We are often asked before earnings season by clients and journalists what we are expecting. This time around my answer was simple: "a very mixed picture".

With interest rates in major markets at record highs, and inflation on the wane but still elevated, these conditions are affecting stocks and industries in different ways. Many of these effects are not constant, but are changing all the time, making it very difficult to know exactly what companies will report. Here are the key themes that have emerged.

Consumers Are Still Cash-Strapped

After 18 months of real wage increases failing to match inflation, it is not surprising consumers have less cash in their pockets, and, as such, are cutting back on discretionary spending, as well as staples such as groceries.

Nike (NKE) pointed to reduced demand from retail customers, with sales down 2% in the fourth quarter. Starbucks (SBUX), often billed as a small luxury, said sales are seeing a "strong deceleration in recent months". Most striking is the declines began almost exactly at the time inflation started picking up 18 months ago.

Even staple products, such as those supplied by global hygiene firm Essity (ESSITY), have seemingly hit the limit of consumer tolerance to price increases, with the firm reporting volumes that are barely edging upwards, alongside margin deterioration.

Brands and Travel Stocks Still Delivering

We highlighted the opportunities in consumer stocks in our 2024 market outlook, with both consumer staples and discretionary sectors in Europe trading at a discount to our Fair Value Estimates. But as this earnings season has shown, picking the winners here is hard.

One area that has delivered this earnings season is travel. UK listed EasyJet (EZJ) whose share price has still not recovered from the pandemic, reported strong numbers, with the key takeaway being that demand is "building well" in 2024, a good omen for travel spending generally, given the knock-on effects prevalent in air travel spending. Hotel groups like Premier Inn (owned by Whitbread [WTB] in the UK, and Hilton (HLT) more globally, have also seen revenues rise solidly in 2023. This theme could well continue into 2024.

It wouldn't be a Morningstar article without mentioning Economic Moat Ratings. One important Moat source is intangible assets, which in many cases can be brands. Strong brands and the ability to adapt to ever-changing consumers needs have been a key theme this earnings season.

Staple firms such as Unilever (ULVR) and Procter & Gamble (PG) have used this brand power effectively, with the latter recently reporting the strongest sales across their business from Europe, albeit with much of this growth coming from price increases rather than volume growth. Although luxury has been a mixed bag, there are still some firms hitting the high notes such as fashion giant LVMH (LMVH). High-end chocolate manufacturer Lindt (LISP) is another, with margin and volume growth over the period.

Investors Still Want AI, But it's Overvalued

While we still wait on earnings releases from big AI hitters like Nvidia (NVDA), investors have looked to the likes of Dutch darling ASML (ASML) for the likely trajectory of growth exiting 2023. They have not been disappointed: ASML continued to see strong order growth, with revenue and EBIT growth up 30% in the last quarter of the year. Although the pattern of growth may not be in a straight line from here, management are building up 2025 as a serious growth year, a sentiment echoed by other semiconductor firms such as TSMC (TSMC).

Despite the allure of structural growth, which admittedly is difficult to ignore, we believe the valuations of many of the companies touted as AI plays are too rich. This is a call which is very much out of consensus, as most sell-side analysts have jumped fully on the AI bandwagon. ASML, for instance, we see as around 15% overvalued currently. Nvidia, likewise, we see as around 20% overvalued, with the consensus still showing upside to its lofty 80+ times price/earnings ratio.

