March Market Outlook Takeaways

• The US stock market remains undervalued;

• The economy has been resilient to tightening monetary policy, but a slowdown is coming;

• The markets will be looking for an upswing in leading indicators to take next move higher.

After posting extraordinarily strong returns to start the year, the stock market retreated 2.31% in February 2023. This leaves stocks slightly more undervalued than at end of January but less undervalued than noted in our 2023 Market Outlook.

As we highlighted last month, while we view the stock market as undervalued for long-term investors, in the short term, we think the easy returns are behind us. Looking forward, we suspect that the market will be entering a stage where economic and monetary headwinds will slow additional gains over the first half of the year. We expect markets will be looking for an upswing in leading economic indicators in order to begin the next move higher toward our long-term, intrinsic valuations.

Latest US Stock Market Trends

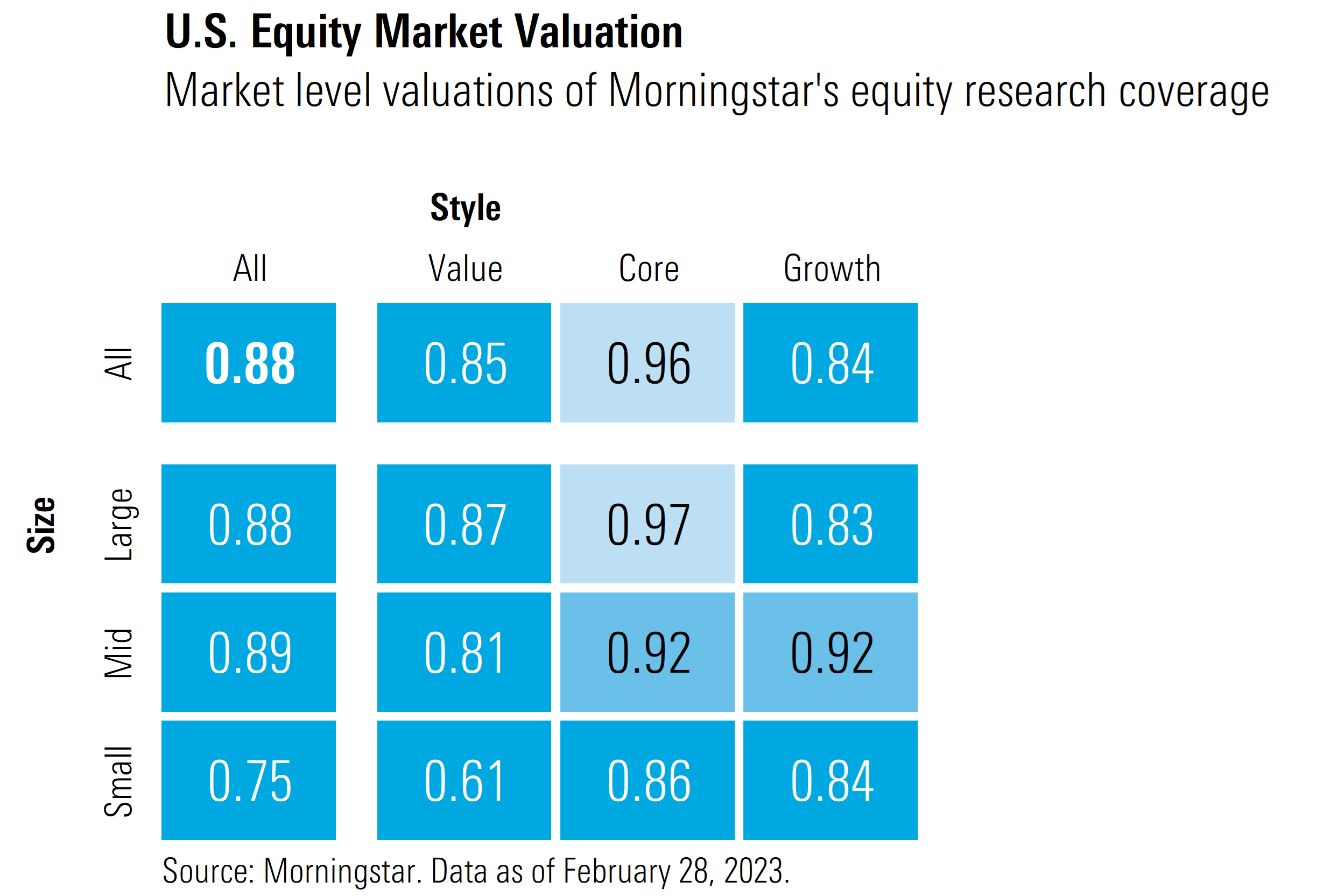

According to a composite of the 700-plus stocks that we cover and trade on US exchanges, as of 28 February, the broad US market was 12% undervalued.

