French luxury group Kering (KER) will release its full-year earnings on February 8, before the market opens.

There are several questions surrounding Kering’s earnings, but the most pressing ones concern its flagship brand, Gucci. The Italian luxury brand has recorded poor sales figures over the course of several quarters, lagging peers like LVMH (MC) and Hermes (RMS). Kering remains a very profitable company, but investors are wondering just when it will be able to post positive sales growth figures.

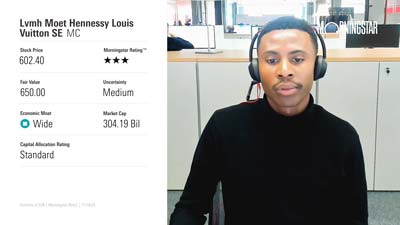

Key Morningstar Metrics for Kering Shares

Fair Value Estimate: €600

Current price: €391.55

Morningstar Rating: ★★★★★

Morningstar Economic Moat Rating: Narrow Moat

Morningstar Uncertainty Rating: Medium

What to Expect from Kering Earnings

After a 9% organic sales decline in the third quarter of 2023, analysts expect Q4 revenue to decline 4.6% on a like-for-like basis to €4.81 billion, according to Factset consensus data. Gucci should record a revenue decline of 2.8% on a like-for-like basis to €2.46 billion.

Two of its other brands, Bottega Veneta and Yves Saint Laurent, are expected to record organic sales declines of 3.8% and 5.8%, respectively, during the last quarter of 2023.

Full-year revenue is expected to fall to €19.54 billion compared to €20.35 billion in 2022 – down 2.5% on a like-for-like basis.

Earnings before interest and taxes is forecasted at €4.87 billion for the year, compared to €5.59 billion a year earlier.

Net income for 2023 is set to hit €3.15 billion, while free cash-flow is seen at €1.68 billion. This is down from the €3.21 billion the company posted in 2022.

Looking ahead, analysts are cautious about Gucci’s sales recovery, expecting mid-single-digit organic decline in sales during the first half of 2024, and a mid-to-high single-digit growth during the second half of the year.

Overall, markets envisage low single-digit organic growth for Kering, with the expectations around 2.6%.

Like LVMH, Kering does not provide hard numbers for its earnings guidance. When it released it 2022 financial results, the company stated its ambitions to “maintain a trajectory of profitable growth resulting in high levels of cash flow generation and return on capital employed, and confirm its status as one of the most influential groups in the luxury industry”.

So far, sales and earnings have been far from achieving this ambition.

Kering Stock: Should I Buy, Sell, or Hold?

The current fair value estimate of €600 per share factors in long-term sales growth of 5.2% per annum for Gucci, slightly above Morningstar’s forecast for the industry (+4.9%).

Jelena Sokolova, equity analyst at Morningstar, says: “We expect revenue for Gucci to be down by mid-single digits in 2023 and marginally up in 2024 as the brand repositions its offering toward new designer collections and reinvests in marketing to boost appeal.”

Margins should stay in the low 30% region for Gucci in 2023 and 2024 (in 2022, this was 35.6%). Long-term margin for the brand is expected to remain below the 41% peak it reached in 2019, but Sokolova expects it to be “significantly above its historical low-30s margin”.

Other brands in the group should record more solid growth going forward: 4.5% for Bottega Veneta, 4.3% for Yves Saint Laurent, and 5.2% per annum for other luxury brands.

After last earnings season, Sokolova noted that the current weakness could represent a buying opportunity, and the stock is currently trading in 5-star territory, or in other words, is significantly undervalued.

“We still believe it is highly unlikely one of the best-known luxury brands with strong control over distribution and the backing of Kering’s substantial resources (marketing and access to talent) will continuously trail the industry in growth, something that Kering’s 13 times forward earnings multiple (20-sector average) seems to imply.”