The UK government borrowed a record amount in February to support spending on energy support schemes, according to the Office for National Statistics on Tuesday. UK public sector borrowing - excluding public sector banks - totalled £16.7 billion last month. This figure is significantly higher than market expectations of £7.67 billion of total borrowing, and the £7 billion borrowed in February 2022.

The ONS said this was the highest February borrowing since monthly records began in 1993, largely due to substantial spending on energy support schemes. But this figure is not an anomaly: December 2022’s borrowing figures were also the highest since records began, as the government paid out the latest £1.9 billion tranche under the Energy Bill Support Scheme that month – a scheme that has now been extended to June.

February’s record borrowing figures follow January figures which painted a different picture of the government’s fiscal “headroom”. With the January 31 tax deadline looming, the government brought in a bumper £21.9 billion of self-assessment tax receipts, the highest January figure since records began in April 1999 – AND £5.5 billion higher than the same point in January 2022.

Budget Giveaways?

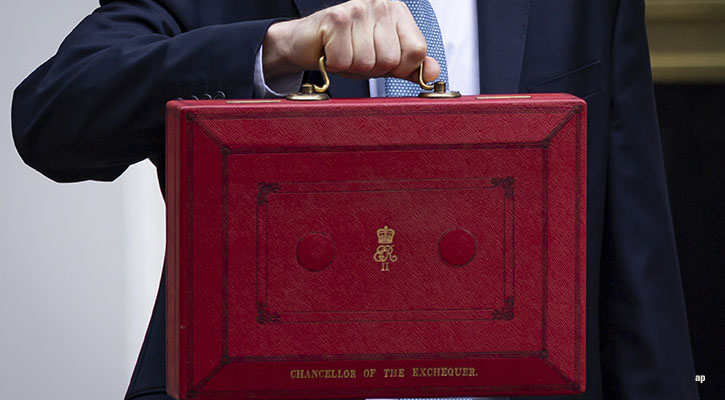

In his Spring Budget last week, UK chancellor Jeremy Hunt confirmed that the energy price guarantee, which caps average household bills at £2,500, will be extended at its current level from April to June. According to the Budget red book, this will cost the government £2.5 billion in the coming financial year. Still, January's surprise surplus gave the chancellor some room to splash the cash on various schemes, in contrast to the belt-tightening message of the Autumn Statement.

Fiscal Rules

Total UK public sector net borrowing came in at £15.9 billion – a narrower measure of borrowing than the headline total – compared to £6.2 billion in February of last year. Last week Jeremy Hunt said that the government, as per its fiscal rules, has managed to keep public sector net borrowing (as a percentage of GDP) below the stated “fiscal rule” of 3%, and will gradually reduce this to 1.8% in 2027-2028.

As well as energy support for households, government borrowing is also significantly higher because of the elevated cost of its interest payments. The state funds spending plans through issue debt through bonds – since inflation spiked these bonds, known as gilts, must pay a higher rate of interest. And some of these bonds are “index linked”, which means they are tied to RPI inflation, which hit 13.4% in January.

.jpg)