HSBC has confirmed it has bought the UK arm of the failed US lender Silicon Valley Bank.

The Asia-focused lender said its ring-fenced UK subsidiary, HSBC UK Bank PLC has acquired Silicon Valley Bank UK Ltd, for the nominal price of £1. "The transaction completes immediately," HSBC said.

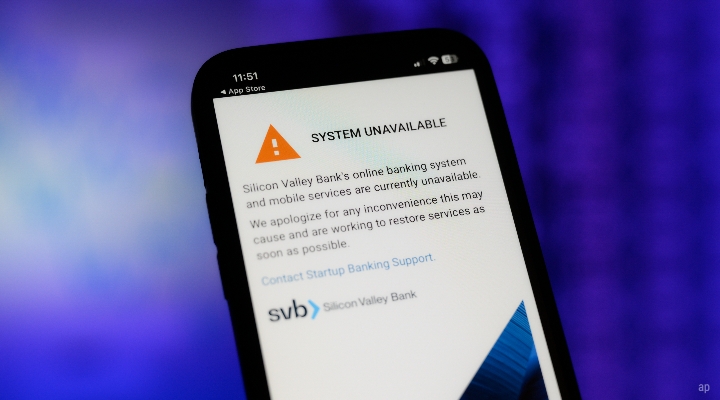

On Friday, SVB UK's Californian parent company collapsed, with US regulators seizing its assets. The Bank of England then ordered its UK arm into insolvency on Sunday night.

A number of buyers were said to be considering the acquisition of SVB UK, with Sky News reporting that JPMorgan Chase & Co also was exploring the possibility.

According to HSBC, as of Friday, SVB UK had loans of around £5.5 billion, with deposits of around £6.7 billion. In 2022, it brought in pretax profit of £88 million. Its tangible equity is expected to be around £1.4 billion.

"Final calculation of the gain arising from the acquisition will be provided in due course," HSBC said.

The bank confirmed that any assets and liabilities of SVB UK's parent company were excluded from the transaction.

"This acquisition makes excellent strategic sense for our business in the UK," said chief executive Noel Quinn.

"It strengthens our commercial banking franchise and enhances our ability to serve innovative and fast-growing firms, including in the technology and life-science sectors, in the UK and internationally.

"SVB UK customers can continue to bank as usual, safe in the knowledge that their deposits are backed by the strength, safety and security of HSBC."

On Monday, UK Chancellor Jeremy Hunt said on Twitter that the UK government and the Bank of England had "facilitated a private sale" of SVB UK to HSBC.

"Deposits will be protected with no taxpayer support," Hunt confirmed.

"I said yesterday that we would look after our tech sector, and we have worked urgently to deliver that promise."

On Sunday, Hunt warned the insolvency of SVB UK posed a "serious risk" to the UK's tech and science sectors, vowing a bring a plan forward "very quickly" to resolve the situation.

According to BVCA – an industry body representing venture capital investors – a survey of 31 venture capital firms found that 34% of their portfolio companies (or 336 firms) have accounts with SVB UK. Some £2.5 billion in capital from these firms is locked in the lender, according to BVCA.

HSBC shares were up 0.1% at 592.90p early Monday in London.

By Elizabeth Winter, Alliance News senior markets reporter

.jpg)

.jpg)