If we invested in 2022 using lessons we've learned from the history of the financial markets, we will have been left with a sour taste in our mouths.

Now, we wonder what mistakes not to repeat in 2023. Keep in mind, however, that though lessons on investing history are valuable, they don't always work. We must be careful not to trust "averages" too much.

One example is how correlations between different asset classes have behaved.

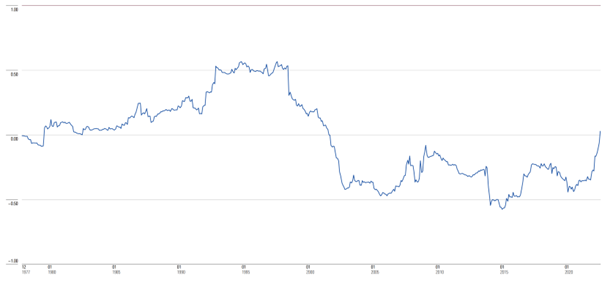

"From 1973 to the end of 2021, the monthly correlation between global equity returns and US bond returns was -0.02 points (ranging from +1, when two assets move together, to - 1, when they move in the opposite direction. A value of zero indicates that there is no correlation)," explains Nicolò Bragazza, senior investment analyst at Morningstar Investment Management (MIM).

Based on this data, we can say that holding US Treasuries has offered diversification over the years. Unfortunately, however, in 2022 that was not the case. "The five-year rolling correlation of stocks and bonds is at a 20-year high," says Bragazza.

The 5-year Rolling Correlation Between Stocks and Bonds is at a 20-year High

Source: Morningstar Direct. Performance is in USD. For equities: S&P 500 TR index; for fixed income: US Treasury TR index. 5-year rolling correlation from January 1973 to September 2022.

"Relying only on historical correlations can be risky or even misleading," continues the MIM analyst, "because the correlation is an 'average' and does not tell us much about the behaviour of asset classes during certain market phases.

"In times of recession, the correlation between stocks and bonds has been positive by 0.09 points. In phases of high inflation (above 5%) it even rose to +0.23".

Which Mistakes to Avoid

We could feel upset about this. Or we could use them to build stronger portfolios for the future. Here are four mistakes we should avoid in our planning for 2023.

Relying Only on Historical Correlations

The first mistake to avoid is relying exclusively on historic correllations. Also, keep in mind that diversification isn't solely about how far two asset classes move in different directions. Morningstar analysts suggest looking for "diversifying fundamentals," rather than just “negative correlations" alone.

For example, the correllations between the industrial sectors were all positive in 2022, but, unlike the others, the energy sector had positive returns. Having the energy sector in your portfolio would have provided one of the best diversifications in 2022.

The same applies to the US dollar: it is true that Treasuries have fallen in the last year, but the US dollar has appreciated greatly due to the differences in the ways and times of monetary policies between the Federal Reserve and the other main central banks.

More Investment = More Diversification

The second mistake we must avoid in 2023 is thinking that adding more asset classes will increase the diversification of our portfolio. In 2022, there have been no "places to hide" in fixed income. Declines have been widespread. Stock markets had one of their worst years and having quality companies in your portfolio didn't offer any protection either.

"2022 is an example of a year where more assets in the portfolio would not have offered more diversification," says Bragazza.

"The only asset classes that have delivered positive returns are the energy sector, the US dollar and some 'niche' markets such as Brazilian equities."

Using Market History as Your Only Guideline

The third mistake is to think that history always repeats itself.

"Knowing history helps put things into perspective, but it's not enough," explains MIM's Bragazza, who uses the Japanese Yen as an example.

The Japanese currency has generally offered protection in times of market stress; however, in 2022 this was not the case, because the surge in inflation created large differences in monetary policies.

Trying to Predict the Future

The fourth mistake is trying to predict future. Central banks have powerful systems for making economic predictions and they are often wrong. Can we do better? I don’t think so.

"It’s better to spend your time more productively building your portfolio," says Bragazza.

Tips to Avoid Investment Mistakes

Here are some tips to help you avoid common investment mistakes:

- Think about investments in a way that is consistent with your goals;

- Take into account the beta (indicator of sensitivity to market fluctuations): a high beta means greater volatility and therefore risk;

- Look at investment fundamentals. Early 20th century global indices were composed mainly of financial stocks and rail transport, today technology and telecommunications dominate. The fundamentals, therefore, are completely different.

- Prepare for different market scenarios and accept uncertainty. Bragazza summarizes it in one word: robustness. "It is the ability to withstand different stages without compromising long-term performance."