosure and the integration of biodiversity,” Hortense Bioy, head of sustainable investing research at Morningstar says.

In a report published last month, Bioy divides biodiversity funds into three categories, risk-oriented, mixed and solutions-focused.

“Risk-oriented funds typically invest only in companies that aim to reduce their negative impact on biodiversity. Risk-oriented funds also typically exclude companies involved in activities that harm ecosystems,” she says.

“Meanwhile, solutions-focused funds target companies that help to protect and restore biodiversity through their products or services.”

Leading Funds for Biodiversity

The Robeco Biodiversity Equities Fund, which has a Morningstar Medalist Rating of Silver, is the biodiversity fund with the highest Morningstar rating available in Europe.

The fund’s top holding is France’s Veolia Environnement SA VIE, the world’s largest water company, at 5.05%.

According to Morningstar data, the fund has experienced inflows of over €1.9 million [£1.58 million] in the year to date and has gained 7%, beating the Morningstar Ecology category.

The BNP Paribas Easy ESG Eurozone Biodiversity Leaders PAB Fund has a Bronze Rating.

The fund’s top holding is German software giant SAP which sits at 10.7% of the portfolio

The fund has gained 12.37% in the year to date and over that same period, it saw €29 million in outflows.

Obstacles for Biodiversity Funds

For Morningstar’s Bioy, there are two obstacles impeding biodiversity from accessing the capital it needs: the lack of data, as well as lack of interest from the US.

“What we’re seeing on the investment opportunity side is that there’s very little progress that is made there. The lack of data availability is one of the challenges, the fact that there are no standards and no single set of metrics for investors to turn to. And the development is all happening in Europe,” she says.

Nevertheless, she feels the key to boosting investor engagement is through legislative change. The push to preserve biodiversity cannot solely come from the financial services industry but from government-made policy.

Competing interests between companies that want to accelerate the green transition and those who want to slow it down have also shackled governments, stagnating the progress the world needs to make.

Did COP 16 Make A Difference?

Nonetheless, Lindsey Stewart, director of stewardship research and policy for Morningstar Sustainalytics, was sceptical that COP16 would make much of a difference.

“A lot [would have had to] depend on the kind of framework that the countries [agreed on], [to] determine the way that investors and countries will start to look at this,” he says.

However, the conference ended on a down note after rich countries blocked a proposal to develop a fund that would assist poorer nations in restoring their damaged natural environments.

The decision left African and Latin American nations furious and many refused to continue to engage in talks on other pressing subjects.

In addition, the event saw record numbers of business representatives and lobbyists from a range of industries. A total of 1,261 industry delegates descended on Colombia for the conference, more than double the 613 that attend the UN’s biodiversity conference in 2022.

However, there were some wins at the conference including an agreement which recognizes the key role that Indigenous Peoples and people of African descent play in biodiversity conservation.

Capital is Not Free

Yet for Stewart, the subject of materiality, how businesses report and track the costs of the natural resources they depend on, is still an elusive question that needs to be addressed.

“The way business is done in the world, natural capital is treated as though it is free. You might have to pay somebody to access their property rights. But if you find some natural resource, generally you do not have to account for its cost to nature. And so, to build a financial materiality case for something you have been able to access for free for centuries is very difficult.”

When compared with climate change, there is infrastructure such as the Financial Stability Board, an organization of global central banks, that looks at the key economic and macro impacts of climate change on the global economy.

Stewart concedes that the regulatory response to climate has been slow, but there has been a political impetus driving the movement, momentum that biodiversity as a theme despite COP 16 has yet to experience.

The Impact on Human Economies

Yet, with all the noise around COP16, Gayaneh Shahbazian, biodiversity engagement manager at Morningstar Sustainalytics, wants people to recognize the main issue is the continual destruction of our ecosystem.

“In the last 50 years, wildlife populations have plummeted by over 70%. This dramatic decline is not only a tragedy but also a stark warning,” she says.

The continued destruction of biodiversity could lead to the complete destruction of essential services that humans depend on for life from access to clean drinking water to climate regulation.

“These services have been treated as externalities and overlooked in political and economic decision-making, yet they support everything from global food production to business resilience in the face of climate change. The consequences of degrading nature beyond these tipping points will be catastrophic for both society and the economy,” she says.

Biodiversity Fund Trends

“The overall trend for biodiversity-solutions funds remains positive,” Bioy concludes.

“Investor surveys show that there is still an appetite for investments that seek positive environmental outcomes and have the potential to deliver alpha at the same time.

“Companies offering products and services that contribute positively to the protection and restoration of natural ecosystems will benefit from the growing need to address the biodiversity crisis in years to come.”

At the same time, she says that progress in factoring biodiversity risk into investment decisions remains slow, despite this being in the top three of investor risks in the next decade (World Economic Forum report).

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.