Flexible Friends...

We asked Bestinvest managing director Jason Hollands for his take on the ISAs versus Pensions debate. He replied with something of a masterpiece!

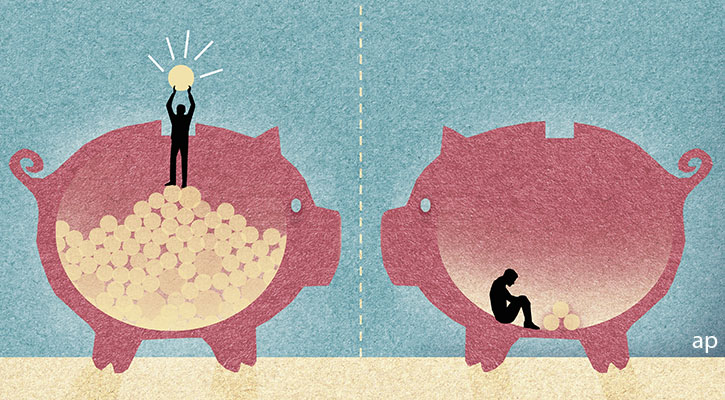

ISAs versus pensions is a subject I’m regularly asked about. They’re the two key pillars of long-term tax efficient saving in the UK and both have their respective strengths.

In terms of tax, pensions have the edge – especially for the growing number of people subject to the higher rates of income tax (a record 6.1 million this tax year, forecast to rise to 8.3 million by 2028) as they provide income tax relief at the investor’s marginal rate. That means a 40% taxpayer gets a £10,000 investment at an effective cost of £6k, providing a massive head start to returns.

Pensions are also very tax efficient from an estate planning perspective as they do not count as part of your estate from an inheritance tax (IHT) perspective. If you die before 75 your beneficiaries can inherit your residual pension tax-free. After 75, they will pay income tax at their marginal rate from any assets drawn from an inherited pension.

But there are strings. You can only access your pension pots from age 55 (rising to 57 in 2028) and the amount you can take from a pension as a tax-free lump sum is restricted to 25% of the pot (subject to a maximum amount of £268k from the next year). Once tax-free cash has been taken, withdrawals are subject to income tax depending on your circumstances and tax band.

While ISAs don’t provide upfront tax relief and don’t escape your estate on death (unless the portfolio is held in shares that may be subject to business relief e.g. qualifying AIM shares), they stand out for their flexibility. There are no restrictions on when you can take money out of an ISA, so the money can be used for a wide range of financial goals. Gains and income from ISAs are tax-free and you don’t even need to declare them on your self-assessment tax return. ISAs are the long-term investor’s tax-efficient flexible friend.

Has the Budget Changed The Rules of Engagement?

At the recent Budget, Jeremy Hunt did not rethink his Autumn Statement raids on the dividend tax allowance and annual capital gains exemption. As such, ISAs remain ever important for investors seeking to shelter their wealth from taxation. In my view, the current tax year end is the most important in living memory given the savage reduction in these allowances. The capital gains allowance will be slashed from £12,300 to £6,000, and then halved again in April 2024 to £3,000. The annual dividend allowance, which five years ago stood at £5,000, is currently £2,000, and will halve on 6 April this year to £1,000. In April 2024 it will fall to a meagre £500.

If you don’t have the cash to make full use of your £20,000 ISA allowance, but do have shares or funds held in a taxable environment, then you should urgently consider “Bed and ISA”: selling the shares or funds, taking care not to exceed the current £12,300 capital gains exemption, and then repurchasing them within an ISA. As this process can take a few days for trades to settle, there are just days left to act.

Of course, the big news in the Budget was about pensions, with the surprise scrapping of the lifetime allowance (LTA), as well as anticipated increase in the annual allowance (from £40,000 to £60,000) and the money purchase annual allowance from £4,000 to £10,000.

These are very welcome developments. People in a position to make bigger contributions can now do so, and, for those who have avoided pensions over lifetime allowance concerns can now recommence their payments. However, anyone with LTA protections in place should not act without first understanding how they will be impacted, especially when it comes to their tax-free cash.

There was a sting in the tail in the Budget, though. Going forward, tax-free cash lump sums of 25% from pensions will be subject to a maximum cap of £268,000. That’s equivalent to 25% of the current lifetime allowance of £1.073 million. This cap will effectively reduce the amount of tax-free pension cash someone can take in real terms over time. We anticipate those with LTA protections in place will retain access to a higher sum, but we need to see the legislation first.

As for really high earners, pension funding is set to remain highly constrained due to the continuation of the hellishly-complicated tapered pension allowance regime. Those with adjusted income over a threshold of £260,000 will see their annual allowance reduced by £1 for every £2 above this level until the allowance available to them reaches a minimum of £10,000.

For those subject to the higher rates of tax and who are perhaps behind with pension funding – perhaps because they own a business that has taken off in more recent years – then pensions are likely to be the greater priority next year, especially given Labour has vowed to reinstate the LTA.

In theory, someone who has made no pensions contributions in recent years could plough in as much as £180,000 into a pension in the new tax year by, firstly, using the new £60,000 allowance, and then mopping up the three previous years of unused allowances of £40,000 each, through a process known as carry forward.

Should I Use Both Pensions and ISAs to Save?

Absolutely. For most people, it need not be an either/or decision. Pensions are the primary retirement savings vehicle, but ISAs can sit alongside as flexible pots to dip into, either through lump sums or by providing access to tax-free dividend income and interest on cash and bonds.

Will ISAs Miss Out Now?

The relative advantage pensions have in terms of their tax treatment on death is not new. In my view people need think about IHT mitigation more broadly, as there is a variety of ways to address a potential liability – the most straightforward being lifetime gifting. To some extent this is really about sequencing. Someone with significant assets might therefore choose to drain their ISAs and other assets such as second properties before drawing on their pensions.

What Will Happen if Labour Wins The Election?

Labour’s knee jerk pledge to reverse the removal of the LTA was akin to lobbing in a hand grenade of uncertainty. The LTA has caused havoc in the NHS in particular, but also disincentivised people in the private sector from working. Removing the LTA was a simple solution to a serious problem that treated all those affected by the LTA equally rather than carving out a special deal just for a particular profession with an already-generous defined benefit scheme, underwritten by taxpayers.

It concerns me that pensions are a political football. People crave stability when they are trying to make important decisions about how they will fund their retirement and endless tinkering just undermines trust. One outcome of Labour’s pledge will be that some will likely decide to maximise contributions next year and then crystallise benefits when it becomes clear who is going to win the election. That will drive early retirement decisions, which is the opposite of what the government was trying to achieve to address the tight labour market.

The LTA was only introduced in 2006, so has not been a permanent feature of the pensions landscape. While a rationing of tax reliefs is understandable, this is already in place through the annual allowance. The most distasteful feature of the LTA on money purchase pensions is that it’s also a tax on growth. That penalises people who have made good investment decisions.

When the LTA was first introduced by Labour in 2006 it was £1.5 million. In today’s money that would be worth £2.3 million adjusted for inflation and by the end of the last Labour government it had risen to £1.8 million; £2.5 million in today’s money. Having pledge to reintroduce the LTA, Labour should at least set out its plans.

Is The Lifetime ISA Really Necessary?

The ISA brand has been applied to a variety of accounts, which can be a little confusing. However, the Lifetime ISA does have a very specific role in helping younger people purchase their first home. I think it’s a useful option. A very shrewd move for those with maturing Junior ISAs is to recycle these into that product.