With the recent flurry of thematic launches targeting cutting-edge tech from generative AI to genomics, you'd be forgiven for thinking that thematic funds were a relatively recent concept. But believe it or not, thematic funds can be traced back to at least 1948, when the Chicago-based Television Shares Management Corp., looking to capitalize on the nascent television industry, launched The Television Fund.

In the decades that followed, more thematic funds emerged, each reflecting the sometimes weird and wonderful investment ideas of that era.

The 50s saw the arrival of atomic and nuclear funds while the 60s saw the launch of one fund targeting underwater farming and communities, which against all odds survived until the early 90s.

Throughout the century, thematic funds have remained on the fringes of the mutual fund industry, representing only a tiny fraction of the market by number and size.

The first meaningful wave of thematic launches came with the internet funds riding the "dot-com" wave in the late 90s/early 00s.

In a few decades, when people look back at the thematic fund launches of the 2010s and 2020s, they'll see a snapshot of the trendiest investment opportunities and topics during this era; artificial intelligence, blockchain, metaverse, cannabis products, and the commercialization of space travel, to name a few.

What is Thematic Investing?

Thematic investing has many forms, from buying single stocks to investing in specific thematic funds. A thematic investment fund explicitly selects its holdings based on exposure to one or more environmental, technological, or societal structural trends that transcend the traditional business cycle.

In recent years, the global menu of thematic funds has experienced unprecedented growth. The result? A steady supply of increasingly niche and complex investment strategies from asset managers alongside increased demand from investors for greater clarity around how these funds should be categorized, benchmarked and used. As many funds define and track their theme differently, investors are also getting to grips with the need for more in-depth due diligence processes.

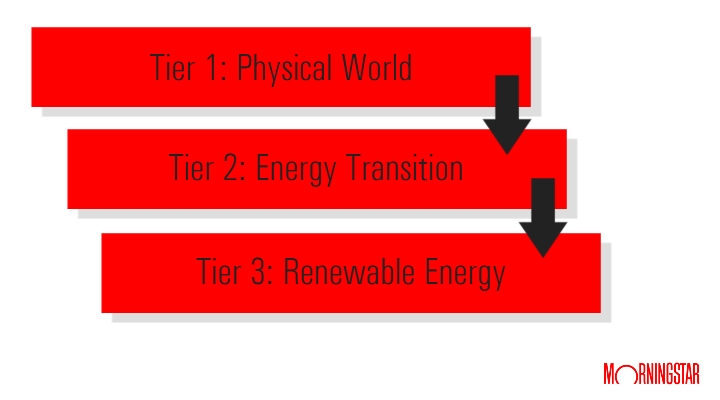

That's where Morningstar comes in. Through industry-leading research from analysts like Kenneth Lamont, and our data platform Morningstar Direct, we've devised a three-tier classification system comprised of incrementally granular tags.

Tier one focuses on four broad themes:

1. Technology (e.g. robotics, AI, and fintech)

2. Physical World (e.g. climate-focused initiatives)

3. Social (e.g. politics, demographics, and wellness)

4. Broad Thematic: funds that track multiple themes across the above areas

Tier 2 establishes a more nuanced theme within that category, while Tier 3 allows you to go even deeper with a sub-theme. For example:

The European Fund Landscape

Thematic funds saw a meteoric rise in popularity on a global scale around the time of the covid-19 pandemic, garnering unprecedented inflows. During this time, technology and physical world themes were especially popular amongst European-domiciled funds.

But since this pandemic peak, inflows have started to dwindle, with thematic funds experiencing significant outflows from late 2023. The physical world theme, which contains several sustainability-focused sub-themes, from clean tech to solar and wind, has suffered a notably higher level of outflows compared to the other themes.

How do I Know if Thematic Funds Are Right For me?

Investors need a deep understanding of risks and potential rewards when investing in thematic funds. Established characteristics of "success" remain, namely, low cost, a well-regarded parent organization, and an experienced management team, but an additional layer of due diligence is essential.

