Criticism of sustainable investing in the United States has become very politicised over the past year. To understand the timeline and its magnitude, in a recent study we took a look at the funds (Morningstar counts 26) that have picked up the anti-ESG banner. Although there’s been a lot of talk about anti-ESG funds, it’s not clear that they have staying power.

What’s an 'Anti-ESG' Fund?

Generally, 'anti-ESG' funds take an opposite tack to sustainable investing and its sibling, environmental, social, and governance (ESG) investing. We took a broad approach to defining the group of funds included in this report, but some of the fund companies included may not think they are opponents of ESG. Some anti-ESG advocates were likely excluded.

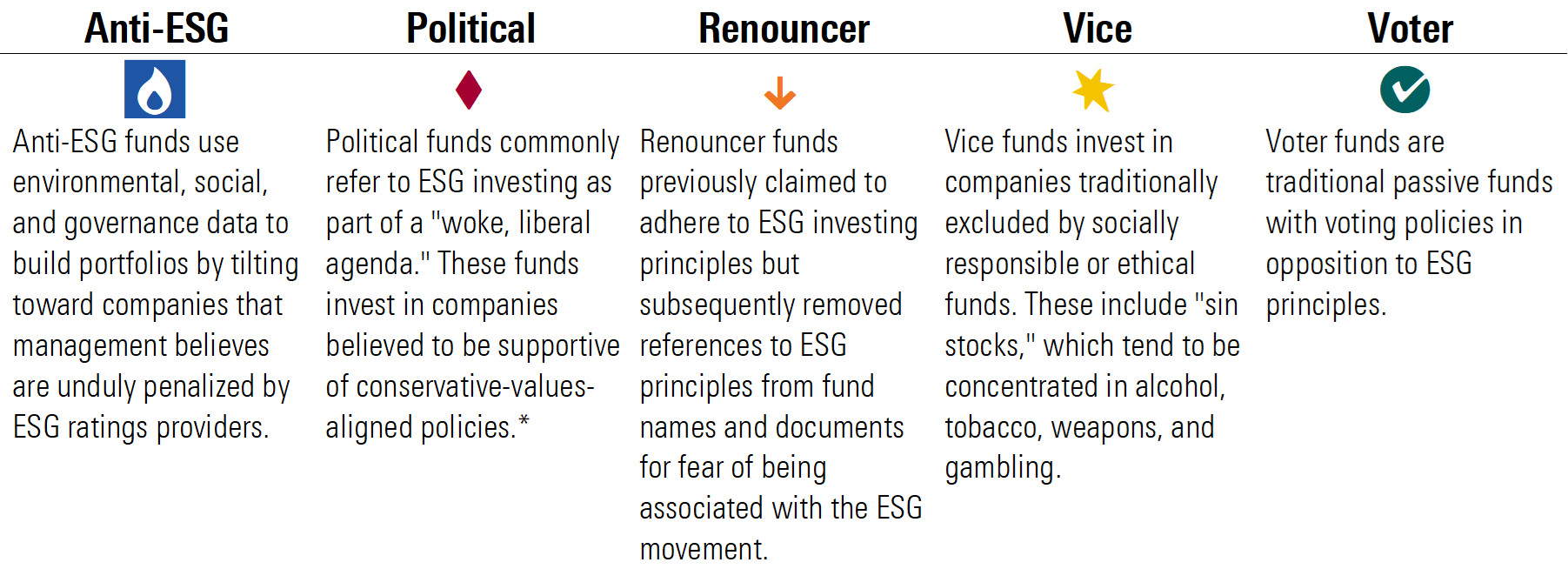

We grouped these funds into five mutually exclusive categories, primarily by referencing prospectus language, which mirrors the process we follow to establish Morningstar’s sustainable funds universe. For the occasional borderline case, we consulted proxy-voting policies and marketing materials. The categories are "Anti-ESG", "Political", "Renouncer", "Vice", and "Voter".

Anti-ESG investments differ, so the lines between the five anti-ESG categories can be blurred. In many cases, it is unclear whether a fund qualifies as a plain-vanilla index fund, a niche thematic offering, an anti-ESG fund, or something else entirely.

Short-Term Track Record, Long-Term Sentiment

With the exception of two 'vice funds' – VanEck Gaming ETF BJK and USA Mutuals Vice Fund VICEX – anti-ESG funds have short track records. The chart below shows that the vast majority of these funds have cropped up within the past two years.

However, anti-ESG sentiment is not a new phenomenon.

In her recent article, climate writer Emily Atkin traced the origins of the modern-day anti-ESG movement to 2004, when tobacco lobbyist Steve Milloy and Philip Morris alumnus Tom Borelli formed the Free Enterprise Education Institute, a non-profit focused on discrediting corporate social responsibility, or CSR, initiatives.

This group managed a website called "CSR Watch: Your Eye on The Anti-Business Movement" and started a fund – the Free Enterprise Action Fund – to invest in companies that management viewed as economically disadvantaged as a result of social activism.

In the fund’s prospectus, the firm provided examples of what it termed "harmful social activism": "energy companies that have forgone investment in power plants based on social and environmental activism rather than on the projected profitability of building such facilities"; and "companies that have made certain benefits available and other concessions to their employees based on activism rather than on sound management principles."

Anti-ESG Flows Peaked in Q3 '22 (And Lost Steam)

Boosted by product development, flows into anti-ESG funds peaked at $376 million during the third quarter of 2022. More than 80% of that was collected by Strive’s first fund (Strive U.S. Energy ETF DRLL) which attracted nearly $100 million in its first week. Strive looked poised to continue this momentum when it launched six more funds over the following three months, but what started as a downpour slowed to a drizzle.

