Carbon ETFs: What Are The Risks And Opportunities?

ESG-focused investors must keep in mind that, at best, products only carry indirect environmental benefits. That said, there is a good case to invest

Investors have a wide variety of options for exposure to climate protection, and carbon exchange-traded funds (ETFs) are emerging as an asset class. We have taken a look at what ETF products are available, and if it’s worth taking the risks.

CO2 markets are certainly not for the faint of heart. Just take the world's largest trading system by volume: the European Union Emissions Trading Scheme (EU-ETS).

Through 2021, the price of European emissions allowances (EUAs) tripled to start 2022 on a bullish note with quotes near €100 per tonne. But following Russia’s invasion of Ukraine, the price of the benchmark contract (yearly futures maturing in December) plummeted to €55 per tonne.

Impact of the Ukraine War

"Worries over demand disruption and high energy prices, as well as international investors minimising exposure to European assets, created a snowball effect that ultimately caused a full-blown crash," according to Refinitiv's Carbon Market Year in Review 2022. In addition, market participants had to liquidate their EUA positions to cover margin calls in energy (energy companies are the main player in the market).

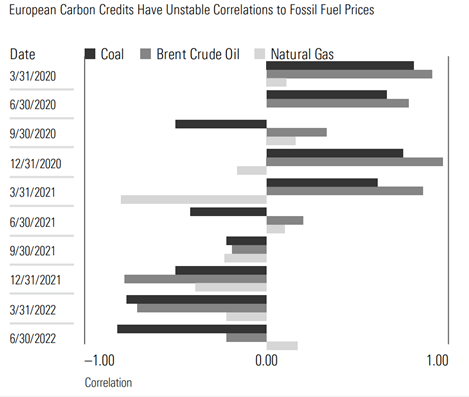

Morningstar’s carbon expert Madeline Hume noted negative correlations between EUAs and fossil fuel prices in mid-2022.

"A carbon credit is a government-issued permission slip to burn fossil fuels, but surprisingly, we find that carbon credits don't respond predictably to fossil fuel price movements," she said in the report 2022 Carbon Credits Landscape. Over the past five years, the European Union's carbon credit prices exhibit a beta to the markets of non-renewable energy of roughly 0.3, on average.

'Political' Markets

More often than not politics rather than fundamentals, determines where prices head.

"We find that even the most sophisticated cap-and-trade programs exert little control on how fast emissions fall, especially early on. Companies that reduce emissions faster than expected flood the market with cheap credits, introducing price volatility," Hume said.

In mandatory cap-and-trade systems, the state sets a cap on total emissions. Plant operators must submit allowances for their respective amount of emissions at the end of a specified period. In the case of the EU-ETS, energy companies buy the EUAs in auctions or on the fairly liquid secondary market, while many industrial plants continue to receive EUAs free of charge.

Needless to say, determining who gets how many of the precious allowances has kept Brussels busy from day one. In effect, any headlines on policy decisions on the allocation of EUAs have the potential to send prices South or North in the speed of light.

Last year, European Commission, Council and Parliament struggled over details of reforming the EU ETS as part of the "Fit for 55" program. In late 2022 the triumvirate concluded an agreement to significantly reduce the number of EUAs available in the cap-and-trade system. Details will be specified in 2023 (and closely monitored by market players). A one-time reduction of the cap is slated for 2024.

What ETFs Are Available?

Investors can choose between two popular types of investment strategies that provide exposure to carbon markets. The first are multi-strategy commodity funds with a small (less than 10%) exposure to one or two individual markets based on a short-term tactical thesis.

The other option is a dedicated thematic vehicle. Such ETFs are similar to those that invest exclusively in commodities such as oil or gold. Investors in these strategies assume that CO2 prices will rise over time. The below strategies are solely focused on CO2 markets.

Eight strategies are dedicated to the European market, while another eight ETFs track a basket of benchmarks from around the world. The Carbon Strategy ETF (KARB), for example, mixes in EUA contracts with exposure to the California Emissions Trading System and RGGI, the mandatory trading system for power generators in 12 U.S. East Coast states.

KraneShares Global Carbon (KRBN), which invests in three carbon contracts, is by far the largest, with more than $1 billion invested since its July 2020 inception.

But investors haven't had much success with these strategies recently, the table reveals. April 2023 has been particularly harsh, especially in Europe. This is because, in the EU ETS, industrial and energy companies subject to emissions trading must surrender their allowances for the volumes emitted in the previous year by the end of April.

This catapulted prices towards €97 per tonne at the beginning of April, supported by EUA purchases by industrial companies. However, sentiment soured after Easter as compliance purchases waned and the energy complex was under pressure. The EUA contract closed April at around €87 per tonne.

Voluntary CO2 Markets, Involuntary Chaos

But it can get worse, the table also reveals.

KranShares Global Carbon Offset (KSET) went down more than 25% in April alone, and the year-to-date drop exceeds 83%. This ETF tracks carbon offsets, which are generated in voluntary markets, for instance for withdrawing CO2 from the atmosphere in carbon sink projects (reforestation); or by avoiding emissions in the first place.

"Voluntary markets gain traction by convincing individuals and companies to take accountability for their emissions," says Hume. She argues it takes time in voluntary markets to build consensus.

In its recent State and Trends of Carbon Pricing 2023, the World Bank even observed a downward trend in voluntary markets. After two years of rapid growth, carbon credit markets slowed in 2022. Supply of new credits and demand from end users both fell slightly, which represents a reversal of the sharp increases experienced in 2021.

As in compliance markets, prices collapsed beginning with Russia's invasion of Ukraine; however, the price decline continued into Q1 2023, albeit to varying degrees by type and region.

According to the World Bank, economic headwinds are one contributing factor, but confidence in the market has also taken a significant hit in the past year.

Just one example: more than 90% of the carbon credits by Verra, the largest certifier of voluntary credits, were not backed by actual emissions reductions.

In short, the certificates promised far more than they could deliver, a research network led by the British newspaper The Guardian and German weekly Die Zeit revealed early 2023. And South Pole, a Swiss project developer, faced allegations of greenwashing. To date, prices have not recovered.

Keep This in Mind

So risks and volatility are high – both in compliance and voluntary markets. Investors adding an allocation to carbon to their portfolio should keep this in mind – and be aware the risk/return profile could change even more in the years to come.

The case for a standalone allocation in an individual's portfolio is therefore slim, Morningstar analyst Bobby Blue concluded. Meanwhile, professional asset managers may seek allocations in specialist commodity or trend-following strategies for some diversification benefits.

It’s also a problem that certificates from various regions are not comparable.

"As the largest and most mature carbon market, the European Union is the only ETS that has proven it can increase the price of their offsets over time by reducing the availability of credits for regulated entities," says Hume.

But the rest of the carbon markets worldwide have created carbon offsets that are so specific to their local jurisdiction that these securities are not comparable with one another.

"This absence of comparability means that the asset class does not warrant a dedicated strategic allocation in investors’ portfolios, in our view," she says.

So is it ESG?

ESG-focused investors must also keep in mind that, at best, such contracts only carry indirect environmental benefits. For instance, buying carbon contract with the intention of reselling does not directly benefit the environment. The simple purchase and resale of an emissions contract results in nothing more than a monetary gain or loss – and not a mitigation of emissions.

"That said, we believe that the potential for using carbon credits as an impact investment has not been sufficiently explored." Hume says. Purchasing credits in the spot market can reduce emissions if they are not subsequently resold.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OD2K6IJEXRBFREQJOI66XPPKLU.png)