By Sahil Mahtani, head of macro research at Ninety One

When Russia invaded Ukraine, India’s external affairs minister Subrahmanyam Jaishankar remarked that Europe “has to grow out of the mindset that its problems are the world’s problems, but the world’s problems are not Europe’s problems”.

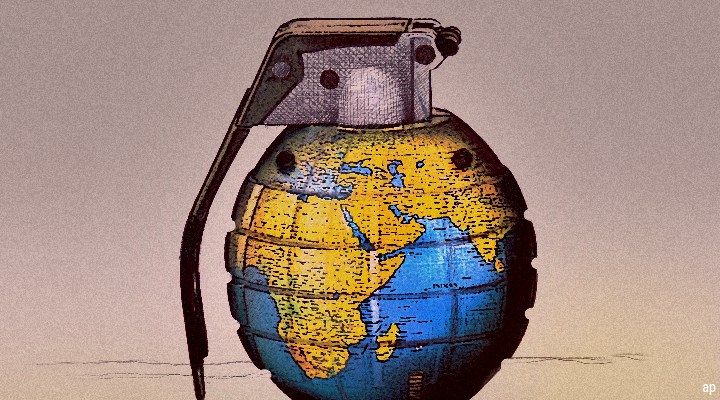

Two years later, Ukraine is still Europe’s problem, but it is also increasingly clear the outlines of a new multipolar international system are being forged. As such, the conflict remains relevant for all portfolios, no matter where investors are.

For one thing, the Ukraine conflict has kickstarted the end of the long “peace dividend” of falling military expenditures since the end of the Cold War. In Europe, annual defence spending in 2028 is projected to be about €100 billion higher in real terms than pre-invasion. Outside of Europe, annual defence spending by 2030 is expected to be about $200 billion higher than it would have been prior to the shock of the invasion.

Whether these plans are realised, of course, is not a simple matter of spending, but of technical and organisational ability, badly eroded in recent years – defects with German Leopard tanks or the crisis at Boeing (BA) come to mind. But the direction of travel is up, and the numbers could well be higher.

If countries that spend less than 2% of GDP a year met that level and the remainder increased spending by half a percentage point of GDP, global defence outlays would rise by $700 billion a year. If global capital expenditures is about $25 trillion, the projected rise in spending since the Ukraine war would be about 1.2%-2.8% of global capex – meaningful in the context of real global GDP running at 3% annually.

Structural Forces Drive Further Defence Spending

Second, the Ukraine conflict has driven a wedge between the US, its allies and the rest of the world, a division that has been exacerbated by the most recent iteration of the conflict between Israel and Hamas.

The term “global south” has tripled in search usage globally over the last five years, despite the geographic incoherence of the term – most of “the global south” is in fact in the northern hemisphere. That growing self-definition and division was already rooted in different histories and different values, values that as recent cross-country World Values Surveys show, are only getting larger.

In the background of these shifts, of course, is the metastasising rivalry between the US and China and the relative decline of the “Pax American” unipolar world that has persisted in some form since the second world war and that went into overdrive in the early 1990s.

All this means that the recent shifts in trade and financial flows, e.g., accelerating investment in new and less fragile supply chains, as well as material de-dollarisation via central bank gold buying in recent years, are underpinned, and reinforced by deeper structural forces.

War Drives Decarbonisation and Deglobalisation

Finally, the Ukraine conflict has accelerated investments in climate solutions and in dual-use technologies. The 18-fold increase in European wholesale gas prices that followed the Ukraine invasion catalysed investments in the green transition not just in Europe.

By some measures, the war in Ukraine has fast-tracked the energy transition by an impressive five-to-10 years as households and governments boosted spending on electric vehicles, heat pumps, efficiency measures, and green power generation.

Meanwhile, because neither Russia nor Ukraine has achieved air superiority, both are increasingly using long-range artillery, missiles, and drones, while also investing in electronic warfare in the form of jammers, spoofers, and high-energy lasers. Technological development and war have gone together as long as humans have been fighting, and the Ukraine war suggests this time is no different.

For these three reasons, we are likely to see a higher probability of compounding supply shocks underpinned by trends in decarbonisation, “deglobalisation”, higher defence spending, and weaker demographics – which the war in Ukraine exacerbates.

Investors Should Watch Tailwinds

The most straightforward response for investors is to lean into thematic tailwinds and avoid headwinds. We believe a thematic approach can underpin superior returns over time, provided investors exercise valuation discipline.

Such supply shocks are also likely to transform the macro environment as a whole as they increase the probability of higher growth and inflation volatility. Whereas the macro-financial environment of the 2010s was underpinned by a “great moderation” of weak growth, disinflation, and easy monetary policy, encouraging investors to revise discount rates lower and increase the valuation of long duration assets, the next cycle will be different.

Volatile growth and inflation impulses will underpin volatility in central bank rate cycles. Moreover, nominal growth rates and bond yields are likely to be higher over the medium-term (supported by higher fiscal deficits), especially if not compensated for with higher productivity.

Such environments historically have caused higher asset correlations and equity multiple compression, while government bonds become less reliable as diversifying assets.

All this means the war in Ukraine will contribute to structural changes for all investors, not just those in Europe.

Sahil Mahtani is head of macro research at Ninety-One and sits within the Multi-Asset investment team and the Ninety One Investment Institute