LVMH (MC) will release its full-year earnings on January 25 after market close.

As the largest luxury group in the world, its comments on the state of luxury market, in particular in Europe, the US and China, will be watched closely. As usual, the company will say little about its own outlook.

When it released third quarter sales figures last year, LVMH characterised its outlook in the following terms:

"In an uncertain economic and geopolitical environment, the Group is confident in the continuation of its growth and will maintain a strategy focused on continuously enhancing the desirability of its brands, drawing on the authenticity and quality of its products, excellence in distribution and agile organization."

Expect more of the same for 2024.

What to Watch For: LVMH Sales and Profits

After a solid first half in 2023, when sales grew 17% on a like-for-like basis, revenue growth sharply decelerated in the third quarter at +9%. In Q4, consensus expects total revenue of €23.62 billion (£20.2 billion), growing at 8.6% organically.

Fashion & Leather, which houses Louis Vuitton and Christion Dior and has been the main driver in growth and earnings for many years, has also seen its growth decelerating.

In the final quarter of 2023, analysts expect the division to grow 9% on a like-for-like basis. Some analysts are more bullish than others, seeing growth rebounding, in part thanks to easier basis of comparison in China.

For the full year, LVMH is expected to report total sales of €85.74 billion, an operating profit of €22.49 billion and net income of €15.70 billion (compared with €79.18 billion, €21.06 billion and €14.08 billion in 2022 respectively).

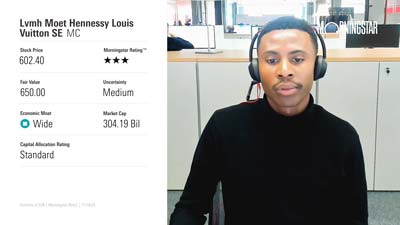

Fair Value Estimate for LVMH

Morningstar analyst Jelena Sokolova recently upgraded her Fair Value Estimate (FVE) for LVMH to €670 from €640 per share, to incorporate the time value of money "offset by slightly more pessimistic expectations for 2023 sales and profits."

"We expect Louis Vuitton brand to grow 3% faster than the luxury leather goods supported by an outsize marketing budget, brand recognition, and pricing power", she wrote in a report dated January 8. In 2023, the fashion and leather good division should grow 7% and report an operating margin of 40%, compared with 20% and 40.6% respectively in 2022.

Key Morningstar Metrics

• Fair Value Estimate: €670;

• Current Price: €661;

• Morningstar Rating: ★★★;

• Morningstar Economic Moat Rating: Wide;

• Morningstar Uncertainty Rating: Medium.

Is Luxury Slowing Down?

After years of double-digit growth, the slowdown in luxury market and more cautious consumers in the US and Europe have weighed on the momentum for many luxury companies, with few exceptions like Hermes.

One important question for LVMH is what is the "new normal" in terms of organic growth and profit margins going forward?

Pricing should help fuel some growth and protect margins, and the company should be able to continue enjoying its favourable business mix towards Fashion & Leather, thanks to its continuous investments in marketing and in retail channels.

Yet despite somewhat easier basis for comparison in Q4 of 2022 (mostly due to China's lockdowns), analysts don’t expect growth to reaccelerate.

This has translated in a compression in valuation multiples, from a peak of 27.6 times expected earnings in April 2023, when it reached an all-time high of €901 a share to 21.3 times currently.

LVMH – Wide Moat Rating

We believe LVMH's portfolio of leading brands spanning multiple industries will allow it to generate economic profits for years to come. It scores highly on most of our brand intangible asset supporting criteria. Most brands in LVMH's portfolio are at least 100 years old.

The flagship Louis Vuitton brand is among the best known and recognised luxury brands with strong market share (double the next biggest peer in leather goods according to Euromonitor) and a strong track record of pricing power. The brand generates around three fourths of its revenue from iconic bags and low-double-digit percentages in accessories, where product cycles are long (reducing product and fashion risks and encouraging people to spend more for a product they will use longer), and scale allows to generate very attractive margins (usually in excess of 40%). Recurring buyers represent around a half of Louis Vuitton’s revenue, somewhat reducing revenue cyclicality.

LVMH's portfolio of watch brands is made up of midrange and high-end brands, with average prices of €2,000 and up. LVMH also has a strong position in branded jewelry with the Bulgari and Tiffany brands, which is among the leading players in the industry, where we consider entry barriers to be higher than other luxury goods, thanks to the high value attached to raw materials, low availability to communicate the brand, stickier gifting demand, and need for quality assurance on the top end.

In perfumes and cosmetics, LVMH has around 10% global market share, with a strong heritage in fragrances (notably Christian Dior and Guerlain). In wines and spirits, it commands leading market share in attractive conspicuous niches. It has over 20% global and 30% export market share in Champagnes with such brands as Moët & Chandon, Dom Perignon, and Ruinart, and it has undisputed global leadership (half of the market) in cognacs with flagship Hennessy.

Louis Vuitton Sees Spectacular Growth

We assign LVMH a Morningstar Uncertainty Rating of Medium. Luxury goods growth over the past 15 years has been fueled by emerging markets demand linked to China's economic development. This makes industry growth vulnerable to future structural and cyclical growth in this region.

Recent growth for Louis Vuitton has been spectacular (doubling in revenue from 2018 to 2022 from around €10 billion to around €20 billion) and faster than its historical pace, thanks to favorable cyclical demand environment, brand investments, pricing, and strong brand momentum. Slower demand for luxury goods overall and an adverse fashion cycle could further limit the brand's growth on an increasingly challenging comparison base.

Deceleration of demand from European and American customers, who spent record amounts on luxury in the years since Covid-19, was helped by savings from foregone experience spending, solid asset markets, and payment checks in the US Chinese demand, dampened by weak real estate prices and slower GDP growth, may not compensate for this slowdown.

While the firm's overall record of mergers and acquisitions is quite successful, in our view, there remains a risk of overpaying or choosing a target poorly. Acquisitions can also drift the group into less moaty and more competitive areas.

A large portion of production and administrative costs is incurred in euros, while almost 80% of revenue is invoiced in other currencies. In addition, given the global pricing transparency that the internet has made possible, adjusting pricing for currency movements has become more challenging. While LVMH has historically been able to pass through currency-related cost increases to consumers, this may prove more difficult in a weaker demand situation.

.jpg)