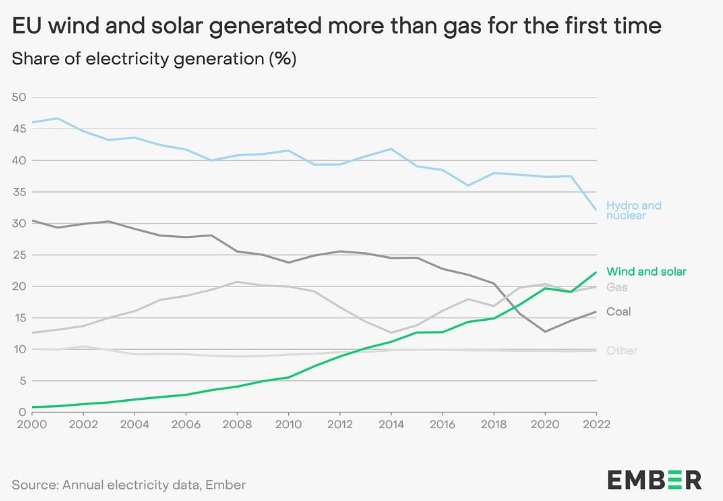

2022 was a year of historic events - amid war and energy scarcity, for the first time in history, sun and wind power generated more electricity than gas within the European Union.

According to data from London-based renewables think tank Ember, last year 22% of the EU's electricity was generated by solar panels and wind turbines, compared with 20% from the use of natural gas. “Europe has avoided the worst of the energy crisis”, says Dave Jones, head of data at Ember. “The 2022 shocks caused only a small increase (1.5%) in coal power and at the same time a huge surge in support for renewables. Any fears of a coal recovery are now dead.”

The historic shift was a choice imposed by the invasion of Ukraine, the subsequent European sanctions against Moscow, the almost complete halt of Russian gas imports and the resulting spike in prices and volatility.

After hitting an all-time high last August at €340 per megawatt-hour, however, natural gas contracts traded on the Dutch TTF platform are currently hovering around €51 per MWh, at their lowest since September 2021. With just a month left of winter, European storage facilities are 65% full, well above the 10-year average of 53% for this time of year. Equally, volatility and uncertainty in energy markets are far from over, especially in the face of rebounding Chinese demand after long periods of lockdown.

“Wholesale gas and power prices have been skyrocketing since the beginning of the energy crisis in 2021, and they will remain well above their historical average”, says Tancrede Fulop, senior equity analyst for utilities at Morningstar. “We believe that they will normalise around the middle of this decade in the wake of a structural reduction in gas consumption in Europe and a rebalancing of the global gas market as new gas liquefaction plants will come on stream.”

Electrifying both supply and demand

The war in Ukraine has placed the focus of European policy on diversifying energy supplies, and on managing demand through higher efficiency; electrification and renewables are key to both. Last May, Brussels launched the REPowerEU plan, a €300 billion (£264 billion) programme meant to end dependence on Russian fossil fuels and boost investment in renewable energy up to 45% of the energy mix by 2030.

“In particular, solar is expected to increase to 600 GW by 2030 and over 320 GW by 2025, more than double today’s levels”, according to Morningstar's Fulop. “The largest European diversified utilities did not wait for the energy crisis to tilt their investments towards renewables. They started to do so in the last decade as power prices were depressed and renewables investments benefitted from high subsidies. We reckon that European utilities we cover will dedicate more than 40% of their investments to renewables in coming years. A good chunk of the rest of the investments will go to networks which need to be upgraded and expanded to accommodate growing renewables.”

Boosting renewables output is one side of the transition, but the electrification of energy uses will be key for it to succeed, cautions Roman Boner, Portfolio Manager of RobecoSAM Smart Energy Equities strategy. “Such change will be driven not only by transport markets, but also by buildings, through energy efficiency, and by industrial markets, through the electrification of production processes.”

Last week, the European Parliament approved a controversial ban on new sales of carbon-emitting petrol and diesel cars by 2035. The EU plan also supports the electrification of buildings and businesses and expands investment in infrastructure connecting the bloc’s economies.

“In the short term many companies will face considerable costs, especially in hard-to-electrify sectors,” says Boner. “However, the production costs of renewables are falling relative to those of conventional forms of energy, and as conventional energy costs soar, consumers and energy-intensive sectors will eventually speed up their energy transition.”

"Beginning of a huge investment cycle"

Beyond Europe, the world's largest economies have already set ambitious targets to increase the share of renewable energy in their national energy mix. In the United States, the recent Inflation Reduction Act (IRA) earmarks nearly $400 billion (£330 billion) for the development of domestic renewable energy production and storage, and the use of clean energy by consumers.

“Despite the current challenges, electrification seems to be at the beginning of a huge investment cycle that will extend across all sectors,” Roman Boner adds.

“We believe we are close to a tipping point where governments will stop incentivising fossil fuels and encourage the adoption of technologies that facilitate the complete electrification of economies. As the fuel mix diversifies and customers are given more flexibility, competition between energy sources will only increase.”

But first, a fossil fuel bonanza

2022's energy price rally spurred governments' efforts to transition away from fossil fuels, while energy majors' legacy businesses performed fantastically well.

At $59.1 billion, ExxonMobil (XOM) reported the highest profits ever for any Western oil company. Shell (SHELL) announced the highest profits in the company’s 115-year history at $39.9 billion. Chevron (CVX) raked in $36.5 billion, TotalEnergies (TTE) $36.2 billion and BP (BP.) $27.7 billion, also setting new records.

In 2022, the “five sisters” more than doubled their profits from the previous year. Last September, the EU passed emergency legislation imposing a 33% "temporary tax" on fossil fuel profits (we wrote about windfall taxes from a UK perspective here). Oil giant ExxonMobil filed a lawsuit in response, claiming that this initiative falls outside the EU's legal authority and would discourage investments. In its 2022 earnings report, Exxon said it could have earned an extra $1.3 billion and partly blamed the EU tax for the shortfall.

Accelerating green investments doesn't seem to be a top priority after the latest profit windfall. Chevron is returning a whopping $75 billion to investors through share buybacks while spending only $2 billion in 2023 on projects to lower its carbon footprint. And in the UK, BP has scaled back ambitious plans to cut emissions 40% by 2030, reducing this target to a 25%reduction.