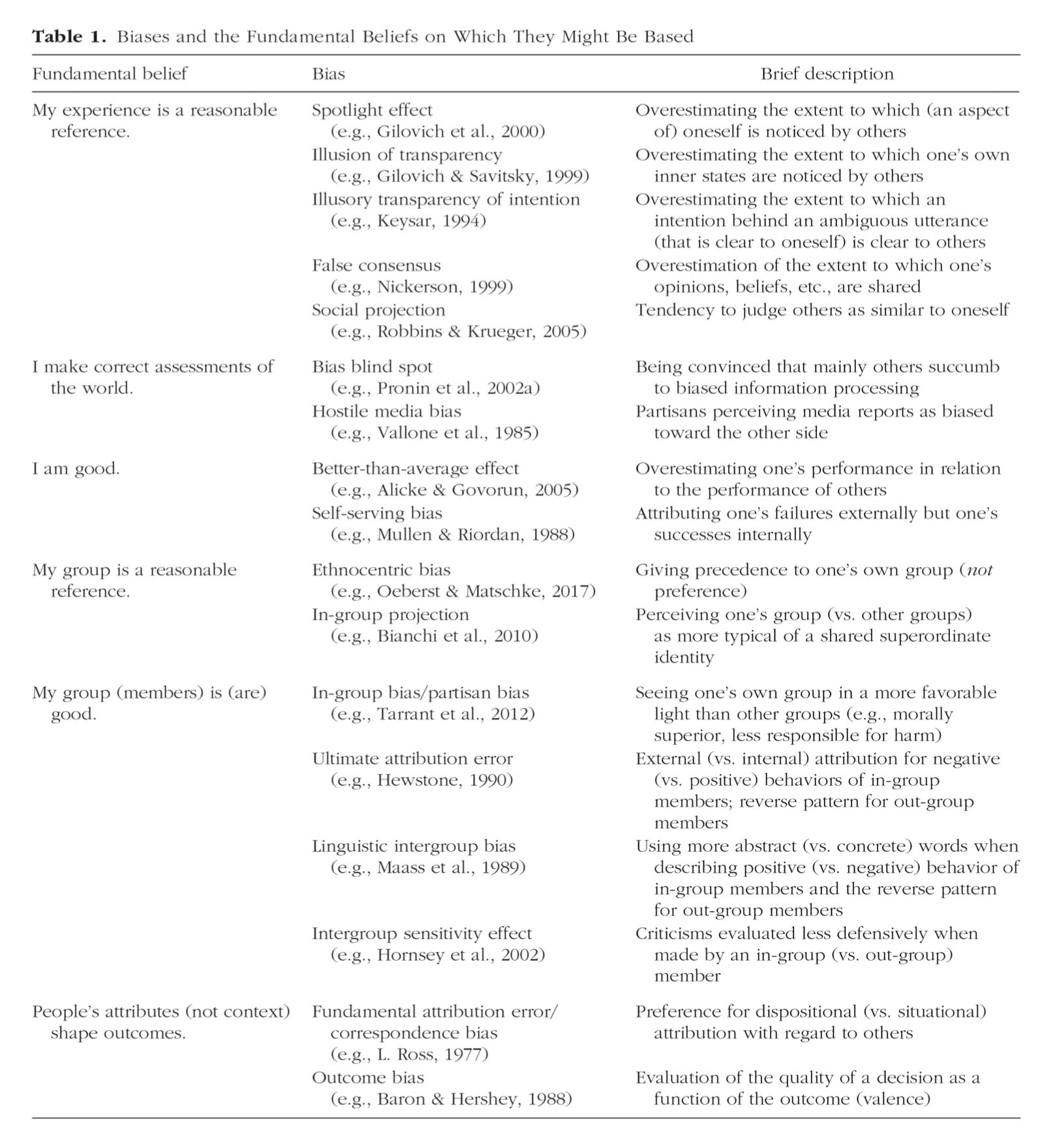

After a strong few years, luxury stocks have started to come under pressure in 2023. Asset prices in US and Europe and property prices in China have damaged consumer confidence and slowed sales growth, while cost pressures have hit profit margins. But that means stock prices are converging with their fair values, and some name are discounted. We look at the current market valuations and Morningstar’s best investment ideas in the sector.

What is happening to luxury stocks? If we look at their market valuations compared with their fair values, the average price/fair value (P/FV) of the names covered by Morningstar Research is now close to 1, which means that market prices are in line with the fair value. This is a dramatic change from 2021, when the industry was substantially overvalued.

