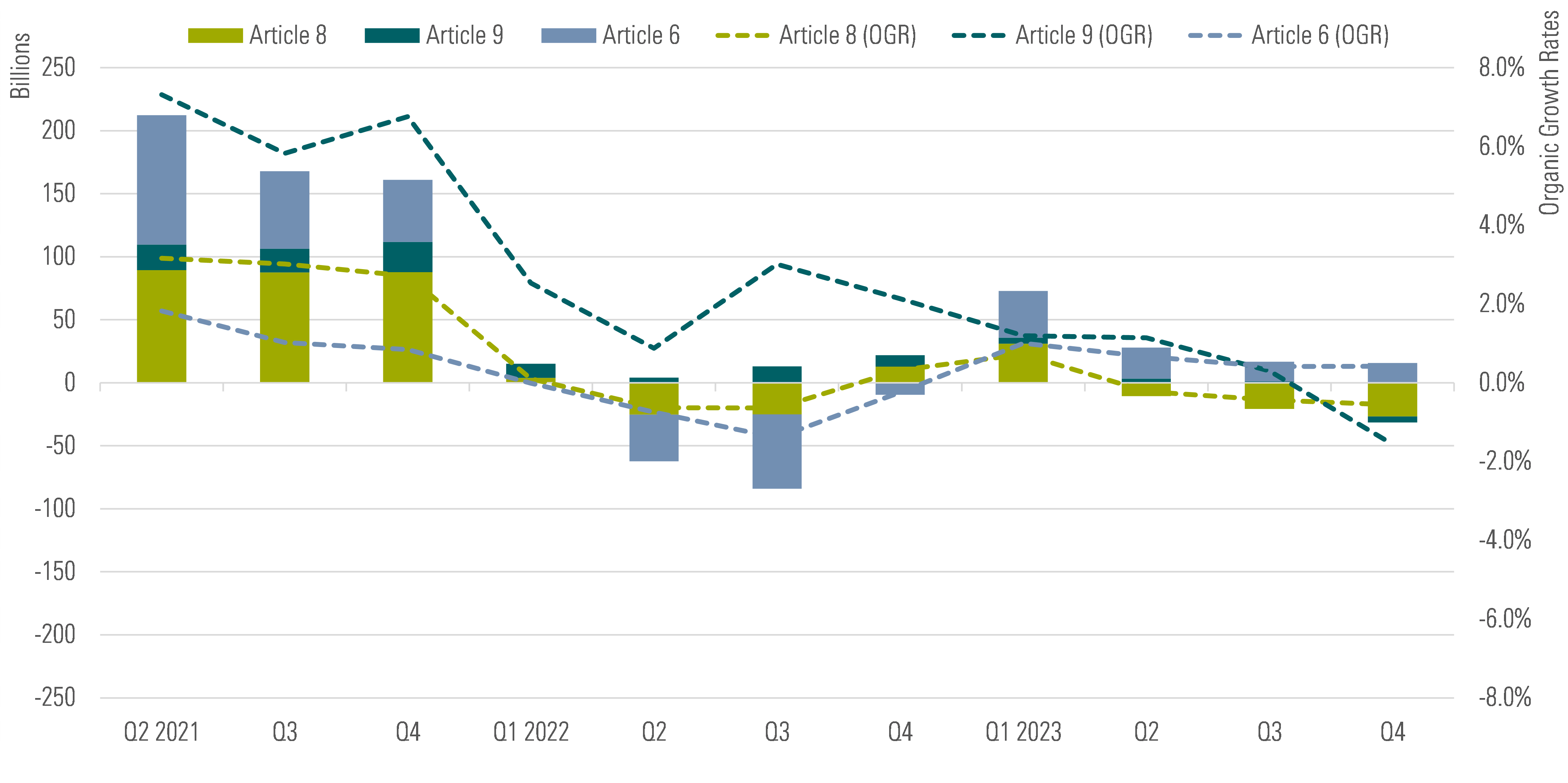

As the European Commission closed its consultation on the future of the Sustainable Finance Disclosure Regulation (SFDR) in the final quarter of 2023, Article 8 funds were registering the largest quarterly outflows on record.