Based on our valuations, we continue to see the best positioning for long-term investors in a barbell-shaped portfolio: overweight value and growth stocks, which are 15% and 16% undervalued, respectively, and underweight core stocks, which are trading closer to fair value.

By market capitalisation, small-cap stocks remain the most undervalued at a 25% discount to fair value, whereas the large- and mid-cap categories remain at a discount similar to the broad market. The most undervalued category in the Morningstar Style Box is small-cap value, trading at almost a 40% discount to our fair value.

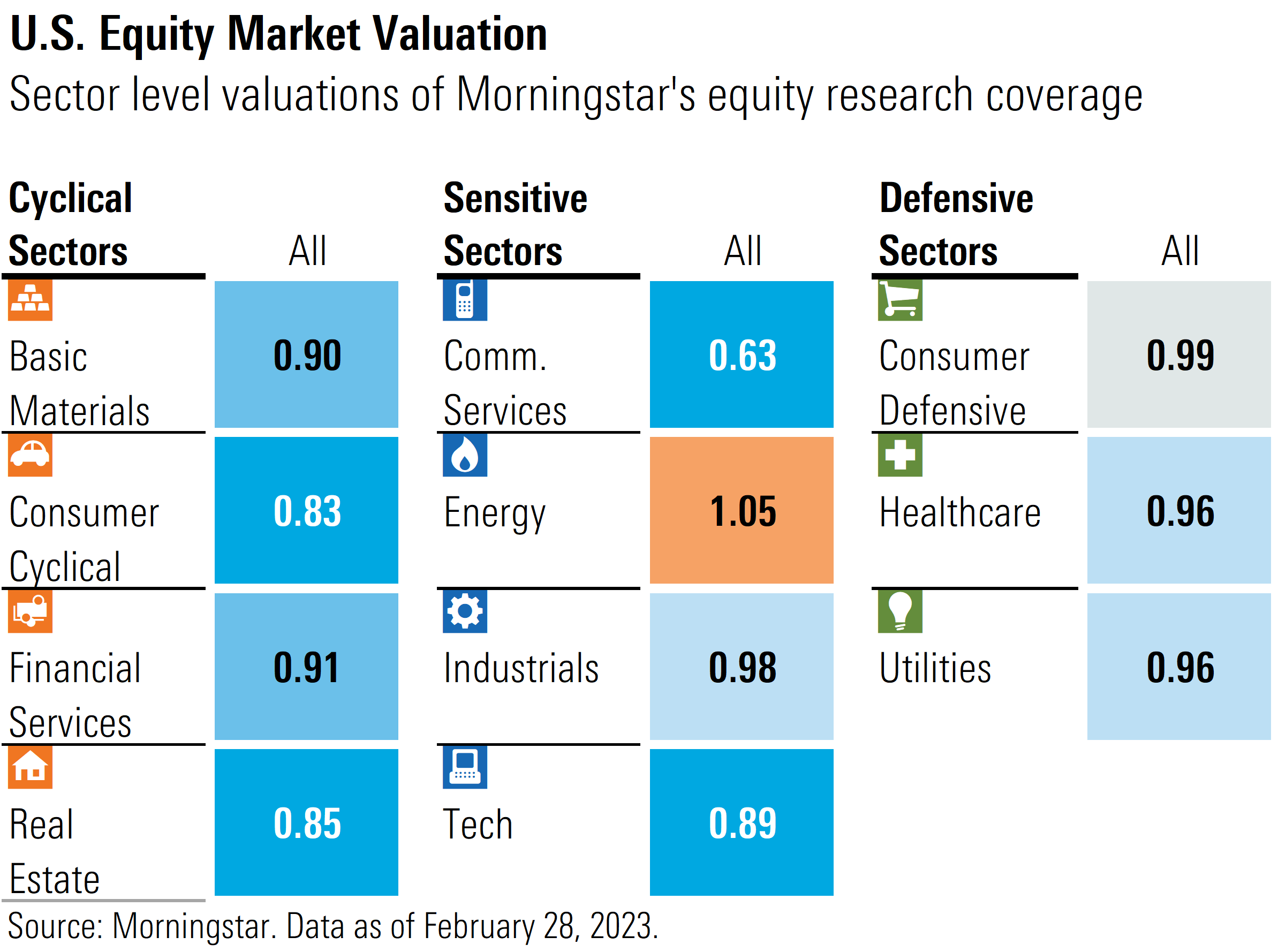

Defensive sectors slipped below fair value but are fully valued on a relative basis as compared with the rest of the market. Within the economically sensitive sectors, energy was the worst performer yet still the most overvalued.

Communication services fell slightly more than the market but remains the most undervalued sector, trading at a 37% discount to our fair value. The only sector to post a gain in February was technology. The most notable move in cyclical sectors was real estate, which became even more undervalued and is now trading at a 15% discount to fair value.

