.jpg)

After a strong post-pandemic recovery, the global luxury sector is showing signs of cooling. Morningstar detected both positive and negative drivers for revenue and margin developments in the coming years and recommends investors wait for a better entry point in the sector, as the market looks too optimistic and valuations are too high.

Luxury sales consistently grew from the second quarter of 2020, recovering to prepandemic levels at the end of 2022.

"Although consumer confidence indicators show signs of improvement in early 2023, other indicators point to a less favorable luxury consumer environment", says Jelena Sokolova, Senior Equity Analyst at Morningstar.

As asset prices typically contribute to wealth and consumer confidence among affluent consumers, there is strong correlation between equity prices and luxury sales expectations. For this reason, analysts believe the recent weakening of equities and real estate prices in China could lead to a slowdown in luxury demand.

Strong luxury sales in the Americas and Europe during 2021 and 2022 were "exceptional, boosted by savings from foregone travel, psychological needs to self-reward after stress, and strong asset markets.

Performance in the Americas was already decelerating in fourth-quarter 2022 and showed steeper declines in first quarter of 2023. Higher interest rates, weaker asset markets, and a tougher employment situation in high-wage sectors such as technology and finance should further pressure buying," Sokolova writes, adding that growing demand in China is set to compensate for the weakinging in developed markets.

Market data supports this: the Mastercard SpendingPulse, which tracks luxury sales excluding jewelry, turned negative in the second quarter of 2022 and the Visa Spending Momentum Index (SMI) in the US also started weakening from March 2022.

Companies with big exposure to the US market, such as Tapestry (TPR) and Capri (CPRI), as well as companies that experienced very strong recent growth in the market such as Gucci owner Kering, could be most at risk from the slowdown. That said, Morningstar analysts are confident that these companies' downside risk is more than compensated by attractive valuations.

While developed markets are weakening, there is a strong expectation for a recovery in the Chinese market, driven by the return of travel demand.

"Chinese travel recovery is particularly important for the sector as Chinese nationals did around two thirds of their luxury spending abroad and, even if travel flows remain below prepandemic levels, there are signs of strong recovery once the restrictions are lifted," says Sokolova.

"Domestic travel in China experienced a strong rebound in the beginning of 2023 as the government abandoned its zero-Covid-19 policy, but we believe it should take a couple of quarters for Chinese travel in Europe to resume based on the length of the visa application process and airline capacity planning", says Sokolova.

On the margins side, Morningstar sees little space for improvement as weak sales growth meets rising costs. Marketing and communication spending, store rental and wage costs grew on average in line with sales, limiting margins expansion in the sector.

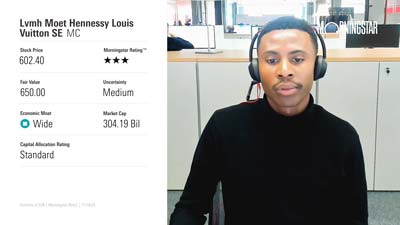

Based on these considerations, shares continue to look pricey. "Shares are mostly traded above or in line with their fair value", says Sokolova, though pockets of opportunity remain.

"Among the big companies of the sector, Swatch (UHRN) and Kering (KER) are the only ones traded at a discount, but there are also some small brands such as Capri Holdings (CPRI) and Tapestry (TPR) that are traded at 35% and 25% discount respectively".