Specifically, investors pulled €26.7 billion (£22.8 billion) from Article 8 funds over the period. Those with no commitment to sustainable investments were disproportionately affected.

Meanwhile, Article 9 funds – those with a sustainability objective – experienced their very first quarterly outflows, at €4.7 billion.

The bleak picture for Article 8 and Article 9 products in the last three months of 2023 contrasts with the positive momentum maintained by Article 6 funds (those with no ESG characteristics) which attracted €15.7 billion in net new money, consistent with the figures observed in the preceding quarter.

Fig. 1: Quarterly Flows into Article 8 and Article 9 Funds Versus Article 6 Funds (EUR Billion) and Organic Growth Rates (%)

Overall Article 8 funds registered net outflows of €27 billion in 2023, while Article 9 funds collected €4.3 billion and Article 6 funds garnered €93 billion.

Why is ESG Appetite Waning?

Several factors contributed to waning investor appetite for Article 8 and Article 9 funds last year. They included the macroeconomic environment, high interest rates, inflation, fears of recession among some major world economies, and geopolitical risks.

Among other implications, that led investors to favour government bonds, an area where ESG integration remains a challenge. In fact, it’s not feasible to integrate ESG considerations into single-country government funds investing in, say, US Treasuries or UK gilts.

In addition, it’s fair to assume some investors took a more cautious approach to ESG investing last year in the wake of the underperformance of ESG and sustainable strategies in 2022. That itself was due to the typical underweight in traditional energy companies and overweight in technology and other growth sectors that struggled at the time. While the latter rebounded in 2023, other popular sectors in sustainable strategies continued to underperform. Renewable energy companies, for example, have been particularly affected by soaring financing costs, materials inflation, and supply chain disruptions, among other issues.

Additional factors weighing on investor demand for Article 8 and Article 9 products include greenwashing concerns and the ever-evolving regulatory environment. To some degree, the wave of fund reclassifications to Article 8 from 9 in late 2022 and other issues related to the implementation of SFDR have also caused confusion among investors.