Stock Sector Performance and Valuation

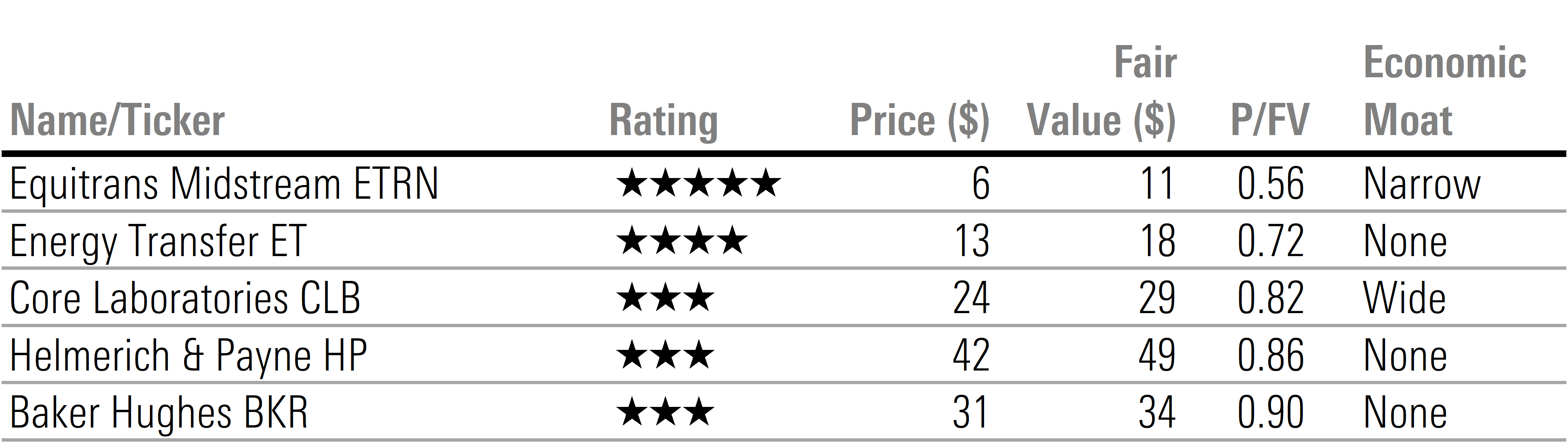

Energy stocks were the worst performers in February as the sector dropped 6.80%. Energy was also one of the worst-performing sectors year to date, having fallen 4.23%.

While energy was the most undervalued sector coming into 2022, it skyrocketed over 60% last year to levels that we viewed as significantly overvalued.

While oil prices surged higher after the Russian invasion of Ukraine and remain relatively high, we have maintained our midcycle price forecasts of $55 per barrel for West Texas Intermediate crude. Whereas the market is pricing in higher oil prices for longer, we forecast that oil prices will subside over the course of the economic cycle.

Among the energy stocks we cover, there are only two that have Morningstar Ratings of either 4 or 5 stars: Equitrans Midstream ETRN and Energy Transfer ET. The only other value we see within the sector are largely 3-star stocks within the oilfield services industry, such as Core Laboratories CLB, Helmerich & Payne HP, and Baker Hughes BKR.

