Last week, the Wall Street Journal published an article called "I Came to Kill the Banks". Meme-Stock Traders Find a New Passion. The article profiled retail investors who have purchased put options on regional-bank stocks, to profit from their declines, and who then promote their trades on investment forums.

Writes the reporter, Gunjan Banerji, after one target bank opened lower:

"In his Discord chat room, traders celebrated, exchanging screenshots of winning trades or memes of Leonardo DiCaprio from 'The Wolf of Wall Street' and Steve Carrell from 'The Big Short.'"

Spooked by the stock’s downturn, depositors removed almost 10% of the bank’s assets.

Pot, Meet Kettle

I found that tale…amusing. In January 2021, when according to the prevailing narrative (the facts are murkier) everyday investors had "squeezed" hedge funds that had shorted GameStop [GME], I sided with the institutions. The public had scored a temporary victory, I argued, but hedge funds would likely enjoy the "last laugh", because GameStop’s valuation was untenable.

To my surprise, that article generated the rudest responses I have yet received, save when I panned the stock of Digital World Acquisition Corporation DWAC. (The investment columnist’s paradox: The more overpriced a stock, the harsher the treatment of those who doubt it.) How could I side with hedge funds? They were self-evidently wicked, because by shorting GameStop, they sought to prosper from the company’s misfortunes. Hedge fund managers are vultures.

How things have changed! Two years ago, chatroom investors had harangued me about the evils of short-selling. Now, per the WSJ’s article, chatroom investors have been celebrating not only the losses of regional bank stocks, but also the possibility those companies might go bankrupt. Such irony!

An Ethical Framework

This led to me wonder: What are acceptable investment ethics?

I do not refer to the currently raging debate on environmental, social, and governance investing. That dispute is a subset of the broader issue of permissible investor behaviour.

Rather, I refer to the ethical principles that apply to different investor types, pursuing different investment activities, for different reasons, with different levels of communication.

Yes, that sentence was distressingly fuzzy. The following table provides the details.

The two investor types are retail and professional. The standards that govern their actions necessarily diverge, and sharply at that. For example, while retail customers may freely buy equity shares out of sheer self-interest, purchasing shares in the (probably forlorn) hope their trades will increase the stock’s price, mutual fund managers cannot. Doing so would violate their fiduciary duty.

Investment activities consist of buying, avoiding, and shorting. The first and third are obvious. The middle choice typically happens through boycotts, as with those who forswear alcohol and tobacco companies.

The three reasons to invest are for financial gain, to implement preferences, or for the previously mentioned purpose of self-interest. The typical approach, of course, is financial gain. Preferences are orthogonal to profit motives. They might end up increasing the portfolio’s return, having no effect, or even decreasing it. Preference investors hope for the former but accept the possibility of the latter.

Finally, shareholders can either invest privately, without intending to influence others, or they can publicly communicate their decisions.

Professional Versus Retail

I will only briefly address the situation for professional investors, whose actions are governed by regulators. They theoretically may buy, avoid, and short. (Institutional mandates often prohibit shorting, but such constraints represent investment decisions rather than ethical choices.) Fiduciary duty requires that professional investors act solely in the best interest of their clients. Finally, while most publicly disclose their holdings, they rarely promote those decisions. Thus, the distinction between private and public communication is usually moot.

The ethical lines for retail investors are much less clear. Indeed, aside from the well-known crime of insider trading, it’s hard to know whether such lines exist at all.

Retail investors who buy or avoid securities pose no difficulties. Whether they make those decisions for financial gain, personal preferences, or self-interest is immaterial. Nobody denies the public those rights. Nor, to my knowledge, do serious efforts to curb investment discussions on internet forums exist.

Are Vocal Shorts a Problem?

The lone potential issue comes with shorting. I will set aside the general attacks on shorting. While I understand that some who complained about hedge funds' wrongdoings in 2021 are equally outraged at today’s attacks on bank stocks, the fact remains many such objections occur from convenience rather than from principle.

Moreover, researchers generally agree that allowing short-selling makes financial markets more efficient. Without short sales, investors cannot actively "bet against" securities in the same way that they can actively bet for them by placing buy orders. The marketplace would be asymmetrical.

Nor do I see a controversy with private short-selling. Assuming one accepts it should be allowed, the strategy naturally may be used for financial gain. Enacting personal preferences is also fine. Those who detest "woke" companies can invest according to their beliefs, for example, as can their political opposites. If such trades prove counterproductive, so be it. Only outsiders have fiduciary duties. With their own moneys, the people may do what they wish.

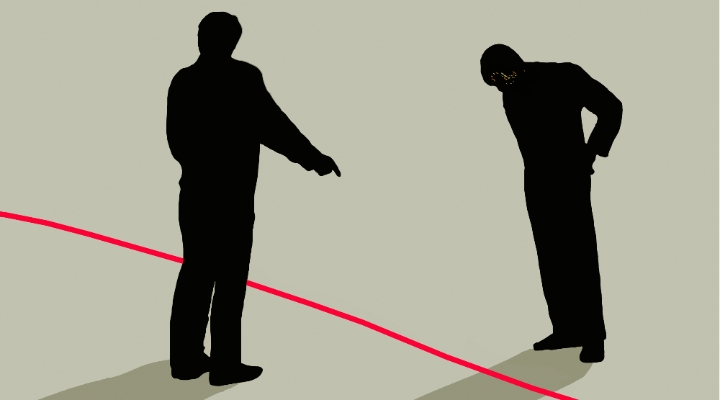

However, shorting publicly, thereby encouraging others to damage the company’s stock, or perhaps even destroy its business, may conceivably be one step too far. Perhaps that tactic can be justified for those who express preferences, as it would be a communal boycott. But it’s not self-evident, to me at least, that colluding in the attempt to knock down a stock’s price should be tolerated.

(To be sure, one can advance a similar argument against concerted chat forum efforts to boost stock prices. After all, artificially inflated stock prices hurt market efficiency as much as artificially depressed ones. The two cases are not identical, though. With overhyped stocks, the primary danger is to investors when the price bubble bursts. But with stocks that have been punished by shorts, business failure may ensue. The social damage is greater.)

Conclusion

Professional investors have ample opportunity to sin (and face ample rules that aim to prevent them from doing so). Without doubt, their investment practices can be unethical.

Retail investors face far fewer potential perils. One possibility, though, might be the internet-enabled practice of collaborating to damage a stock’s price. Permitting short-selling appears to be a public good, by improving market efficiency. But, to my knowledge, there is no evidence that society benefits from times when the activity is conducted collectively. It may even be harmful.

The author or authors do not own shares in any securities mentioned in this article. John Rekenthaler is director of research at Morningstar. This article originally appeared on Morningstar.com and has been reproduced and edited here for a UK audience

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)