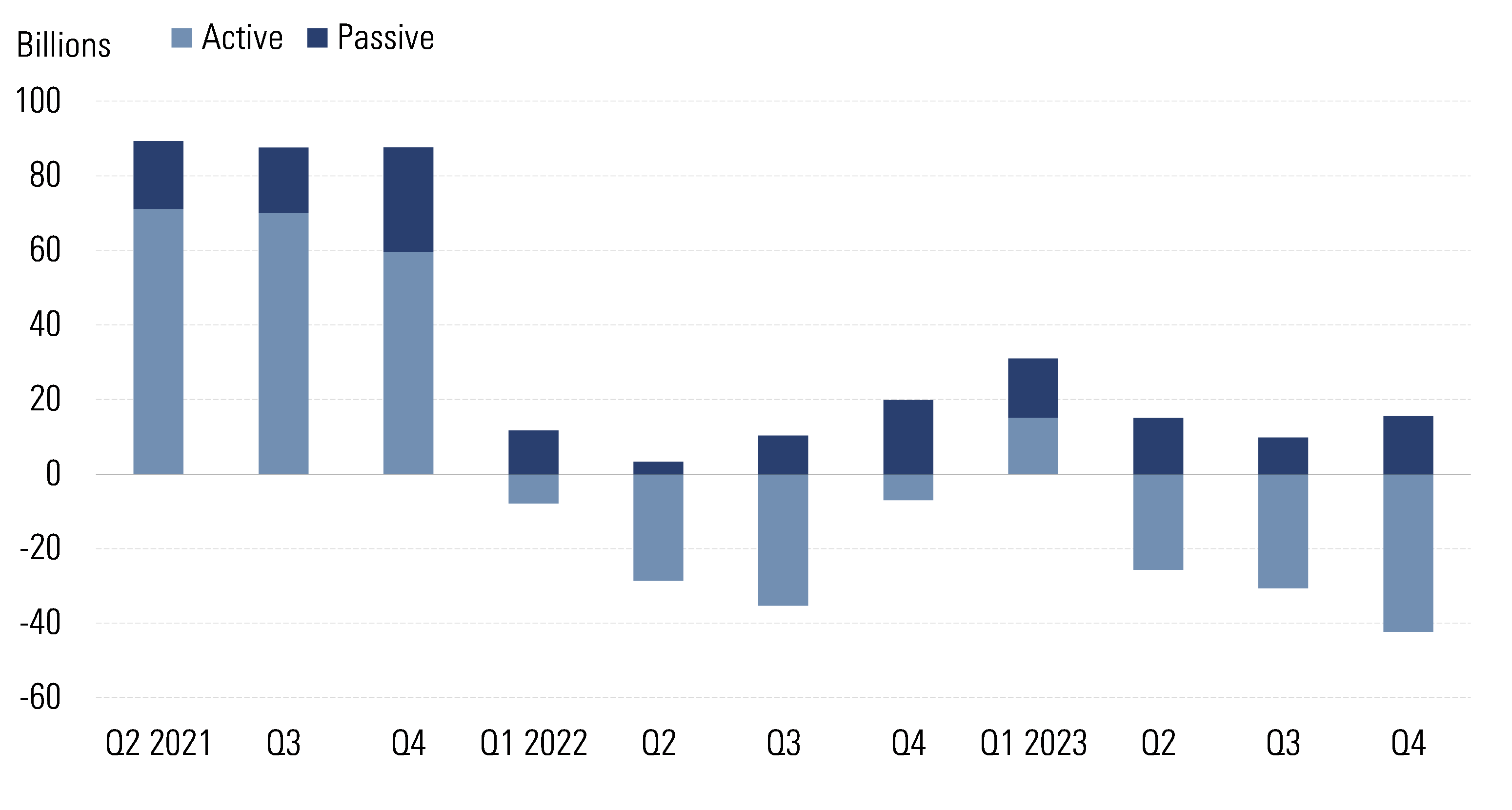

Active Funds Drove Outflows, so What Did Passives do?

Active funds drove all the Article 8 fund outflows in the fourth quarter as well as over the full year. Contrasting with the challenges faced by their active peers, passive Article 8 funds sustained their momentum throughout 2023.