Strive’s second fund (Strive 500 ETF STRV) picked up $33 million in its first month on the market, and the following five funds attracted less than $2 million on average in each month since launch. Moreover, in February 2023, Strive's cofounder Vivek Ramaswamy declared his candidacy for the US presidency, building on an anti-ESG policy platform.

The following exhibit shows net flows into the five categories of anti-ESG funds beginning with the fourth quarter of 2017 (the first time that investors had more than two Vice funds to choose from).

The lone fund in our Anti-ESG category has struggled so far to gain traction. Constrained Capital ESG Orphans ETF ORFN launched in May 2022 and picked up $870,000 on average in each quarter since. On June 2, 2023, the fund filed to liquidate.

Anti-ESG Funds Reject ESG Shareholder Proposals

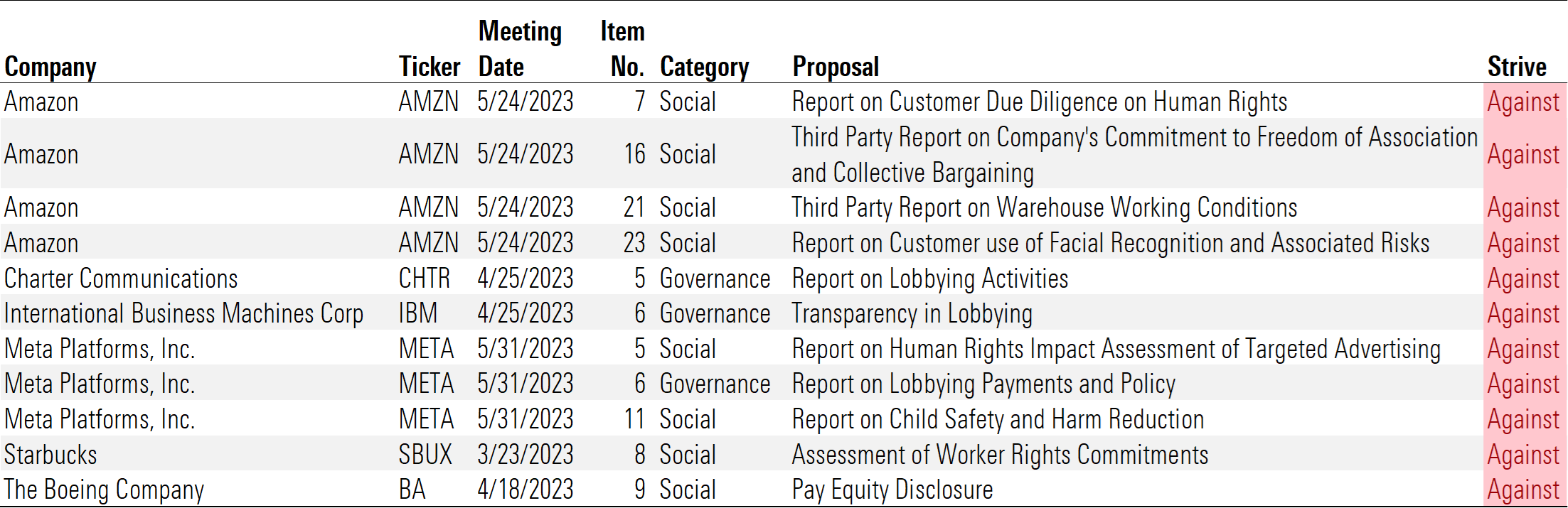

Strive’s ETF lineup comprises the Voters category of anti-ESG funds. These funds track traditional broad market indexes and promise to generally oppose environmentally or socially motivated shareholder proposals. The annual proxy season concludes at the end of June, and Strive’s funds only launched in August 2022, so we don’t yet have a full season’s worth of voting records to evaluate. However, early indicators show that Strive’s policy is playing out as promised.

So far, Strive voted against all 11 of the key ESG shareholder resolutions that we have identified at S&P 100 companies so far in 2023. These resolutions related to issues such as working conditions, pay equity, lobbying activities, and the freedom to unionise.

Intentionally or not, Strive’s approach seems to serve as an anti-ESG foil to that of Engine No. 1, which attracted significant attention when it successfully campaigned to replace three members of Exxon’s board with directors more focused on climate change in 2021. Both firms aim to vote for resolutions that help managers more effectively run their companies, but they take different stances on how helpful environmental and social measures are.

We evaluated a list of 44 ESG-related resolutions put forward at large US companies in 2023, and Strive and Engine No. 1 opposed one another in 80% of cases. Engine No. 1 voted in support of all 11 key ESG resolutions mentioned above, as well as some resolutions that received lower levels of overall support (including one that requested additional reporting on gender/racial pay gaps at Amazon.com AMZN).

Strive and Engine No. 1 made the same decision on nine of the 44 resolutions. These resolutions were put forward at Chevron CVX, Exxon Mobil XOM, and Meta Platforms META, and topics ranged from setting scope 3 greenhouse gas emissions reductions targets to reporting on community impact from plant closures or energy transitions.

In each of these cases, the company board recommended a vote against the proposal, and Strive and Engine No. 1 agreed. We can't say for certain why Strive and Engine No. 1 made the same decision on these proposals. It may be that the resolutions themselves were too prescriptive to receive significant shareholder support; those statistics are not yet available.

One thing is clear: Anti-ESG investing is not a monolith.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)