If used correctly, thematic funds can allow investors to make targeted bets while aligning their portfolios with their interests and preferences (like ESG). When replacing a single stock bet in a portfolio, a thematic fund can diversify away stock-specific risk while retaining desirable exposure to the target theme.

But thematics don't come without risk. In fact, there's a few things to be aware of.

Historically, the odds of a thematic fund surviving and beating a broad market benchmark over longer periods have been low. You can increase your chances of success by picking a fund run by an asset manager you trust to keep the fund open even in periods of extended underperformance.

Thematic funds can be highly volatile, and potentially outsized returns come with increased downside risks too. Thematic positions should not represent more than a small part of a diversified investment portfolio.

Picking the right theme is trickier than you think. Is there a compelling evidence-based growth narrative or is it all hype? Despite the fanfare and a flurry of launches targeting the theme, the metaverse fell out of favor almost as quickly as it arrived. Investors must understand the characteristics of the theme itself. For example, we can all imagine the exponential upside to AI technology, but there are significant risks to growth too, such as regulation and IP complications which need to be factored into your evaluation.

Picking the right fund matters. Different approaches to tracking a theme can lead to very different investment outcomes, and it can be hard to compare funds. To that end, the Morningstar Thematic Fit Score can help highlight funds which are closely aligned to their theme.

You can pick the right fund tracking the right theme, but if you don't use it sensibly, you can still end up empty-handed. Investors have repeatedly shown themselves to be poor at timing markets, and that's especially true when it comes to thematic funds, as shown in the Morningstar research paper The Big Shortfall. In-built narratives encourage investors to play into the hype cycle and elevated volatility exacerbates losses from poor investment decisions.

Which Thematics Are Popular Right Now?

We know that global events can make or break a thematic fund. Perhaps nowhere is this more evident than in defence-themed funds.

A recent FT article by Morningstar analysts Kenneth Lamont and Michael Field examines how geopolitical instability and conflict—from Ukraine and the Middle East to China and Taiwan – means global players are looking to bolster their defences, from traditional arms to cybersecurity.

Coupled with a demand from the US presidential candidate Donald Trump that all 32 members of NATO raise their defence spending from 2 per cent to 3 per cent of GDP, defence-themed funds are very much part of a long-term investment strategy.

While defence-themed funds may work for your portfolio, you have to consider the purity level. As Lamont and Field note, the DFND fund lists Boeing and Airbus among its top holdings. While Boeing and Airbus operate in the defence space, they also have commercial businesses, lowering the thematic purity level. And this matters.

Boeing has been in the news a lot recently, from grounded fleets to missing bolts resulting in doors blowing out mid-flight. As the narrative around Boeing's commercial business has soured, the effect has been felt on their share price, which has dropped 25 per cent. This is a clear case for why investors should scrutinize the individual holdings within a thematic fund before making a decision. Your theme might be popular, but unwanted exposures could blow you off course.

How Morningstar Direct Can Help Thematic Investors

The idiosyncratic nature of thematic funds has historically made them hard to classify, making it tricky to screen and compare funds tracking the same theme.

At Morningstar, our three-tier classification system maps the thematic universe, with users able to screen all equity funds across the suite of thematic taxonomy in Morningstar Direct. The datasets are enriched by comprehensive research from our analysts which are published within Direct Compass.

Once they select the relevant theme and sub-theme, like Ageing Population, AI or Urbanization, Morningstar Direct users can pull in additional data points to drill down further into a fund's performance. Characteristics such as industry concentration, sector and asset class, and investment style all help a user assess whether the fund aligns with their strategy and objectives.

But the analysis doesn't stop there. Fund selectors can explore fund-specific reports which use our 3 pillars of assessment—process, people, and parent—to generate a conviction rating about overall future performance.

All this investment research and data comes together to help investors interested in thematic funds develop an understanding of the landscape, from trends and flows to risks and volatility, and enables them to contextualize, compare, and communicate their thematic investment strategy.

Find out more about navigating the thematic fund universe and hear from Kenneth Lamont directly about his investment research and the evolution of the thematic funds landscape in Europe.