Houthi Red Sea Attacks Are Boosting Shipping

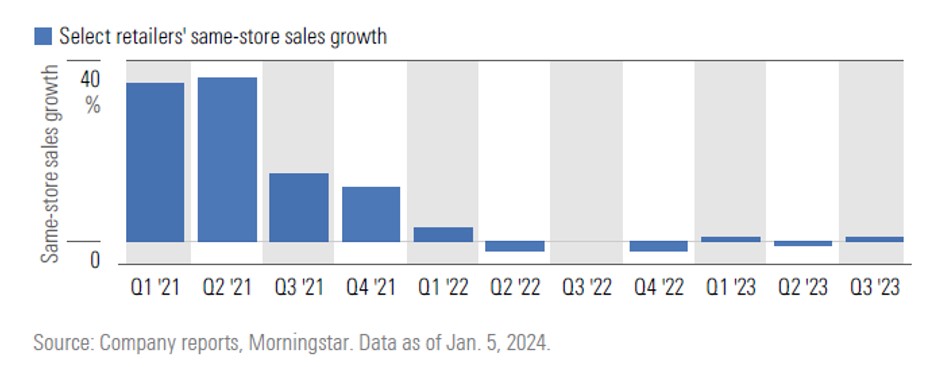

The shipping industry made an absolute fortune in the aftermath of the Covid-19 pandemic. In 2021 shipping giant Maersk (MAERSK) made more money in a single year than it had in a decade. Then in 2022 it made even more. But for every party there is a hangover.

In 2023 orders for new vessels and more capacity started coming through at the exact moment consumer demand across the western world started to wane. This left shipping firms with a glut of excess capacity, which put severe downward pressure on freight rates.

So, for shipping firms, the recent attacks by Houthi militants in the red sea couldn't have come at a more opportune time, sending freight rates spiking as firms instructed captains to avoid using the Suez canal, and instead take the much longer route around the Cape of Good Hope.

Will this save shipping companies from the glut of excess supply? Ultimately no. But periods of oversupply can often last a few years, and with no end in sight to the issues in the Red Sea, shipping and logistics firms are riding their luck while it lasts.

Novo Nordisk: is it Overvalued?

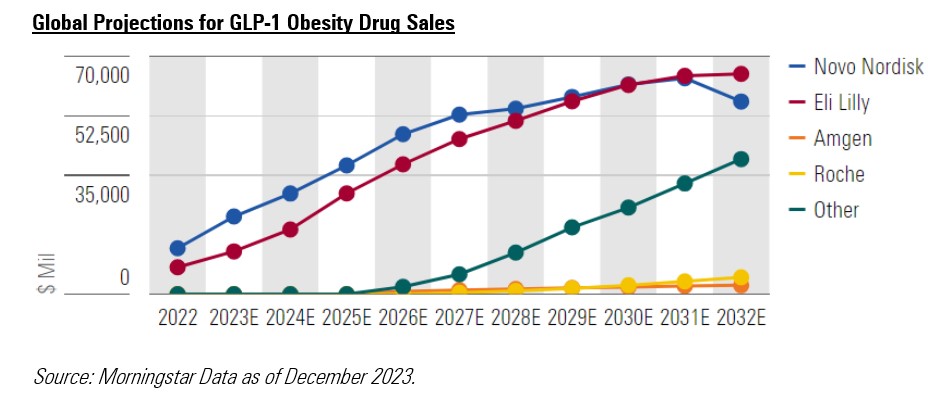

Another sector that we highlighted as offering attractive valuations in our 2024 outlook is pharmaceuticals. The market is very excited about GLP-1 drugs designed to combat obesity, while ignoring many opportunities in other areas such as oncology and immunology.

Given the projections of growth of obesity drugs, this is very understandable. Novo Nordisk (NOVO), one of the leaders in this segment, reported sales growth up more than a third in 2023, with operating income up almost half. However, we believe the expectations priced into stocks in this sector are extremely high, and take the contrarian view that these names are overvalued. Novo Nordisk is now trading almost 30% above our Fair Value Estimate.

Roche and Pfizer Have Upside Potential

Where we do see value in the pharma space is in firms like Roche (ROG). Investors continue to back biotech stocks, and especially those with large Covid-19 drug legacies. So far this stance has paid off, with lost Covid-19 drug sales still proving a drag for the likes of Pfizer (PFE) and Roche.

However, we believe strong pipelines of drugs will support sales growth in the medium term, with our contrarian view on Pfizer showing more than 50% upside, and 35% for Roche.

Michael Field is European market strategist at Morningstar

.jpg)