The market for initial public offerings may have turned ice-cold last year amid a brutal bear market for stocks, yet corporate spinoff activity heated up.

Across a wide swath of industries, a host of iconic brand-name blue-chip companies and others are pursuing spinoffs of some of their business units as they seek to juice growth, boost returns, and create shareholder value.

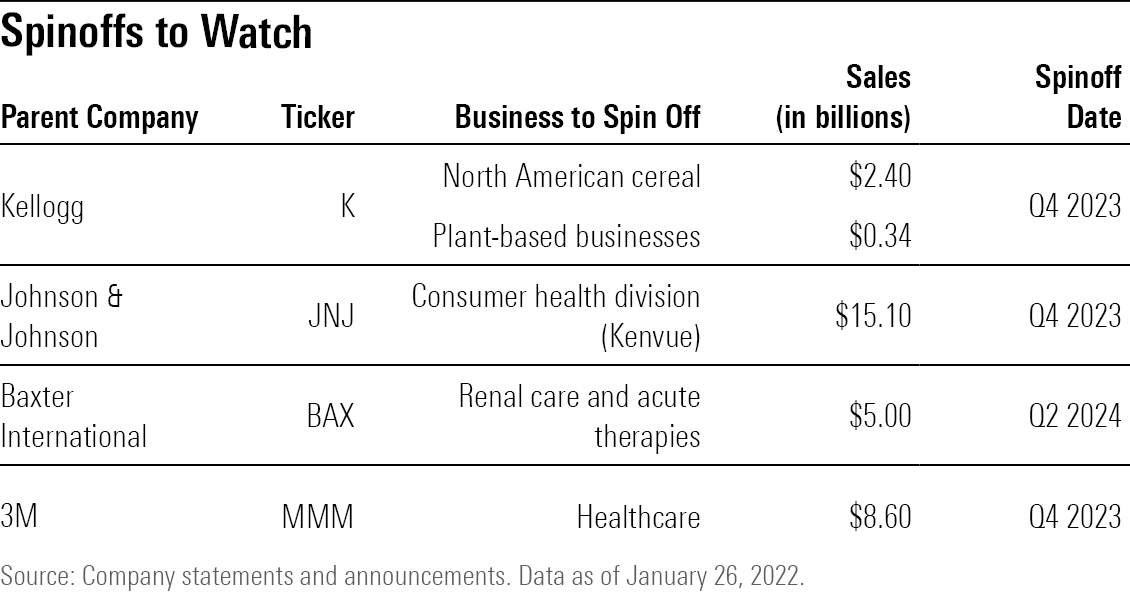

Some of the highest profile blue-chip companies pursuing spinoffs include General Electric GE, Kellogg K, Johnson & Johnson JNJ, 3M MMM, GSK (formerly GlaxoSmithKline) GSK, and Baxter International BAX.

While spinoff activity is red-hot, for investors, spinoffs should be treated just like any stock and are no predictor of higher returns. In fact, history suggests that most spinoffs, and the companies that turn to them, often underperform.

What Is a Spinoff?

In a spinoff, or SpinCo in Wall Street parlance, a parent company establishes and capitalises a subsidiary as a stand-alone independent business, lists it publicly, and distributes shares – typically on a tax-free basis – to existing shareholders in proportion to the amount of stock they hold in the parent. In essence, investors still own the same businesses but now are separated out.

The parent company often retains a stake in the spinoff. The parent will retain just under a 20% stake to assure the tax-free status and signal to investors that it is confident in the prospects of the newly independent company.

GE, for instance, maintains a 19.9% stake in the recent spinoff of its healthcare unit, GE HealthCare Technologies GEHC. The time between announcing a planned spinoff to completing it frequently takes between six months and more than a year.

It’s left to shareholders to determine whether they want to own one or the other company or both. Some newly spun off companies may not fit with an individual’s or fund’s investing mandate because of its size, industry group, or growth prospects.

The companies that are spun off tend to be in a distinctly different industry group than the parent. By freeing it from the confines of the parent, the company believes that the spinoff’s management can allocate capital more strategically, achieve better returns on investment, and act more entrepreneurially, while the parent can focus on and devote more resources to its faster-growing core business.

Why Do Companies Do Spinoffs?

At least 19 spinoffs occurred in 2022 and another 26 are slated for 2023 and early 2024. Right off the bat this year, GE completed a spinoff of its GE HealthCare Technologies on 3 January. That followed a busy December that saw four spinoffs come to market, including MasterBrand MBC, the cabinet business of Fortune Brands, now known as Fortune Brands Innovations FBIN.

With IPO activity still lackluster and the uncertain market diminishing the prospects for mergers and acquisitions, spinoffs offer a way for companies to restructure, refocus, and attempt to revitalise returns.

Big multinational companies with diversified portfolios aim to lift their stock prices by divesting slower-growing units that tend to muddy the stock’s overall valuation, saddling them with what’s referred to as a conglomerate discount.

