Key takeaways:

- European banks' ample cash positions and more diversified funding sources clearly differentiate them from SVB

- Sharp declines in banking stocks reflect fear of rising systemic risk, pushing up borrowing costs for banks

- Psychological scars from Lehman's 2008 collapse, combined with European banking stocks' recent rally are likely spurring investors' exit

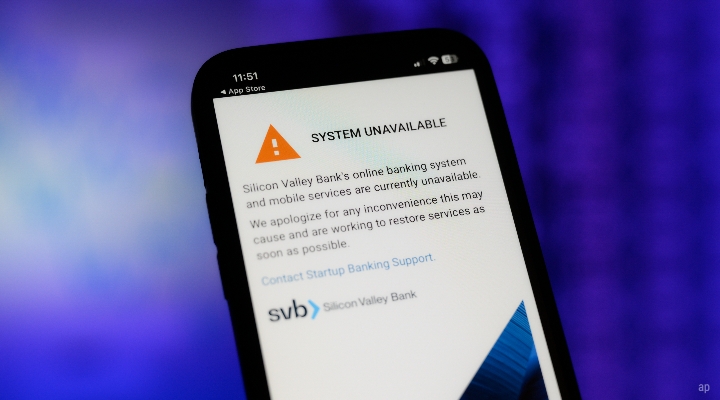

Lukas Strobl: In case you've been away since Thursday, we've got America's largest bank failure since 2008 on our hands. Silicon Valley Bank has entered receivership, that is, effectively collapsed. What's unclear is what knock-on effects this could have. For one, US deposit insurance will reimburse the countless startups and tech firms that depended on it. Also, SVB's fatal bet on long-dated debt doesn't seem to be a common feature among its European and global banking peers. With me are European banking analyst Johann Scholtz and European equity strategist Mike Field.

Johann, let's start with you. Are there any worrying similarities between Europe's largest banks and SVB?

Johann Scholtz: Hi, Lukas. Yes, of course, there are similarities, but I think it's important to take note of some material differences in both the structure of liabilities and of assets between European banks and SVB. And I think where part of this originated from is the fact that SVB was exempt from following certain of the liquidity ratios that European banks need to comply with, and that really resulted in SVB sitting with the situation where 55% of its assets are bonds, that they do not mark-to-market, whilst for European banks, the situation is completely different. Only 4% of their bond holdings do they not mark-to-market.

On the other side of the balance sheet, there's also some clear differences in the funding profile of European banks and of SVB. European banks keep about 14% of their assets in cash with the various central banks and that provides them with a buffer to absorb any immediate need for liquidity, whilst that ratio was only 7% for SVB. And then, European banks' funding base is also much more diversified. Around 40% of European banks' funding comes from stable retail deposits, whilst that ratio was only about 7% for SVB.

Strobl: And yet, as of today, European banks are hurting. Credit Suisse is down 11%, Commerzbank 10%. Sabadell is down 9%. What's going on?

Scholtz: Yes. I think investors still carry some of the psychological scars from 2008, from Lehman's collapse. I think it's slightly different now. What we're seeing here is, the underlying problem is not a problem of asset quality. It's sound asset quality. It's government bonds, which essentially should be risk-free. I think the concerns though are that it's going to spread further than just SVB. And banks remain so dependent on the confidence of their providers of funding. And as that confidence evaporates, you essentially get what is referred to as systemic risk and systemic contagion. I think actually, though, that the only real-world impact for European banks is potentially going to be that they will have to pay up for their funding. So, their funding costs could well increase.

Strobl: Now, the last time we've had an even larger collapse than SVB was, of course, Lehman in September 2008. Back then, European banking stocks only dipped a few percent, as did the rest of the European stock market, before rebounding a few days later. Mike, I bet many traders wish they had sold right then and there. Do you see scars from that behavior still lingering and affecting the fallout from SVB today?

Michael Field: I think to some degree, Lukas, yeah. And as Johann rightfully said, it's a confidence game. And if you look at where markets have come from in the last few months, they've rallied hard, and we're at a point now where things could tip either way based on the macro data points that we're seeing are kind of one-off incidents like SVB. And that seems to just tip the scales in terms of negativity. And the risk there is that investors pile out of the market as a result, and we see further falls.

Strobl: Do you see a pivot to haven sectors and asset classes?

Field: To some degree. I think it's a bit of a scattergun approach today. If you look at the sectors that are falling, it's everything from consumer defensives to oils. There doesn't seem to be a whole lot of pattern around it apart from the fact that some of these are more of the consumer-exposed sectors and the belief being now that incidents like this could tip us further toward that recession, and that would hurt those consumer-facing sectors. So, yes, you could see some pivot. You see some utility stocks up today as a result of that. So, clearly, there's that mindset of, okay, where is safe to put my money right now.

Strobl: Like so often in financial markets, it's part data and part psychology. Of course, we'll keep you updated on how this saga unfolds. Thank you, Mike. Thank you, Johann. For Morningstar, I'm Lukas Strobl.