Stock markets may have been shut over the festive period but the world of business and finance very rarely grinds to a complete halt. So while you were eating mince pies and watching some festive television, here’s what you may have missed.

Arise, Knights and Dames

The New Year’s Honours list of the great and good is a familiar part of the calendar and for my lifetime only one person has handed them out. All that changed last year.

Now King Charles is doing the er, honours, and has awarded gongs to the following:

NatWest chief executive Alison Rose becomes a Dame Commander of the Order of the British Empire (DBE), as does Croda chair Anita Frew. Former Standard Life chief executive Keith Skeoch also gets a knighthood. Tom Scholar, the Treasury’s permanent secretary before Liz Truss's attack on "economic orthodoxy" likewise becomes a Sir.

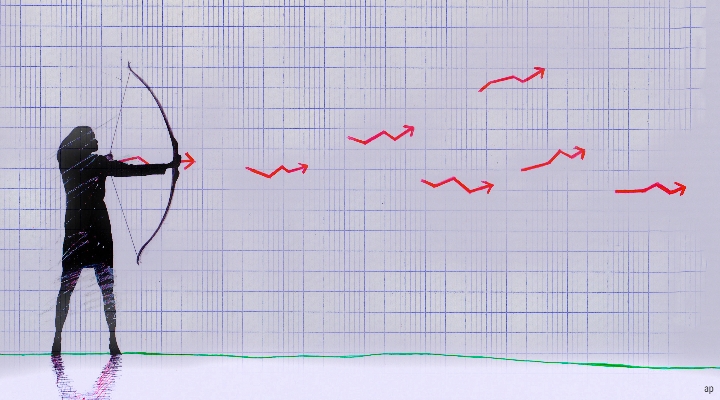

Confusing Retail Figures

It’s that time of year when retail analysts and investors have to stay particularly alert to keep on top of the flood of economic data on Christmas and 2022. It's especially true given the worries over recession and a consumer slowdown.

BRC, ONS, and Kantar data is mixed in with company updates – some of which strip out the festive trading period from their usual results. And that’s muddled by unusual placing of Bank Holidays this year, rail and postal strikes, with coronavirus and flu outbreaks also weighing on results.

Consumer behaviour has changed so much in recent decades too, with a certain e-commerce giant doing much of the heavy lifting. But "footfall" remains a key measure, and, according to retail analytics company Springboard, this was 39% higher this Boxing Day (a Monday) than in 2021, when Covid-19 restrictions were still in place.

The inbetween period of Christmas and New Year is now a key time for retailers, Springboard analysts say, as people have visited relatives and want to get out of the house – or so the theory goes. There may even be some bargains waiting for them.

Groundhogs and Grinches

December was horrible for many people (especially commuters) with the festive period providing some relief from delays, cancellations and strikes (and some much-needed sleep).

Surely the government and rail unions have made New Year’s resolutions to play nice in 2023? Not according to this week’s calendar, where drivers at ASLEF play tag team with RMT workers to knock out Tuesday, Thursday and Friday. The strike’s inbetween days are unlikely to be a passenger’s paradise either. Commuters waking up today are likely to feel like Bill Murray’s character in Groundhog Day, bashing the alarm clock to another day of the same thing. Happy New Year!

Where’s the FTSE?

You may not have noticed or been bothered to check market trading in the last two weeks, and that’s probably a healthy approach. You know it wasn’t a vintage year for stocks or bonds, so might be putting off looking at your portfolio. Still, we had three trading days (the final one a half day) in 2022 after Christmas. Nothing dramatic happened, so where did the FTSE 100 end up? You may have read that the index closed down 0.70% for the year. But we’re saying it’s up 1% and that’s based on comparing the closing level at the last trading day of 2021 (7384 points) with the last trading day of 2022 (7451 points). A lot happened in 2022 but essentially the FTSE 100 ended where it started.