The conundrum occurs when the value of the sum of the parts of a company is considered by Wall Street analysts to be greater than the whole. By spinning off various units, a truer valuation emerges of both parent and spinoff.

Spinoffs are often initiated by big companies that have diversified into new businesses during heady times only to move to streamline operations during difficult times or when the combination of companies clouds the sense of corporate strategy and allocation of capital.

Many of the companies undertaking spinoffs now are the same ones that have historically repeatedly returned to the approach in line with shifting financial fortunes and industry conditions. General Electric, 3M, Baxter, and Fortune Brands, for instance, are no strangers to spinoffs.

Some spinoffs are forced on managements, as activists demand change. Another reason for the increase in activity: peer pressure. As more spinoffs are announced, particularly within certain industries, pressure increases on boards of directors and chief financial officers to consider making similar moves.

"Every time there is another spinoff, the pressure increases from the board and from activists," says Jeff Haxer, a divestiture specialist and partner at Bain & Co.

He points to the flurry of activity among major healthcare companies to separate their higher-returning biotech and pharmaceutical businesses from their slower-growing but more predictable consumer healthcare lines as indicative of the pressure that company managements are facing.

Spinoff Plays Often Underperform

Still, spinoffs are no guarantee of higher valuations: studies show that in the short and long run, both the spinoff’s and the parent company’s stock prices more often than not underperform the S&P 500 index.

Houlihan Lokey, a Los Angeles-based investment bank and financial and valuation advisory firm, noted in a study last summer that, of 38 spinoffs completed between January 2019 and June 2022, the majority underperformed the S&P 500 in the 30 days from separation and 1.5 years later. Parent companies underperformed in the short term and ever-so-slightly outperformed 1.5 years following completion.

Backing up that observation, in research published in the Harvard Business Review in December, Bain’s Haxer and two of his colleagues analyzed 350 public spinoffs between 2000 and 2020 and found 50% of companies added value by an average 5% based on combined equity value two years from the spinoff date.

The rest failed to create any new shareholder value two years down the road, and some destroyed a significant amount of shareholder value in the process.

Haxer explains, "you don’t get multiple expansion for free. If you run the companies the same way as you were doing, you will see no added value."

The best-performing spinoffs tend to be those that have the clearest growth goals and lay the groundwork for achieving them by setting targets and appropriate cost structures, says Haxer. He points to Baxter’s 2015 spinoff of its biopharmaceutical arm Baxalta as a model separation.

GE Spinoffs

Of the current batch of spinoffs, Haxer sees GE HealthCare as one in which the market has recognised the appeal of both the new company and the parent and rewarded each.

In early 2024, General Electric expects to spin off its power business as GE Vernova, leaving the original company an aerospace and aviation company named GE Aerospace, which Morningstar senior analyst Joshua Aguilar calls the "crown jewel."

Still, investors aren’t fully appreciating the turnaround efforts at GE, he says, noting that the shares are stuck in "deal limbo" following GE’s spinoff of its healthcare business and the expected Vernova power spinoff in early 2024.

At a recent $80.75 a share, GE trades at an 8% discount to his $88 fair value estimate.

"We believe GE has line of sight to a high-single-digit free cash flow margin and potentially higher once GE completes its spins," says Aguilar.

"Following the spinoff of GE HealthCare GEHC, we think there’s an opportunity for GE to shift from debt reduction to other capital allocation options that favor the shareholder."

GE HealthCare has some "very good growth drivers," says Aguilar, but there were no synergies between it and the other business units. GE is a case of a classic argument for a spinoff, he says.

"It was too big a sprawling conglomerate for any one person to manage, each of the assets were under owned, and so now you have better capital allocation and more focused operations," says Aguilar.

However, he acknowledges in spinning off its healthcare division "the firm is losing one of its most highly desirable assets that generates consistent earnings power."

And while GE’s Vernova power unit showed significant improvement in the fourth quarter, Aguilar says it continues to face serious secular pressures and uncertainties.

In a presentation to investors a week after the spinoff, GE HealthCare executives said they expect 2023 organic revenue to grow by 5% to 7% from 2022 levels of about 7%.

The company also expects free cash flow conversion of more than 85% in 2023. The backlog for its imaging systems is at an all-time high level based on supply challenges and pent-up demand for procedures.