Fig. 2: Net Flows Into Article 8 Funds Divided by Active and Passive

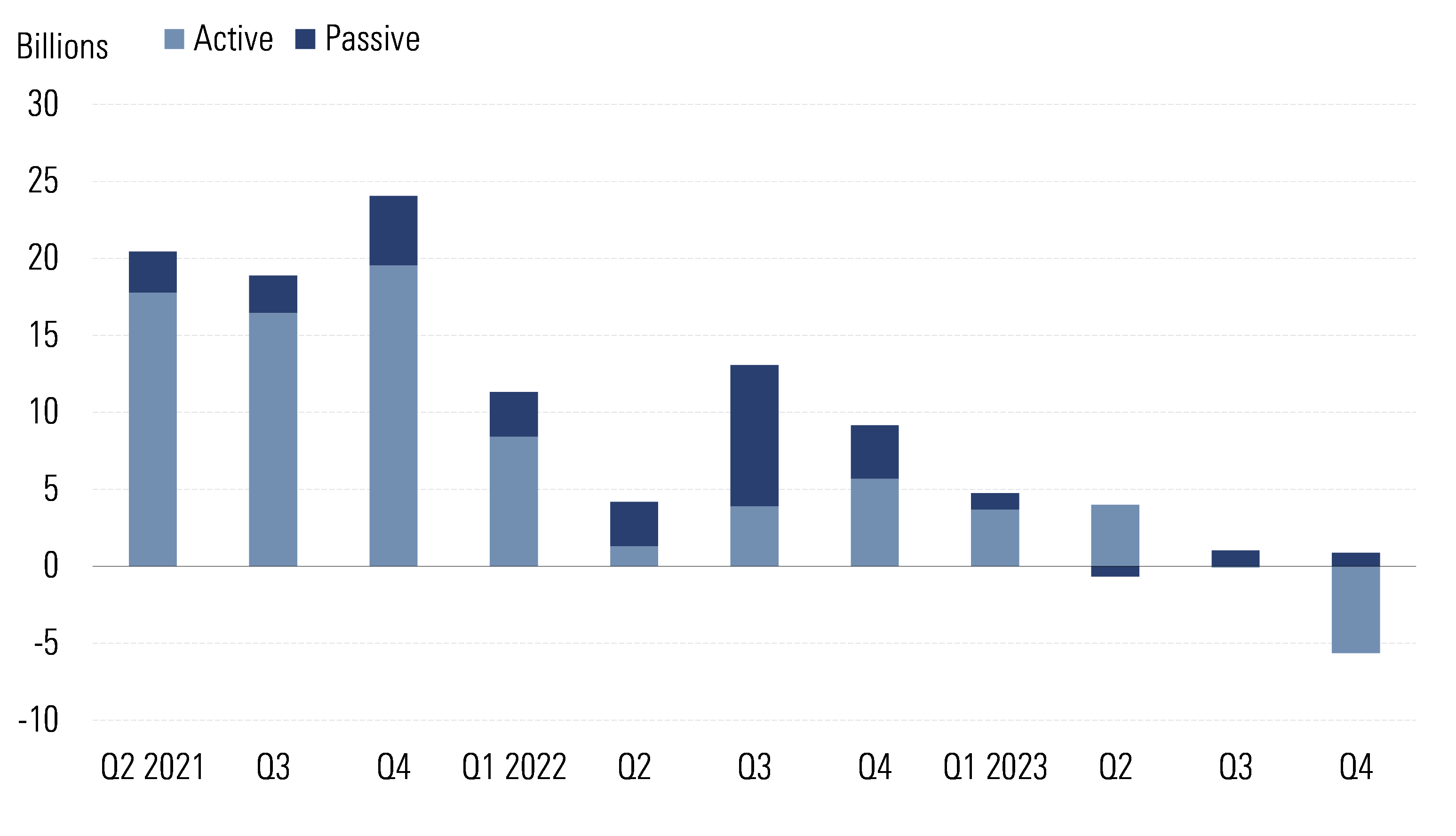

Meanwhile, active funds in the Article 9 category enjoyed continued inflows until last quarter, when they suffered €5 billion of redemptions. Passive Article 9 strategies garnered positive net flows in all but one quarter. Inflows into this group of funds shrunk significantly following the reclassification of many large exchange-traded funds (ETFs) and index funds tracking climate benchmarks in late 2022 and early 2023.

