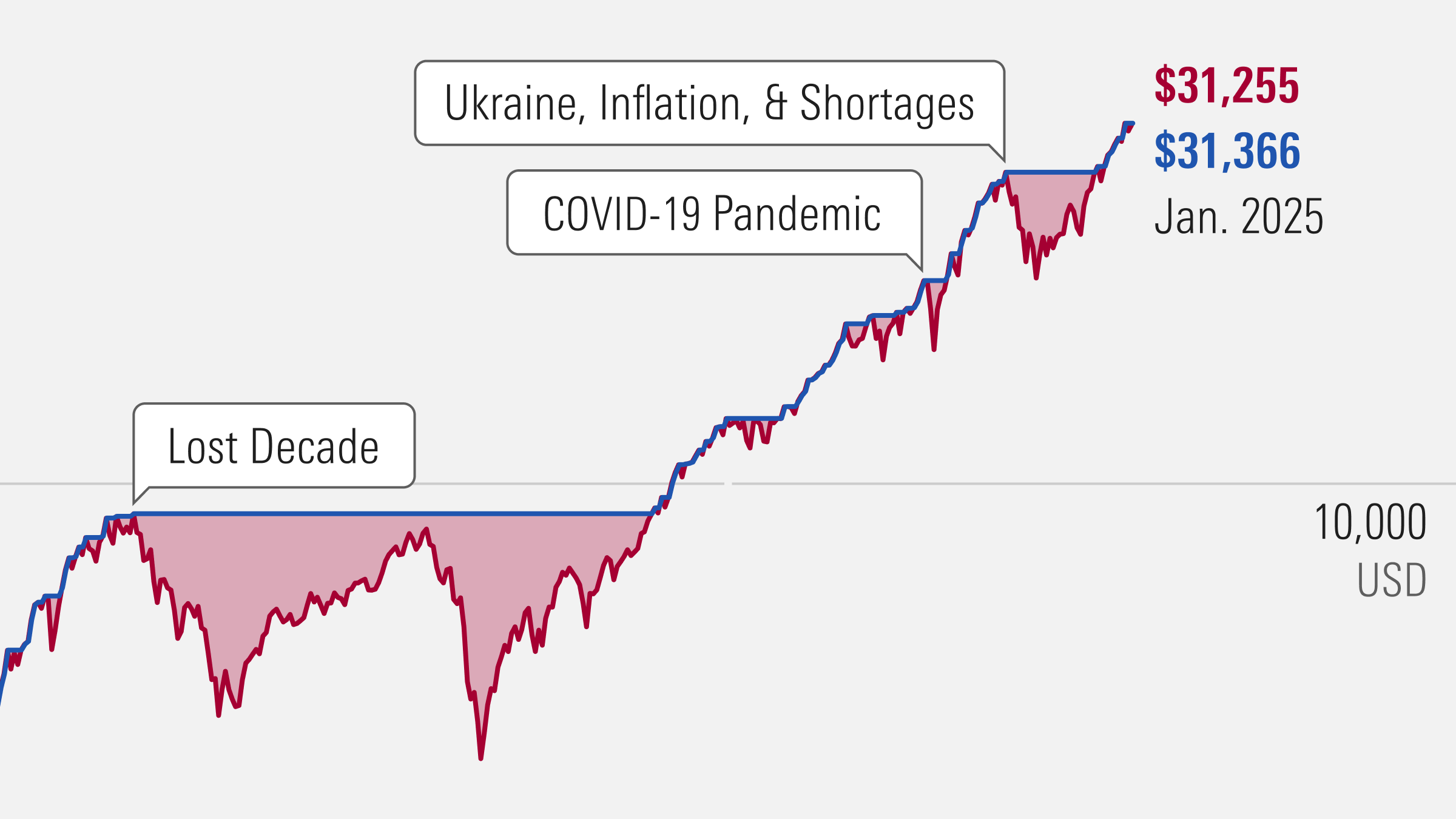

The good news first: Europe is probably going to be just fine next winter. Natural gas in EU storage amounted to 853 terawatt-hours (TWh), or 75.8% of total capacity, at the end of June, according to data from Gas Infrastructure Europe (GIE). The long-term average filling level at this time of the year is about 58%.

The only time in history when Europe had more gas in storage in early summer was in 2020, when the collapse in global demand due to the Covid pandemic had pushed front-month futures contracts below 9 euros, less than a third of what it is today.

Supply Swings

After a steady descent from last year's 340 euro peak to just 23 euros at the start of June, European gas prices suddenly seemed to go haywire. The Argus TTF front-month volatility index hit an eight-month high as prices spiked to 50 euros on June 15.

The main cause of this latest mini-shock was the temporary shutdown of important natural gas facilities in Norway, Europe's largest gas supplier since the end of Nord Stream.

Equinor's (EQNR) Hammerfest LNG export plant suffered a gas leak, forcing a shutdown during the first half of June. Two weeks later, Shell (SHEL) had to stop operations at the Norwegian Nyhamna processing plant due to a cooling system outage. Nyhamna's re-opening recently had to be postponed to July 15, creating uncertainty that does not help price stability.

On top of the outages, an expected heat wave in Europe and the resulting energy needs for air conditioning and cooling systems contributed to June's price spike.

Demand Swings

All indications are that gas demand is set to rise in the second half of the year. An analysis by the International Energy Agency (IEA) sees EU gas consumption rising to 395 billion cubic metres (bcm) this year, up from 360 bcm in 2022.

