For European aerospace companies, the road to recovery has been long.

Despite a rebound in airborne traffic and the expectation that a reopening of Chinese economy will bring back flows of tourists and business travellers around the world, the outlook for the civilian aerospace industry is only cautiously optimistic.

This muted outlook is best reflected in the share prices of the largest constituents of the aerospace industry in Europe. The biggest companies are still trading below the level reached before the coronavirus pandemic hit the world at the end of 2019, as seen in the chart below.

Interest is Back, but Prices are Up

While the short-term issues are clearly visible for investors, more fundamental and long-term factors are also at play.

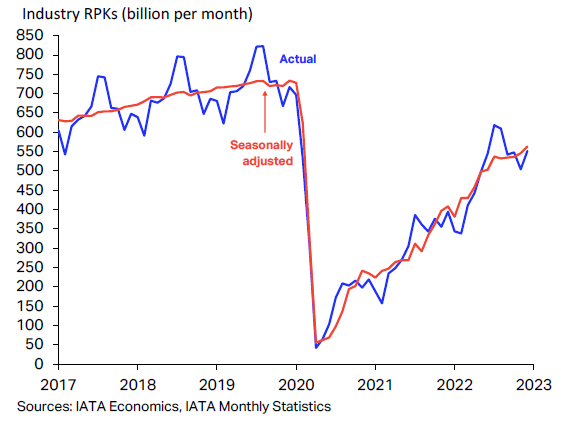

International Air Transport Association, or IATA, says in its latest report that in 2022, “global air passenger traffic gained momentum and recovered substantially as travel restrictions were taken down and passengers expressed very strong willingness to travel.”

Passenger traffic went from 41.7% of 2019 volumes to 68.5% in 2022. Much better, but still not beating pre-pandemic levels. And with inflation and high energy costs, airfares are much more expensive now than they were in 2019.

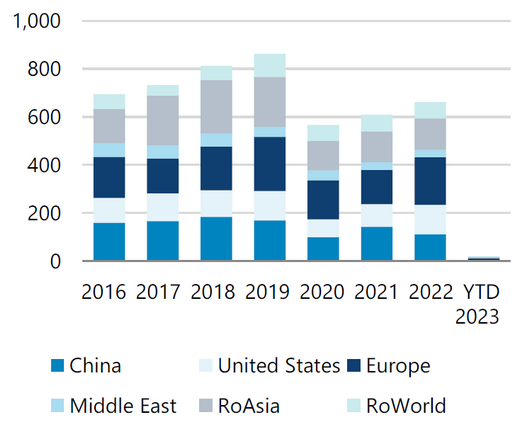

On top of that, investors are wrongly expecting a rapid increase in deliveries of new aircrafts, but the industry is busy battling a number of issues like capacity shortages, a high parked planes rate (c15%) and delayed deliveries taken by airlines.

Delays and Deliveries

In a report from UBS on January 30, analysts state: “Implied consensus expectations of accelerating fleet growth in the coming years appears inconsistent with (…) industry surveys suggesting business travel attitude changes as well as putative cyclical headwinds.”

The bank forecasts that airlines will delay deliveries of new aircrafts, which means demand is unlikely to recover to 2019 levels until 2024, at the earliest. This situation affects both aircraft makers and their equipment suppliers with various degree and intensity.

Wide-moat Airbus (AIR), the largest aircraft maker in the world together with US-based Boeing (BOE), has ambitious production targets in the near term which might be difficult to achieve due to the above mentioned issues.

The outlook seems a bit more positive for OEM manufacturers, such as wide-moat companies Safran (SAF) and MTU Aero Engines (MTX), and narrow-moat Rolls-Royce (RR.). They tend to benefit from the maintenance contracts of the already installed base, on top of the selling of new engines.

Investor expectations are therefore high for the next few years. They are expecting a solid rebound in earnings, with net income rising 23% per annum between 2022 and 2025 at Airbus, 27% at Safran, 19% at MTU and 147% at Rolls-Royce.

Yet on average, the valuation ratios of these companies are barely back at the level they reached at the end of 2019, which illustrates the many uncertainties and challenges the industry still has to overcome in the near future.