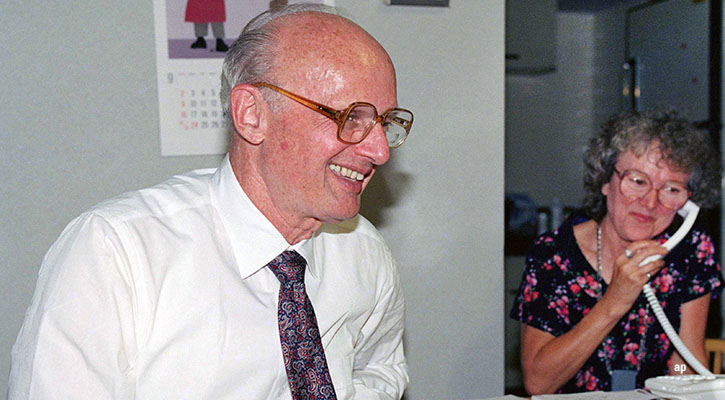

I strongly recommend you acquire a Nobel Prize in Economics for your research on investments. Besides providing $900,000 (£710,000) and a gold medal, the honour apparently also conveys the fountain of youth.

While the list of winners obviously incorporates selection bias, as Nobel Prizes are awarded only to those who are alive – a policy fully applied by John Goodenough, who was honoured at age 97 – the group’s health has nonetheless been remarkable. For example, Harry Markowitz earned the award in 1990 at age 63. He survived another 32 years before his passing last week.

Dr. Markowitz did not require longevity to learn his legacy. Well before 1990, his insights were celebrated. He had discovered Modern Portfolio Theory.

Before Markowitz’s research, investment risk was determined security by security. A Treasury bond was deemed prudent, while debt issued by a low-rated corporation was not. (As the 1970s would later demonstrate, the safety of a low-yielding Treasury during an inflationary environment was illusory, but never mind that.) The same logic applied to equities. Blue chip stocks could be trusted, but not those from emerging companies.

Such beliefs were fine, as far as they went. Inflation aside, Treasuries were safer than high-yield corporate bonds. They always met their obligations, while junk bonds (to use an anachronism, as that term had yet to be coined) sometimes defaulted. Ditto for blue chips versus newly issued stocks. The latter were not only more volatile but also likelier to vanish, via their issuers’ bankruptcy.

The Benefit of Diversification

However, the approach was incomplete. Finance classes use the analogy of a vendor to explain why. Imagine an island that is sometimes sunny and sometimes rainy. Those who market sunscreen prosper on sunny days but languish when it rains. The opposite holds for those who advertise umbrellas. But vendors who carry both items always sell.

Such, we are told, are the benefits of diversification. This is, of course, highly unrealistic. No investment combination moves reliably in opposite directions unless one takes long and short positions in the same security, in which case (barring unusual circumstances) there is no money to be made. The two trades cancel each other out, leaving investors with less than nothing after transaction costs.

Lower Volatility, Higher Returns

However, the insight is deeply valuable, because it incorporates a critical investment principle: not all returns are created equal. Novice investors tend to believe, as I once did, that a 20% annual return followed by no gain reaches the same place as 15% preceding 5%, or two consecutive increases of 10%. Not so. The annualised returns for those portfolios are, respectively, 9.54%, 9.89%, and 10%.

Investors, therefore, need not worry about identifying assets that perfectly offset each other, or indeed anything near that achievement. The salient point is that every little bit helps. Unless an investment moves completely in lockstep with the rest of the portfolio, it will provide a diversification benefit. It will therefore prove beneficial unless its returns are unsatisfactory or its volatility excessive.

By the Numbers

As Markowitz himself acknowledged, he was scarcely the first to understand investment maths. Before he was born, informed investors realised that the same arithmetic average could lead to different results and that lower portfolio volatility could lead to better performance. But Markowitz contributed something entirely new: ge formalized the intuition. He created the formula that determined, to the final basis point, how a portfolio would perform given the returns and standard deviations of each of its assets along with their covariances.

The calculation itself was impractical. Although theoretically interesting, the science behind Modern Portfolio Theory could not be successfully implemented. Even slight inaccuracies in forecast returns led to strikingly different portfolio recommendations. And of course, no investment researcher can achieve even slight forecast errors. The attempt inevitably contains whoppers, mistakes that in effect invalidate the formula’s answers.

Legal Implications

No worries. The power of Markowitz’s formula lies not with its computation, but instead with its very existence. He had demonstrated, accompanied by irrefutable equations, the failure of the traditional method of assessing investment risk. Viewed broadly, a seemingly risky asset might make the portfolio safer rather than more dangerous. After Markowitz, that proposition was undeniable.

As a result, the regulations changed. When Markowitz published his research, common law required fiduciaries to evaluate investments one by one. No legal argument could be made for including an asset to diversify the portfolio unless that asset could stand on its own, while not being judged to be “speculative”. Markowitz scotched that mindset. Common law gradually adjusted and was overturned entirely by 1992′s Uniform Prudent Investor Act, which explicitly permitted fiduciaries to buy riskier assets if they provided a portfolio benefit.

Art as Science

It’s no exaggeration to state that Markowitz did more than advance a theory of portfolio construction. He created the very foundation of today’s investment practices. Not only was he the first to treat the art of investing as a science, but his findings became embedded into future research.

For example, pursuing Markowitz’s argument until its logical end leads to the view that portfolios should own everything. Interested in U.S. equities? Buy them all. We don’t know how the next stock will perform, but we can be pretty sure that it will behave like no other, thus providing additional diversification. Such was the conclusion of Markowitz’s immediate successor and fellow Nobel Laureate, William Sharpe, who developed the capital asset pricing model.