“Risks are now tilted to the upside”, according to a recent study by Banca Intesa. Its analysts say prices below 30 euros/MWh "are not consistent with the structural changes that have taken place over the past two years in supply and demand”. They forecast a price of around 60 euros/MWh in the fourth quarter of 2023 for the baseline scenario, with best and worst case scenarios ranging from of 40 to 160 euros.

Predicting what comes next is difficult, according to Massimo Nicolazzi, professor of Economics of Energy Sources at the University of Turin. “In short, the TTF would appear to have been renormalized, which argues in favor of a decrease in the volatility of intra-European spreads, but nothing tells us about future price trends in the various regional markets.”

“The addition of new regasification capacity and other interventions have apparently normalized the situation, substantially aligning the trend of the TTF both with the Henry Hub and with the prices recorded for the purposes of the Market Correction Mechanism-- the mechanism set up at the European level to verify the possible conditions for the application of the price cap,” the professor explains.

Remember Russia?

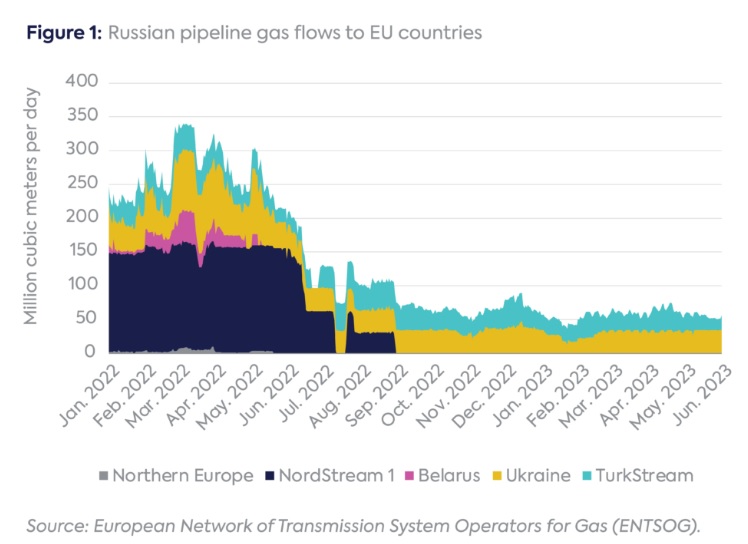

Contrary to popular belief, Russian natural gas continues to flow into the EU through pipelines that cross Ukraine and Turkey. Imports as of March were worth 2.7 billion euros, down from 21.4 billion a year earlier, when Nord Stream 1 was still operational. The remaining flows have proven resilient-- paradoxically, amid all-out war, Russian gas continues to flow through Ukrainian pipelines, supplying hubs in Austria, Italy, Hungary and Slovakia.

The clock for these countries is ticking. Gazprom's hard-won 2019 Ukraine transit deal expires at the end of 2024.

Total annual gas supplies from Russia to the EU fell to 10.8 bcm in the first quarter, compared to 74.4 bcm in all of 2022 and 150.2 bcm in 2021, according to European Commission data.

When the Gazprom/Ukraine contract expires without renewal, the last remaining piped connection to Russia's gas fields will be Turkstream, which enters the EU in Bulgaria and delivers gas onwards to Serbia and Hungary. Other EU members will need to fill the shortfall by buying up additional LNG, competing with global buyers at higher prices.

The whims of overseas demand

Short-term replacements for Russian gas can only be in the form of LNG, and short-term LNG capacities can only be in the form of floating terminals. That's why Europe has quickly bought a dozen floating storage regasification units, including four in Germany and two in the Netherlands and Italy. Most of these will be operational by the end of 2023.

The brand new import capacities will be put to the test come winter, especially if Asian LNG demand picks up and forecasts for a European winter defined by the El Niño weather pattern hold true. In 2022, a major component of the price surge was precisely because European buyers needed to jockey for cargoes against Asian rivals.

S&P Global Commodity Insights noted “increased buying interest in forward deliveries, especially in North Asia” at the start of June. “The price advantage of pipeline gas over spot LNG is fading, which should stimulate buying interest from Asian importers who do not have sufficient long-term contracts in hand,” according to the report. Also, “rising prices of domestic pipeline gas in China could provide some incentive for downstream industries to switch to LNG”.

As more LNG tankers sail to Asia for the price premium over the landing price in Europe, higher prices on TTF may balance the situation.

But such a rally can't necessarily be blamed on China alone, as TTF gas prices are also tied to demand in the US. There, another factor depressing European gas prices could be about to disappear, Professor Nicolazzi explains. “Henry Hub today is decidedly low; but if the US economy were to recover and come out of the stagnation in industrial production suffered in recent months or shale production were to fall, the price could rise again, without any push from Asia, only for US domestic market reasons”.

Surge pricing

Rising overseas demand also affects LNG prices through higher transportation costs. Scarce tankers meant freight rates for LNG in the Atlantic basin for delivery in July jumped 64% and could double again in August, data from the Spark Commodities platform shows.

According to Spark’s price curve, freight rates are expected to average $49,750 per day this month, then rise to $72,750 per day in July, to $107,500 per day in August, and even reach $259,500 per day in December.

Europe's vulnerability to these factors is bound to diminish as the global energy economy grows into its new structure, one in which Europe doesn't subsidize Russia's brutal war to the tune of billions of dollars each month. Until then, it will need to navigate more uncertain waters than it's used to.