Crude Calculations

Oil markets tend to be open even when stock markets are not, so there’s always plenty going on there. British motorists have noticed this when visiting relatives for the ritual motorway slog, with petrol prices easing in the last two weeks. WTI crude fell to around $71 at the start of December but is now back nearer $79, so this is likely to feed through into forecourt prices soon (there's always a lag, especially when oil prices fall). Crude oil hit around $120 in 2022 and December’s price was the lowest level of the year.

FTX Saga

Sam Bankman-Fried may not have been Time magazine’s person of the year but it’s hard not to think of another business figure who generated so much media coverage (apart from a certain other tech boss, we suppose). The festive period brought yet more news on this former case. Social media was excited by pictures of SBF en route to his parents’ house (in first class, of course) in California, where he’s waiting trial in New York. Bail was set at $250 million and the former FTX boss has to wear an ankle bracelet.

Bankman-Fried's former girlfriend Catherine Ellison, meanwhile, claims SBF asked her to mix customer funds, a key plank of the case against him. Judge Lewis A Kaplan is now overseeing the trial. Kaplan, a Manhattan federal judge, has presided over high-profile financial fraud cases before and is known for not having much truck with lawyers’ games. Journalists may want a drawn out and juicy trial, full of explosive revelations, but the judge may have other ideas.

Covid-19 Redux

Chinese tourists landing in the UK in the last few weeks will have been given conflicting messages: first they were not required to test for Covid-19, but now they are. The UK has joined countries like France and Israel in requiring a negative test from people arriving from China, which is in the midst of severe outbreaks of the virus.

Beijing is about to brief scientists from the World Health Organisation on the situation on the ground. We’re better prepared than this time two years ago, at least in terms of vaccinations, but another Covid-19 spike is the last thing the NHS needs, especially as it’s dealing with a huge rise in people with influenza.

Chinese New Year is looming, with the year of the rabbit starting on January 22 – usually a time when people travel, intermingle and visit relatives across the country.

Welcome, Croatia

Croatia has now joined the eurozone, 20 years after the launch of the single currency’s banknotes and coins (the euro was officially born on January 1, 1999). In a neat parallel, the country – made famous by Game of Thrones and now firmly on the tourist trail – is the 20th nation to join the bloc.

A fun fact for the first pub quiz of the year: Croatia is the first country from former Yugoslavia to officially adopt the euro, but Kosovo and Montenegro use the euro as a de facto currency despite having no agreements with the EU. As a result of this, Croatia has stopped using the kuna, which strengthened against the British pound since the Brexit referendum. Expect complaints from friends and family visiting this summer about higher prices (there are various studies out there looking at just this topic). Dobrošla Hrvatska!

Also Welcome, Lula

Emerging market watchers were surprised by the comeback of Luiz Inácio Lula da Silva as Brazil’s president, four years after he was jailed for fraud (he was released in 2020 and had his conviction annulled). It's now water under the bridge, as Lula was sworn in as Brazil’s leader yesterday, with new proposals to cut gun crime and gold mining in the Amazon. In the wake of that the country’s stock market fell.

Lula also took aim at the divisive politics of predecessor Jair Bolsonaro, who refused to concede when the election result was released. The former leader’s supporters are also refusing to go quietly, either threatening to, or carrying out, acts of political violence. In turn, Lula is promising unity, love and better living standards for the country’s poorest. After a disappointing World Cup and Pele's death, the national mood is decidedly mixed.

Not So Dry Dubai

The Qatar World Cup may have been a sober affair – and that probably made for a better experience for fans than most tournaments. But near neighbour Dubai has recently cut alcohol duty in an attempt to lure more tourists. The emirate has a reputation as one of the most liberal in terms of socialising, at least for expats – who must carry an alcohol permit.

Two companies control the distribution in Dubai, MMI and African & Eastern, but the policy change is likely benefit Western drinks brands. Saudi Arabia, which is attempting to lure Western tourists too, is also considering opening a resort in 2023 where booze can be consumed (according to the WSJ). This would mark a huge shift for the Islamic country, where alcohol is strictly prohibited, even for expats.

.jpg)