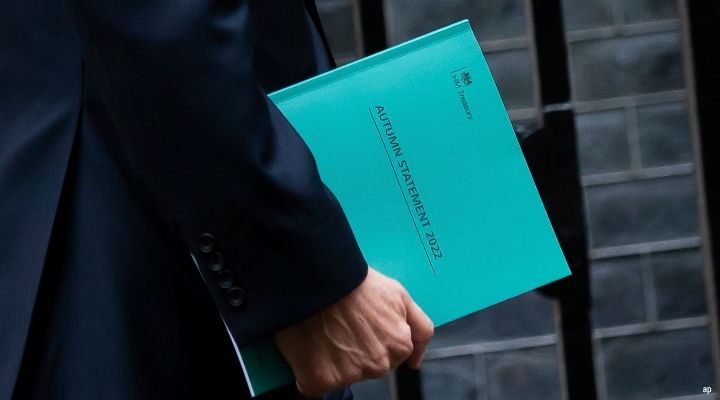

Ollie Smith: There were cuts, there was tax pain and if the words of one journalist are to be believed, there was a solemn atmosphere in the Commons as Jeremy Hunt delivered an enlarged autumn statement to Parliament today.

Joining me now to digest the news is European market strategist Mike Field, who works with me at Morningstar. Mike, thanks so much for joining us. Could I ask you first and foremost, what has been the market reaction to this a very, very important fiscal event?

Michael Field: So, I would say the market reaction has been pretty muted. The FTSE is flat currently. If you look at the exchange rates sterling to euro or even sterling to US dollar again it's pretty flat on the day, and that's about the best we – kind of the outcome we could have hoped for, especially in light of the disastrous mini-budget we had a couple of months ago, which obviously sank the pound. So, I think from that reaction, yeah, reasonably, okay, enough to state the markets at least for now.

OS: For sure. One thing that interested me in the budget was that there was always going to have to be some good news to pad out the bad. Jeremy Hunt seemed to focus his attention a lot on energy and the energy transition, particularly with the war in Ukraine in context, in full view there. There's lots and lots of ambition in the autumn statement about creating a more efficient energy system based on renewables, but also on better insulation. Is there a knock-on effect there? Good news, perhaps for energy companies they are intending to invest in the area?

MF: I think so, overall. Obviously, energy companies had been anticipating a budget that could perhaps hit them. We've kind of capped energy prices for the next year. Obviously, the cap falls then in 2023, and that money has to come from somewhere. So, indeed I think they were very much expecting a windfall tax, so that's come into play as we would have expected. But as you pointed out with regard to green energy and investing going forward, there's a clever way of offsetting those levies, especially on electricity generation for some of the large utility companies. So, you've seen the likes of Drax, Centrica, et cetera up 5% or 6% today on the back of that. So, I think that is kind of reflective of the hope for the future, number one. And two, the kind of visibility that this budget has given them in terms of their investments over the next few years.

OS: Brilliant. And just finally I wanted to touch on the optics of the autumn statement because I think it was quite important politically for Jeremy Hunt to frame the statement as being politically progressive, at least in some way. I was talking to an expert earlier today who seemed to suggest that the move to bring down the threshold for the additional rate of tax was a purely political move to make it look like the (indiscernible) would be taxing the wealthy. To what extent should investors be worried therefore about dividend taxation changes?

MF: So, if you look at the headline result from this, the dividend taxation allowances having from 2,000 to 1,000 as of next April and capital gains is getting even – hit even harder there. So, for the high earners and those kind of that can afford to invest, certainly they're going to be taxed somewhat.

But if you look at the materiality of it in terms of dividend allowance of 2,000 in the first place, it's not going to make or break the difference for a lot of investors I would feel.

OS: Thanks so much, Mike. For more on the autumn statement, and indeed the fallout from Jeremy Hunt's policies today, check out morningstar.co.uk where we're posting relevant and up-to-date analysis on all the Treasury figures and insight. Until next time I've been Ollie Smith for Morningstar.

.jpg)