After a blistering run, the rally in mega-sized technology stocks continues deflating. The latest swoon came with renewed fears over the outlook for the economy. But since most economists see little chance of a recession and Federal Reserve rate cuts are on the way, the bigger challenge remains the valuations of formerly high-flying stocks, as well as the overall market.

Under the hood, this is a rotation, meaning investors are shifting away from recent winners toward names that have been lagging. In this case, the broad shift has been from growth stocks to value stocks.

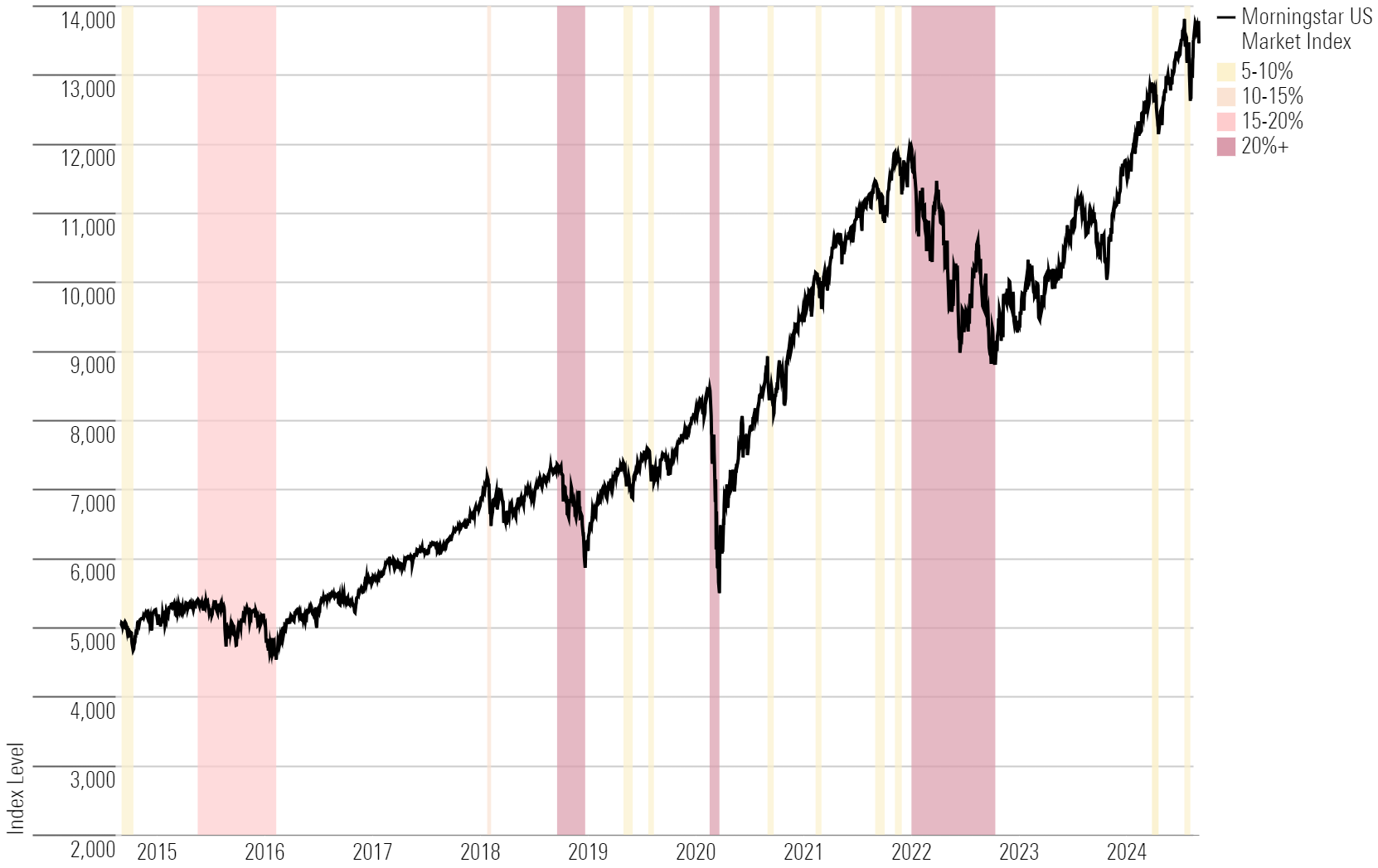

Stock Market Pullbacks Over Time

Over the past two years, tech stocks have dominated the market. From the 2022 bear market low on October 22, 2022, through the most recent market peak on July 16, 2024, the Morningstar US Market Index gained 54.1%. Tech stocks surged 109.5% during that period, beating the market by more than double and contributing 25.3 percentage points to its overall gain. The next-largest contributor, communication services, added 6 percentage points.