Fortune Brands Spinoff

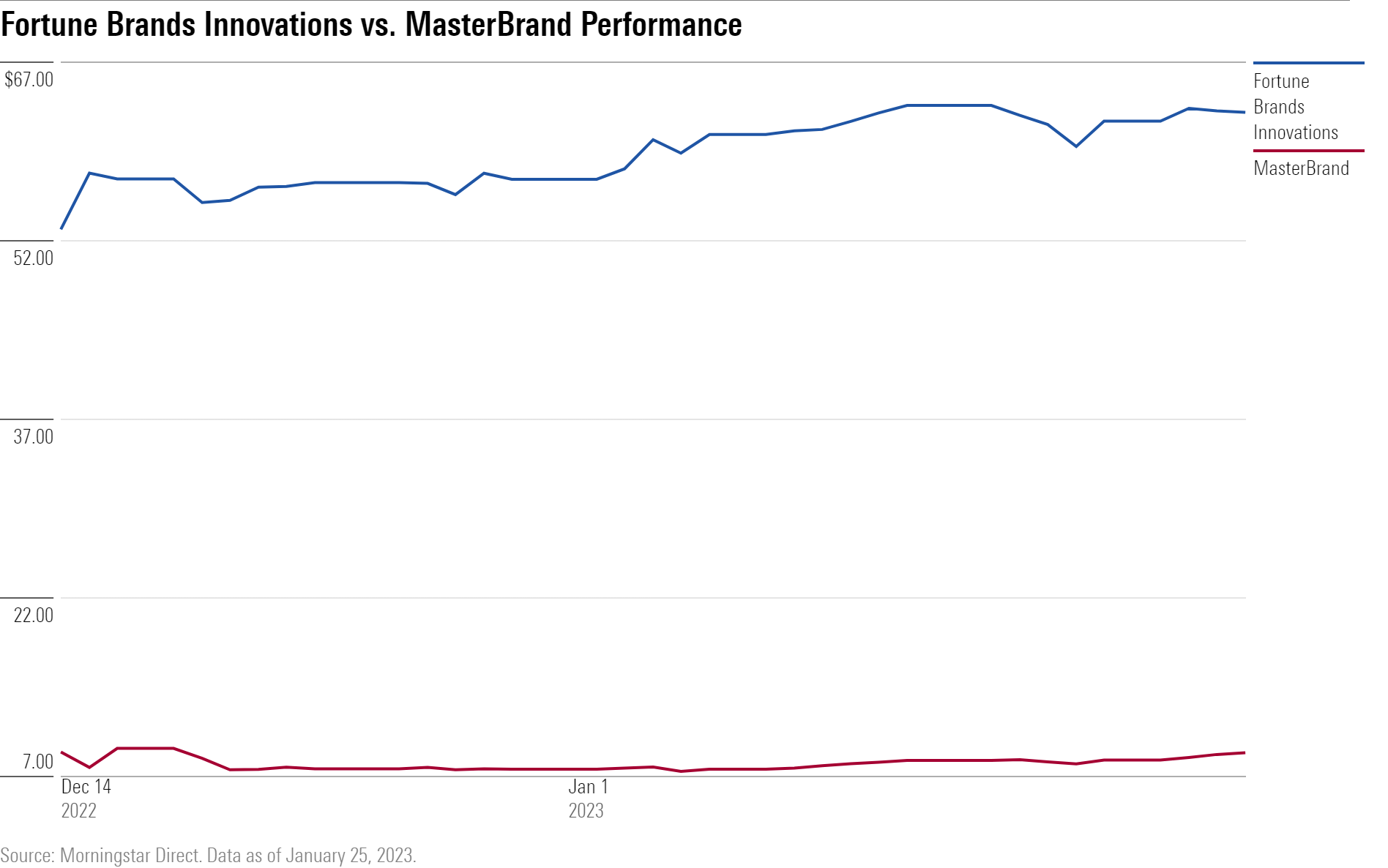

In the case of Fortune Brands, which completed the $3.3 billion tax-free spinoff of its MasterBrand cabinet business in mid-December and then renamed itself Fortune Brands Innovations, Morningstar analyst Brian Bernard said the parent company now "is poised to report stronger profit margins and return on invested capital after the spinoff."

Before the spinoff, its luxury plumbing brands, including the Moen and Rohl lines, as well as its building and security products, represented 60% of sales and more than 75% of its profits, with cabinets contributing the rest.

Compared with the other segments of the company, the cabinets division was a laggard in terms of growth and profit margin and return on invested capital.

"Cabinets was penalising the overall business," Bernard says.

He says Morningstar won’t cover MasterBrand, the leader in the industry with a 15%-20% market share, because cabinetry is a no-moat business, highly competitive, and volatile, as cabinet makers mainly compete on pricing, making it difficult to achieve consistent profits. Returns on invested capital were below its weighted average cost of capital.

Still, MasterBrand looks like a bargain compared with its closest competitor, American Woodmark AMWD, he says. At a current price of US$8.92, MasterBrand trades close to 5 times its 2022 adjusted EBITDA estimate on an enterprise value basis.

In the possible event that MasterBrand’s stock rerates higher to match American Woodmark’s current 7 times adjusted EBITDA multiple or the historical average of 9.5, MasterBrand could trade closer to US$15-US$24 per share, says Bernard.

"We view American Woodmark as an appropriate proxy for MasterBrand and expect the two companies to trade near similar multiples on a longer-term basis."

At a recent US$62.29, "we believe shares of Fortune Brands Innovations are attractive," he says, as the stock trades at about a 20% discount to our US$78 per share estimate.

"While we anticipate near-term headwinds given a tumultuous macroeconomic environment, we remain optimistic regarding the company’s long-term growth potential," he adds.