For months, pundits have looked for the stock market's rally to widen beyond technology stocks, particularly the companies best positioned to benefit from the artificial intelligence boom. But it hasn't happened.

In fact, during the second quarter of 2024, the opposite took place. By one measure, returns grew even more concentrated, as big tech continued to dominate market performance. The Morningstar US Market Index gained 3.48% in the quarter. Of those 3.48 percentage points, 3.46 came from the technology sector – more than four times the next-largest contributor, communication services.

Sector Contributions to Q2 Returns

Morningstar Direct, 28 June 2024

The leading drag on overall performance in the quarter came from industrial stocks, which lost the market 0.29 percentage points. Meanwhile, large-cap stocks carried the market’s gains – specifically large-growth stocks, which contributed 4.00 percentage points to the return on the US Market Index, and large-blend stocks, which contributed 0.94 percentage points. Large-value, mid-cap, and small-cap stocks were down in the quarter.

AI Stocks Lead Market Performance in Q2

Drilling into the second quarter's biggest winners, tech and large-growth stocks, a common thread appears. A few major players capitalising on artificial intelligence hype continued carrying the market. Since the start of 2023, the US Market Index has outperformed the US Target Market Exposure Equal Weighted Index by nearly double, indicating higher-weighted stocks have increasingly driven market gains.

Market-Cap-Weighted vs Equal-Weighted Performance

Morningstar Direct, 28 June 2024

Those stocks are AI giants Nvidia (NVDA), Microsoft (MSFT), Apple (AAPL), Amazon.com (AMZN), Meta Platforms (META), Alphabet (GOOGL), and Broadcom (AVGO). These seven companies have contributed 24.39 percentage points of the 44.23 percentage points gained by the market since the start of 2023, and they currently hold a 29% combined weight in the index.

Contribution to Return

July 1 2024

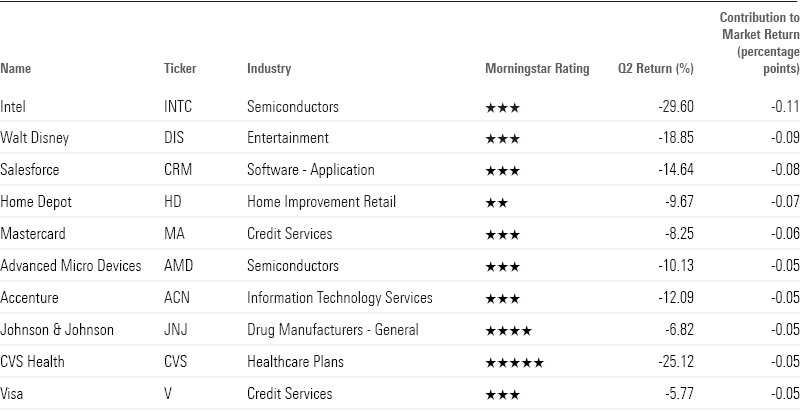

Q2 Leading Contributors

This past quarter was the most dramatic example of the big AI stocks' outperformance, as those seven companies contributed 4.49 percentage points to the market return. The rest of the market detracted 0.99 percentage points.

Nvidia, which gained 36.74%, contributed 1.6 percentage points. "Nvidia's AI GPUs and GPU clusters have a dominant market position at the moment," says Morningstar equity strategist Brian Colello.

"Demand continues to outpace our prior expectations, and we think the company will see a tremendous environment where demand exceeds supply for the next 18 months. Given the introduction of Nvidia's next-generation Blackwell GPUs, which may carry higher prices than the previous generation products, Nvidia's prospects remain bright."

Apple, which gained 22.99%, contributed 1.16 percentage points to the return. After first-quarter earnings, Morningstar equity analyst William Kerwin wrote: "we were pleased with the newly announced Apple Intelligence suite of features, which is Apple's first foray into the field of generative AI. Apple touted a strategy of generative AI that is personal, private, and integrated, which aligns with the firm's overall approach. We were particularly impressed with the ability of Siri to pull data between apps and take actions without redirecting the user."

Notable contributors outside the AI space include Eli Lilly (LLY), which has seen massive tailwinds from its obesity drugs Mounjaro and Zepbound, and Costco (COST), which continues to benefit from its low-price value proposition.

Q2 Leading Contributors

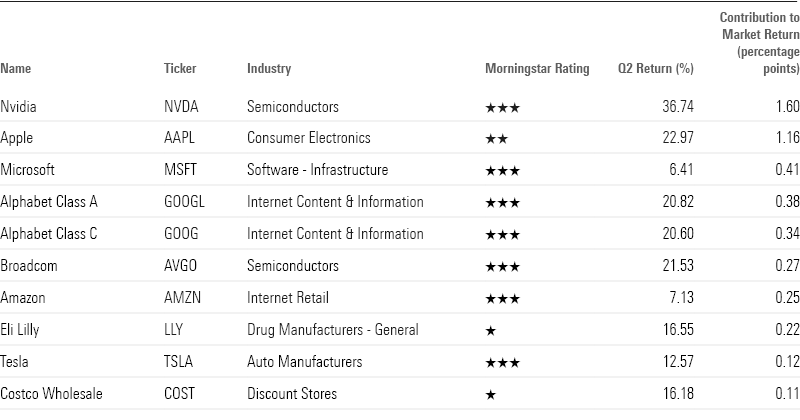

Q2 Leading Detractors

A downside of returns being concentrated within such a small segment is that when those companies don't live up to expectations, the market suffers. Big AI names Intel (INTC), Salesforce (CRM), and Advanced Micro Devices (AMD) saw their stock prices plunge after underwhelming first-quarter earnings.

Intel, which fell 29.60% in the quarter, detracted 0.11 percentage points from the US Market Index's return. "First-quarter earnings and Intel's investor event in early April signaled that the company's emerging foundry business was less profitable than previously estimated," says Colello.

"Intel is doing the right things by focusing on manufacturing process improvement, but even if it achieves its technological hurdles, profitability on this business might be harder to achieve."

Salesforce, which dropped 14.64% in the quarter, detracted 0.08 percentage points from the market's return. After first-quarter earnings failed to meet expectations, its stock plunged 19.74% on May 30.

"The company reported lower-than-expected fiscal 2025 first-quarter revenue and guided for second-quarter revenue lower than we anticipated," says Morningstar senior equity analyst Dan Romanoff.

"Management maintained its full-year outlook, raising the possibility of further disappointment throughout the rest of the year."

Other notable detractors outside the AI space include Walt Disney (DIS), which has struggled with its traditional television business, and Home Depot (HD), which has faced headwinds from low housing turnover and high interest rates.

Q2 Leading Detractors