Real Estate Market Outlook

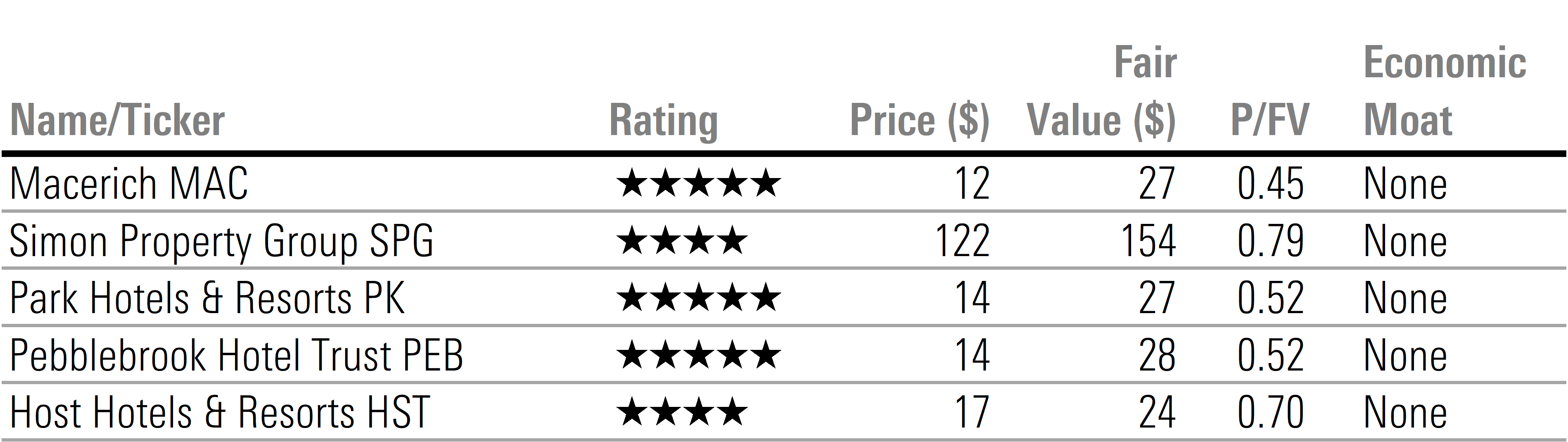

The real estate sector was the second-worst-performing sector, falling 5.97% in February, giving back over half the gain it made in January. We suspect the decline was largely due to an increase in long-term interest rates. Over the course of February, the yield on the 10-year US Treasury bond rose 40 basis points to 3.92%.

In addition, according to Morningstar senior equity analyst Kevin Brown, managements' guidance for 2023 was relatively disappointing across the board. However, Brown noted that, in his opinion, many management teams were being very conservative in their views. With the sector now trading at a 15% discount to our fair value, this could set the base for better returns over the remainder of the year.

Within the real estate sector, we see a plethora of undervalued stocks. One of the themes we expect to continue to play out this year is the normalization of consumer behaviour.

Increasing in-person shopping will drive greater foot traffic across Class A shopping malls. Two stocks that stand to benefit include Macerich MAC and Simon Property Group SPG.

In addition, while much of domestic leisure travel has already rebounded, we expect that international tourist traffic will increase and business travel will pick back up. Examples of stocks that stand to benefit are Park Hotels PK, Pebblebrook Hotel PEB, and Host Hotels HST.