Fig. 3: Net Flows Into Article 9 Funds Divided by Active and Passive

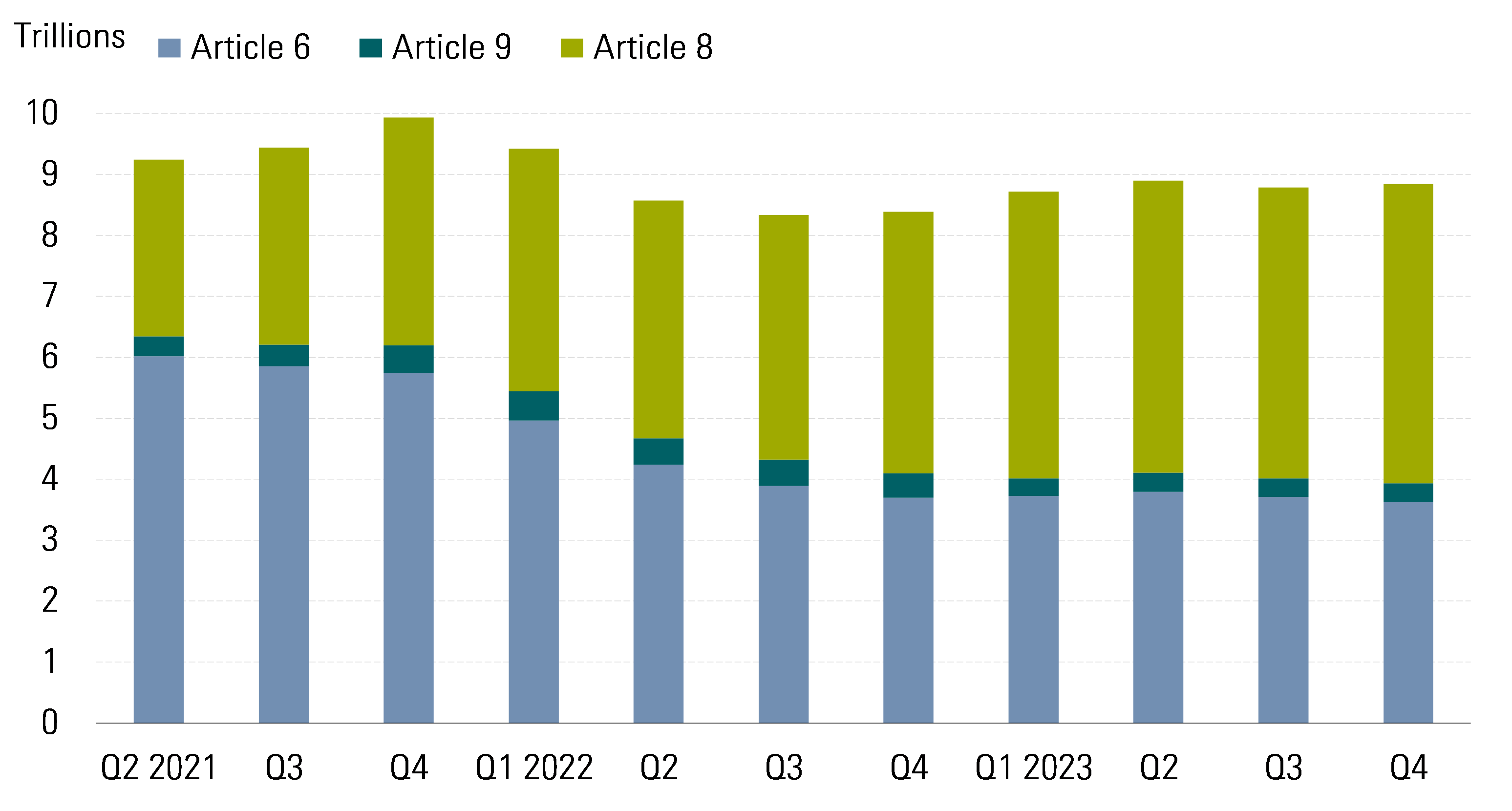

Article 8 and 9 Fund Assets Rise to a Record

Despite the outflows, combined assets in Article 8 and Article 9 funds increased by 1.7% over the fourth quarter to €5.2 trillion – a new record. Conversely, Article 6 fund assets declined by 2.4%.

Together, Article 8 and Article 9 funds saw their market share rise further to almost 60% of the EU universe. In other words, almost 60% of the money invested in funds in the EU claims to have some ESG characteristics. This absolute and relative increase in Article 8 and Article 9 assets can be explained by the continued activity of product reclassification from Article 6 to Article 8 or 9 as well as stock and bond price appreciation.

Fig. 4: Quarterly Asset Breakdown by SFDR Classification (EUR Trillion)

Despite the continued redemptions, Article 8 funds maintained their market share at around 55% at the end of December 2023. The share of Article 9 products stayed at 3.5%, showing trivial change compared with the previous quarter.

Sources: Morningstar Direct. Assets as of December 2023. Based on SFDR data collected from prospectuses on 97.8% of funds available for sale in the EU, excluding money market funds, funds of funds, and feeder funds

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)