.jpg)

While European stocks languish at levels reached during spring's broad rally, this summer's earnings season is laying bare new trends in the luxury, shipping, tech and industrial sectors.

1. Luxury Pains Emerge

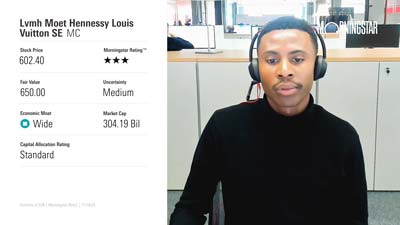

Luxury giants including LVMH [MC], Burberry [BRBY] and Kering [KER] have released mid-year numbers, and the news has not been pretty. Burberry saw retail revenues down 20% in the first quarter of the year. LVMH fared better, with positive, albeit dwindling growth with margins under pressure, while Kering had to scrap its full-year outlook.

What’s causing the weakness in luxury? From 2022 on we were touting the sector as a safe-haven from the travails afflicting the consumer sector in general. The luxury sector, with less price-sensitive (read: wealthier) customers, was able to pass through price increases at will, allowing luxury firms to grow revenues and maintain margins. In the last 9 months or so, cracks have started to show.

Demand for luxury goods has waned, most notably in China, but also in North America and Europe. Ultimately we believe that the boom in luxury goods sales since the pandemic has now proven itself unsustainable. Consumer savings, built up during the lockdown period, have dissipated, stimulus cheques have been spent, and now the bubble is bursting.

That said, we believe these ebbs and flows are inherently part of the sector’s composition. Luxury goods firms have proven resilient through cyclical downturns and industry slowdowns. Historically, downturns haven’t lasted longer than one or two years. In the meantime we have 6 high-quality luxury names under our coverage that are sitting in 4 or 5 star territory.

2. Red Sea Attacks Boost Shipping Firms

As with any cycle, first came the boom, then the bust for the shipping industry. And boy was there a boom during the first year of the pandemic-- one of the largest global shippers, Maersk [MAERSKB], made more profit in a single year than it did over the previous decade, only to again break its record the following year.

Things started to turn in the last quarter of 2022 and freight rates collapsed as a combination of a slowdown in global demand for goods coincided with more shipping capacity coming onto the market. Shippers warned of pain to come for a number of years as the market adjusts slowly to this excess capacity.

The industry had a reprieve however, as attacks by Houthi rebels in Yemen forced ships to avoid using the Suez Canal and divert around the Cape of Good Hope instead. As recently as last month traffic was down almost 90% on the canal. This extra shipping time has eaten up excess shipping capacity, causing freight rates to spike.

Global logistics firms like DSV [DSV] and Kuehne + Nagel [KNIN] have already reported a boost in volumes as a result of the disruption. With increased complexity of travel feeding into the hands of these globally street-wise firms. Of course, this disruption cannot last forever, but it is certainly taking the edge off the over-capacity issue, and buying time for the industry to adjust itself. Revenues and gross profits are still in decline for these firms, but the trend is improving of late. We expect a similar pattern as industry leader Maersk reports Q2 results on August 7.

3. Tech Stocks Prove Resilient

Headlines along the lines of “Big Tech wipeout leads stock markets down” have been everywhere. Tech stocks may indeed be seeing volatility in their share prices, but earnings so far have been strong, and there is nothing to indicate that the party is ending anytime soon.

Europe’s closest thing to a peer for America's Magnificent Seven, SAP [SAP], saw cloud computing revenues up 25% in the second quarter as businesses invest in cloud migration and AI. In a further sign of confidence, management upgraded their 2025 guidance, predicting efficiency gains from an internal restructuring.

ASML [ASML], the European play on AI, has seen its share price take a beating of late, but its operational performance has been strong in Q2. Sales were up close to 20%, with earnings up around a third. Even more encouraging was net bookings, which rose by more than half over the period, which should continue to drive sales growth in the coming quarters.

Fears remain for the industry, however. Google parent Alphabet [GOOG] hinted there might be overinvestment in artificial intelligence, which caused a major pullback in semiconductor stocks. Furthermore, a return of Donald Trump to the White House could mean a ramp up in trade restrictions with China, disrupting the chip industry. Disruption doesn’t mean an end to profitability however, and we ultimately believe the industry will find a workaround.

Although we believe much of the tech sector to be overvalued, recent pullbacks have opened up opportunities.

4. Industrial Firms Prove Vulnerable

One key insight this earnings season has been that when it comes to the performance of industrial firms, their fate depends almost entirely on their end markets.

Swedish-listed Sandvik [SAND] proffered up a decent performance over the quarter, with demand for mining equipment propped up by a buoyant Chinese market and growing demand for rare earth materials. High commodity prices help of course, but exposure to secular growth themes like this are one of the key drivers for industrial firms, in an otherwise tough macroeconomic environment.

Likewise, Wide Moat ABB [ABBN], one of the leaders in the fields of industrial electrification and automation, delivered record operating margins in the second quarter. It was not all good news, as flat order intake disappointed the market, but expectations are always high when valuations rise.

Lastly, end exposures can prove unlucky too. As lift manufacturer and installer Schindler [SCHN] learned in the second quarter. For a number of years the company had been benefiting from an uplift in orders from China’s booming property market, but now comes the hangover. Here, real estate investment fell by 10% between January and May, impacting profits for the new installations business.