Since the stock market's peak in July, tech stocks are down 8.5%, compared with the 1.6% loss on the overall market. The technology sector detracted 2.9 percentage points from the total market return over this period—more than five times the amount detracted by any other sector.

"This summer, we have seen a rotation out of the sectors and stocks most tied to artificial intelligence and into more defensive sectors and stocks that had lagged the market rally," says Dave Sekera, senior US market strategist at Morningstar.

"Generally, investors have recognized that most AI plays had become overvalued and overextended. As valuations rose too high on large-cap AI stocks, valuations appeared even more attractive among value and small-cap stocks. Earlier this year, we noted that value stocks and small-caps neared their most undervalued levels compared with the broader market valuation over the past decade."

AI Leads the Way Down After Leading the Way Up

The big AI names that led the market higher from October 2022 to July 2024 are the same ones dragging the market down over the past month and a half.

Nvidia (NVDA), which climbed over 900% from the 2022 low to the 2024 peak, contributed 7.9 percentage points to the gain on the overall market—the highest contribution of any single stock. Since the market peak, it is down 15.9% and has detracted 0.9 percentage points from the market's return—the largest detraction of any single stock.

Six of the top seven contributors to the market rally are now its leading detractors. The lineup of the top four is the same: Nvidia, Microsoft (MSFT), Alphabet (GOOGL), and Apple (AAPL). Amazon (AMZN) and Broadcom (AVGO) round out the ranks. Meta Platforms (META), the fifth-largest contributor to the rally, is up 3.1% since the peak.

AI will not be an "overnight game-changer," says Adam Hetts, head of multi-asset management at Janus Henderson. "It's going to take some time." He sees the rotation as a healthy development. "We can be grateful that the AI story is a bit of a distortion for the broader, more important narrative: the soft landing is intact and rate cuts are coming. That supports the broader market, which doesn't need to live and die by the AI trend."

The leading contributors to the market since the recent peak are UnitedHealth Group (UNH), which has gained 16.2%, and Berkshire Hathaway (BRK.B), which has gained 9.8%. Both stocks contributed 0.14 percentage points to the return on the market. The next three largest contributors are AbbVie (ABBV), Johnson & Johnson (JNJ), and Coca-Cola Company (KO), which have all climbed over 10% since the market peak.

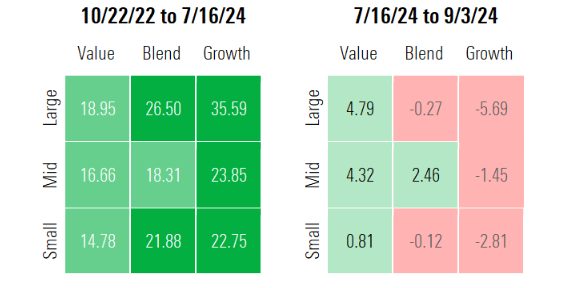

Value Stocks Catch a Wave as Growth Stocks Sink

Growth stocks outperformed value and blend stocks during the market rally but have lagged since. Large growth stocks specifically, which include Nvidia and Amazon, have seen the most volatility.

Value stocks have been steadier, gaining 18.3% on an annualized basis during the rally and 4.4% more since. Blend stocks, which include Microsoft, Alphabet, Apple, Meta, and Broadcom, gained 26.2% annually during the rally and are down 0.8% since.

"Small-cap stocks should perform well with interest rates declining and the Fed easing monetary policy," Sekera notes. Meanwhile, "value stocks, which were left behind in the rush to buy AI stocks, should outperform as the economy slows."

US Equity Stylebox Performance

.jpg)