The Morningstar Global Luxury Goods index then lost 13% in US dollars of its market capitalisation in 2022, weakened by store closures and sales declines as well as fear of a prolonged economic downturn.

Toward the end of 2022 and in early 2023, shares rebounded again, pushed by the expectations for a healthy recovery in Chinese spending, after the lifting of restrictions, and for a resilience of luxury spending in the United States and Europe. This year the index is up nearly 3%, but has weakened in recent months as sentiment has soured again.

“What we see now is that sales deterioration in the US, concerns about the macroeconomic situation and the pace of the spending rebound in China have brought sector valuations to more palatable level,” Sokolova says.

Sales Are Still Growing

So what should investors expect from luxury companies in the coming months? Our estimates now indicate 8% sales growth rate for 2023 and a 6% increase for the following two years.

Despite consumer confidence improving in 2023, both in China and in Western countries, there is a mix of indicators that make our analysts more cautious in their forecast for the next years.

“The lingering weakening of equity prices and real estate prices in China could lead to a slowdown in luxury demand going forward,” Sokolova says. “Revenue declines experienced in the US by the companies in our coverage in first quarter of 2023 confirmed our expectations about a sales deterioration in North America”.

These negative factors should be more than compensated by the sales growth in China, thanks to the recovery in key Chinese spending for domestic and international travel. Although travel trends remain below prepandemic levels, domestic travel in China experienced a strong rebound in the beginning of 2023 as Beijing abandoned its zero-Covid policy and our analysts believe it should take a couple of quarters for Chinese travel in Europe to resume.

On the profitability side, our analysts see limited improvements in the coming years after the significant expansion in 2020 and 2021. So far luxury companies have been very successful in passing higher external and internal costs to the customers. In the next quarters, analysts expect an increase of both rent and marketing costs and that, together with a slower sales growth, will affect operating margins.

“Based on our expectations, we see the luxury sector now as broadly fairly valued, with some interesting opportunities starting to emerge. Into the jewelry and watches segment, Swatch and Pandora are our best investment ideas. Among leather goods producers, we like Kering and Tapestry”, says Sokolova.

Morningstar's Luxury Prospects

Swatch Group

Swatch benefits from a narrow moat through brand intangible assets and manufacturing scale. The stock is discounted over 30% compared with our fair value of 268 Swiss francs as tailwinds are not priced in. Swatch should benefit from high exposure to Chinese consumption, which analysts expect to recover strongly, thanks to post-pandemic pent-up demand and long-term income growth, and significant operating leverage through cost cuts and automation implemented in the past.

Pandora

Morningstar analysts think Pandora has a great pricing power, as evidenced by its high 70s gross margin, and that profitability level should persist thanks to its high share of gifting (over 60% of sales), which is less price sensitive. The company’s size, over twice that of the next-biggest peer, should allow it to outspend competition on marketing. Despite leading market share, healthy financials, and strong recent execution, Pandora is priced at 13 times earnings and is discounted 20% compared with fair value of 930 Danish kroner.

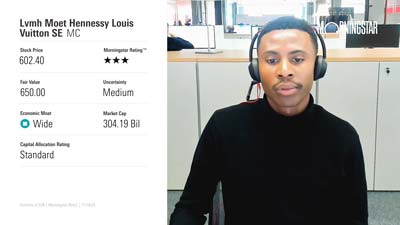

Kering

Kering is the second-largest luxury group by revenue and among the most attractively valued luxury names, trading at 16 times consensus earnings and almost 30% upside to our fair value estimate of 650 euros. Our analysts are confident that, while its flagship Gucci brand is experiencing slowing momentum, it should be in a position to maintain its pricing and desirability in the long run, given its strong brand recognition, very significant marketing resources, control over distribution and access to top managerial and creative talent.

Tapestry

Morningstar analysts assign a narrow moat rating to Tapestry, based on the brand value of Coach, which generates more than 50% of its sales from handbags. Tapestry will also improve its position in the luxury market as it has agreed to buy rival Capri for $57 per share. Among the brands owned by Capri, Michael Kors benefits from the favourable economics of the handbag category, while Jimmy Choo is a leading luxury women’s shoe brand and Versace is one of the best-known luxury fashion houses. The stock trades over 50% below its fair value of $60 and it is rated as 5 stars.

.jpg)