Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

In a week with little economic news, financial markets had only the thin soup of the Federal Reserve Open Market Committee (FOMC) meeting minutes and associated comments to nourish their predictions about the next move in interest rates. With little new in the comments, asset prices remained steady with the Morningstar US Market index ending the week flat (-0.12%) while the Morningstar US Technology index rose 2.72%, supported by strong results from Nvidia which also announced a share split designed to attract more investors. You can find out what Morningstar’s Nvidia Analysts, Brian Colello, thought about the results and the share split here.

Emerging Markets Weaker, Offering Opportunities

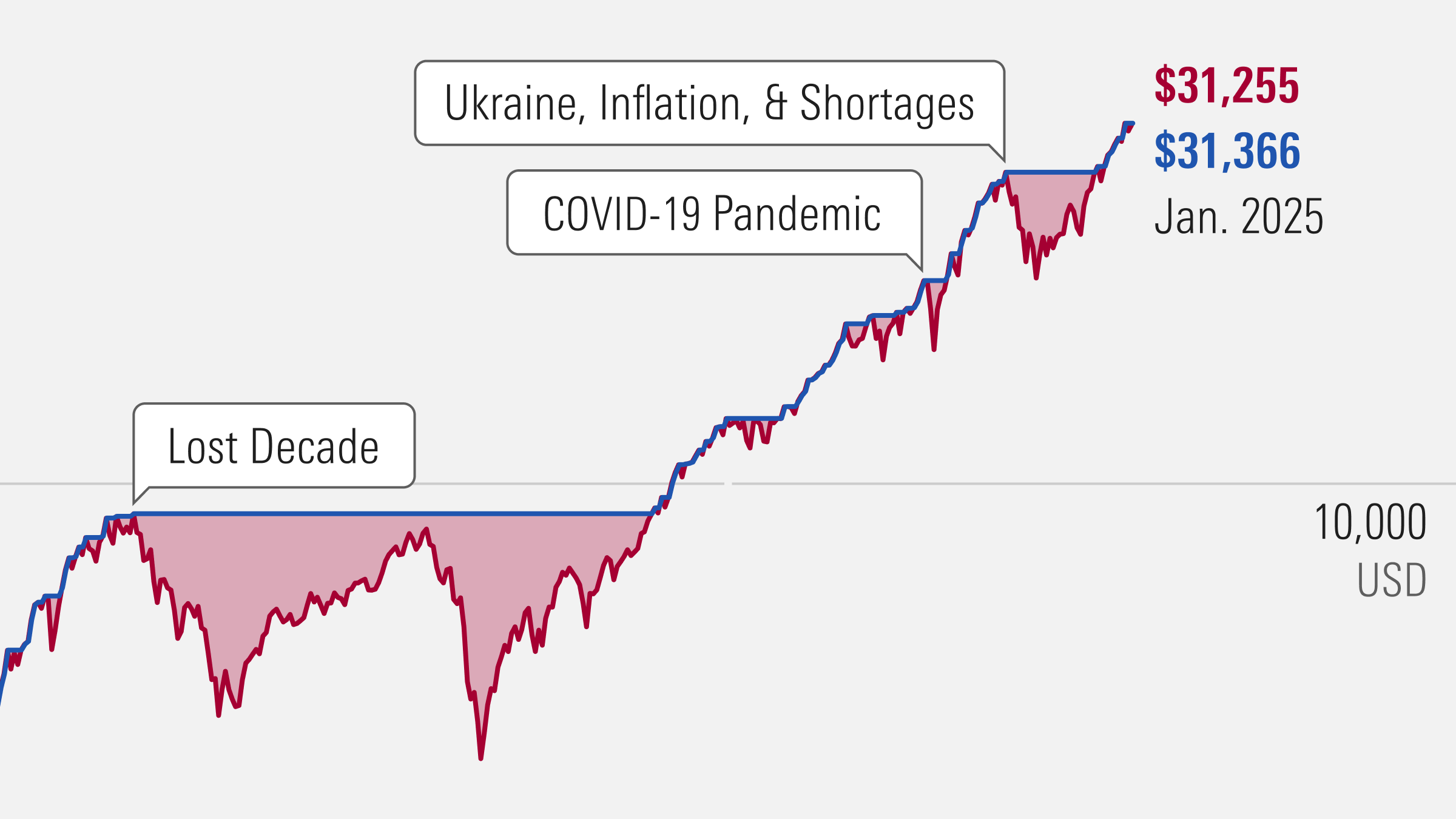

Outside large US technology companies, investors were less sanguine, as exemplified by the Morningstar Emerging Market index which declined 1.7%% over the week, driven by weakness in Chinese stocks which fell 4.61%, partially reversing the progress we have seen in this market over the last few months. Such volatility can induce myopia and make it challenging to access the returns available to patient investors. This is why fundamental analysis and a focus on valuation is so important when making investment decisions. Taking this longer-term perspective, Morningstar’s research team continues to perceive opportunities in emerging markets. A summary of their latest research can be accessed here.

Will the UK Election Bring Fireworks?

Politics was back in the spotlight this week as a rain-soaked Rishi Sunak announced the UK General Election will be held on the July 4. As electioneering takes a central role in the media across the world it is natural for investors to focus on the impact of these events on their portfolios and some may be tempted to position their portfolio to benefit from a particular outcome. However, research conducted by the Morningstar Wealth business reminds us that politics should be treated as a range of risks to be managed rather than a source of investment returns. This is important as investors can view the investing outcome of an election through the lens of their own political preferences and consequently react to results in a way that can impede their progress towards their goals.

More Inflation Data this Week

Inflation will be back in the limelight in this shortened trading week as the latest Personal Consumption Expenditure (PCE) index of consumer prices is released on Friday. According to MarketWatch, year on year inflation is expected to remain unchanged for April. A significant deviation from this outcome may create some volatility at the end of the week.