Even before the government triggered chaos in the mortgage market on September 23, the UK housing market was showing signs of fragility.

There are plenty of reasons to expect a slowdown: among them, a looming recession, sharply rising interest rates, the end of Help to Buy, a long and protracted price boom, the cost of living crisis, and imminent tax rises. On the flipside, the government has just unveiled (another) stamp duty holiday and demand remains strong in a decent jobs market.

But given the key role the housing market plays in propping up consumer spending and the electorally-important "feelgood factor" buying a home provides, the potential extent of this slowdown is causing anxiety. A moderate fall in prices might not be a disaster for the UK economy, given the yawning gap between renters and owners.

Nevertheless, the gloomiest predictions are now gaining the upper hand, and that’s already had a ripple effect on valuations of listing housing stocks. We weigh up the case for and against a housing crash, and what housebuilders themselves are saying: this week we get updates from Persimmon (PSN), Taylor Wimpey (TW) and Vistry (VTY).

A Blizzard of Data

There’s a blizzard of housing market data to digest, some of it giving mixed and outdated messages about the state of the market. This price data often doesn’t reflect the reality on the ground for active buyers and sellers.

Sometimes they act as a Rorschach test: homeowners with a big mortgage may prefer a more upbeat news item than wannabe first-time buyers eagerly anticipating a meltdown that will make properties more affordable. There are so many vested interests and biases here it’s hard to get a handle on what’s really going on.

Let’s start with the most recent update from building society Halifax, a provider of one of the key data sets, along with Nationwide. UK house prices hit a five-month low in October, with growth slowing 8.3% on an annual basis in October, having surged 9.8% in September. So prices may be falling month on month, providing some support to the idea of a slowdown, but are still higher than a year ago.

The average house price, according to Halifax, is £292,599 – so at October growth rates, that house will be worth £316,884 this time next year. The long-term price chart is a sober reminder of how relentless the housing boom has been – even factoring in Brexit, the financial crisis and the pandemic into this equation.

Nationwide’s data shows a 7.2% growth rate last month, down from 9.5% in September, with an average price of £268,282. Robert Gardner, the building society’s chief economist, describes this as "sharp slowdown" with the potential for further falls in the coming months.

"The outlook is extremely uncertain, and much will depend on how the broader economy performs, but a relatively soft landing is still possible," he said.

What are the housebuilders saying? Naturally, they are keen to promote the "glass half full" narrative. Bellway is one of the more recent companies to report, although these are figures for the end of summer, rather than the autumn of economic chaos. It said that buyers have become more cautious as summer ended and that has led to a fall in reservations. But Bellway thinks the stamp duty cut will help prop up demand, along with high employment.

Persimmon posted a trading update today and while it maintained its forecast for 14,500-15,000 homes sold in 2022, it struck a note of caution for 2023 given the "recent and rapid change in market conditions". It's not giving specific guidance for 2023 but it does expect fewer completions and lower average selling prices.

"While we have already seen mortgage providers and customers start to adapt to higher interest rates, the full impact of this uncertainty on consumer behaviour is yet to be determined."

Persimmon also cut its dividend, a move that pushed its share price down.

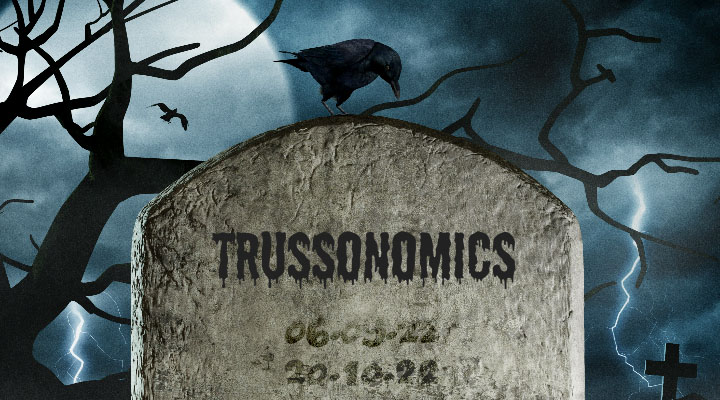

Dead in its Tracks

For an investor, some of this year’s market moves for housebuilder stocks appear to be pricing in the more extreme predictions, with the biggest stocks halving or close to halving this year. Four fifths of the housebuilders Morningstar covers are significantly undervalued.

One of these, Bellway (BWY), is our top pick in the sector, according to analyst Grant Slade. Income investors will also note how hefty some of the dividend yields have become after recent market falls – with the usual caveats about 10% dividend yields.

From a homeowner’s perspective, what happens next year is more important than the most recent data. Mortgage rates have increased steeply because of the rise in interest rates, but there was a sliver of hope offered by the Bank of England last week. Rates may peak lower than the markets are pricing in, the governor said.

Lender Lloyds Banking Group (LLOY) has just forecast a near 8% fall in house prices in 2023, but the media jumped on the possibility of an 18% fall in the most extreme scenario.

All that means the government’s role in what happens next cannot be overstated. Kwasi Kwarteng may have lifted the stamp duty threshold in September, a potential boost for an ailing market, but Jeremy Hunt’s November 17 Budget is expected to introduce measures that will accelerate the housing market’s decline.

One change floated in the press is an increase in capital gains tax (CGT) on residential property, a move that will certainly hit buy-to-let landlords. That’s likely to prove popular among renters but may trigger a sell-off in flats, particularly in urban areas. But could the government be contemplating the nuclear option of imposing CGT on homeowners too?

Imposing tax on residential property profits would go down particularly badly in the Conservatives’ electoral heartlands ahead of an election in the next two years. If you're wondering what might happen to the post-pandemic housing boom, that policy would probably kill it in its tracks.