Communications Market Outlook

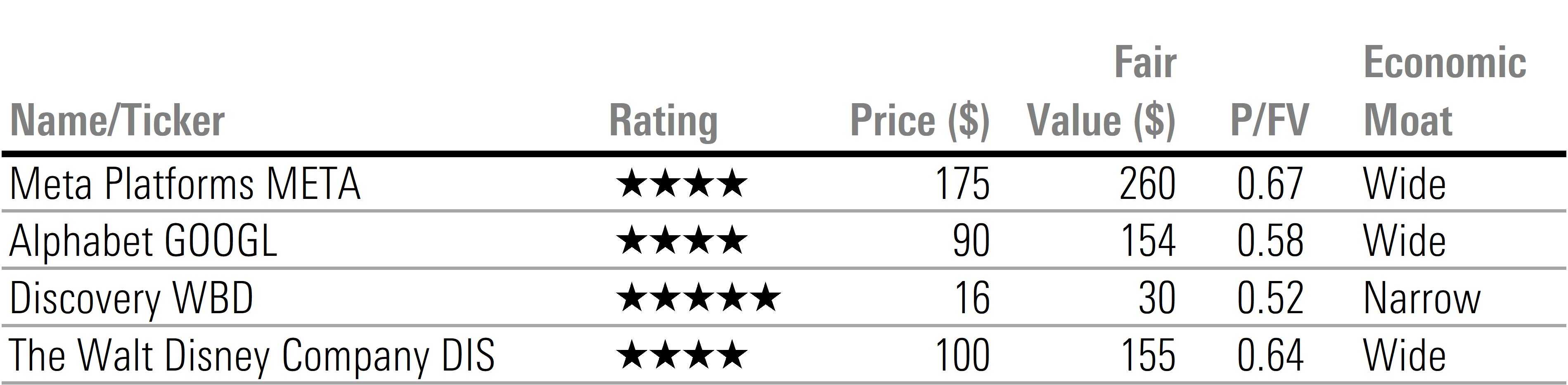

After soaring 14.33% in January, the beleaguered communications sector fell 4.74% in February. The bulk of the retreat was due to the over 9% decline in Alphabet GOOGL.

Investors were particularly underwhelmed by Bard, Google’s version of artificial intelligence, as compared with ChatGPT and Microsoft’s MSFT Bing tool. Partially offsetting Alphabet’s decline, Meta Platforms META surged following its better-than-expected earnings report combined with further cost-cutting efforts.

Elsewhere in the communications sector, 5-star-rated Warner Bros. Discovery WBD rose over 5% as investors were encouraged that the firm is transitioning away from growth at any cost toward a focus on profitability. Disney DIS started strong but gave up earlier gains later in the month. We thought Disney was significantly undervalued even before Bob Iger retook control of the company, and his actions have further reinforced our view.

These actions include cutting expenses that lingered from the Fox acquisition and returning creative control to division heads with a renewed focus on higher-return content. Both of these actions will help to improve margins. On the streaming side, we think Disney is one of few content creators that has the breadth and depth of content to successfully build a profitable stand-alone streaming business. Lastly, plans to reinstate the dividend will bolster sentiment and bring back dividend-focused investors.

Outlook: Stronger Than Expected, But Problems Ahead

Recent economic indicators (for example, payrolls and retail sales) have been stronger than we expected, indicating that the economy has remained more resilient to rising interest rates than we originally expected. However, we continue to expect that tightening monetary policy will slow economic growth.

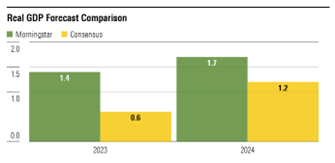

As such, we have pushed back our forecast for an economic slowdown into the third and fourth quarter of this year from the second and third quarter. Our forecast for full-year real US gross domestic product increased slightly to 1.4% (from 1.0%), which is nearly double Wall Street’s 0.6% consensus.

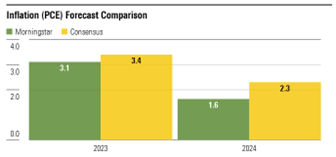

With the stronger economic growth, inflationary metrics also continue to come in a little hotter than expected. We bumped up our 2023 inflation forecast to 3.1% (from 2.8%) but still project that inflation will moderate over the course of this year. Our inflation forecast is lower than consensus as we expect inflation will abate more quickly over the course of 2023. In fact, we project that personal consumption expenditures will end 2023 at a 2% year-over-year growth rate.

Investing During Market Volatility

In an especially uncertain economic environment, investors need to remain steadfast in their commitment to building long-term wealth and not get caught up in short-term volatility. One way to accomplish this is to focus on investing in undervalued stocks that are leveraged to long-term secular growth themes. This strategy provides investors with a few benefits:

It Limits the Downside

During an economic downturn, those companies whose revenues are tied to long-term secular growth trends should decline less than companies whose revenues are not.

It Provides Fortitude

In investing, few things can feel as bad as spending the time to research a company, pull the trigger and buy a stock, and then start to see it trading down. Investing in a company tied to a long-term secular trend helps to provide an investor with the wherewithal to hold the stock during downturns and not panic sell when prices are falling.

It Boosts confidence

Investing in these secular themes helps to provide the confidence an investor needs to be able to not only hold the stock but add to positions when markets sell off.

As an example of investing in long-term secular themes, in "6 Cheap Stocks to Play Long-Term Growth Trends," we highlight five long-term trends and identify six companies in the specialty chemicals sector that are tied to those themes.