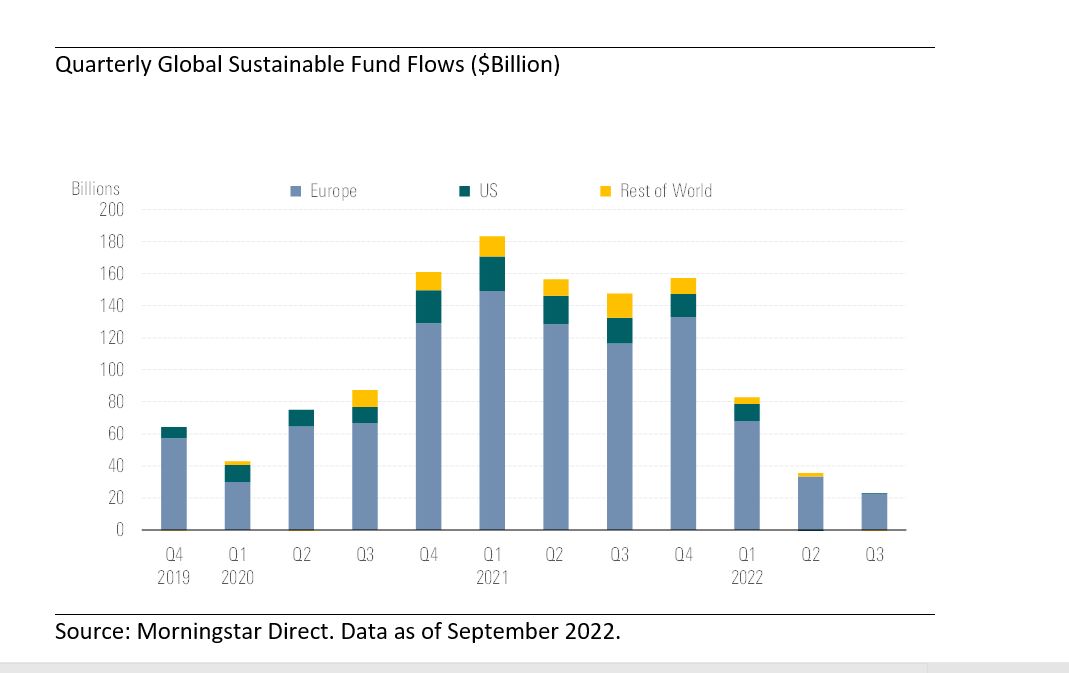

Global sustainable funds attracted $22.5 billion of net new money in the third quarter of 2022, less than the inflows of $33.9 billion in the second quarter.

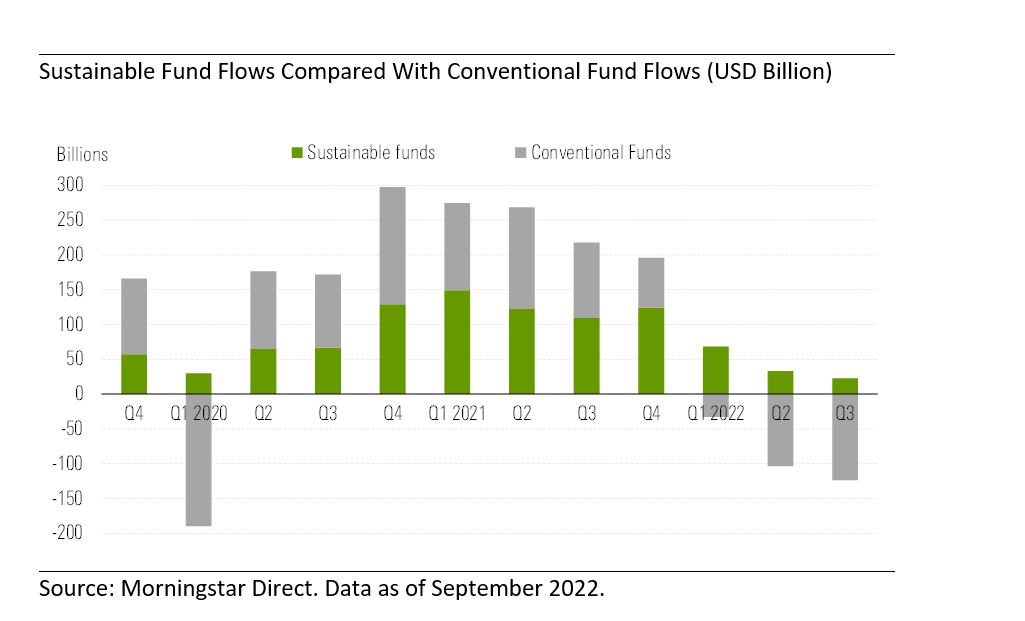

Against a backdrop of continued concerns over a global recession, inflationary pressures, rising interest rates, and the conflict in Ukraine, sustainable funds still held up better than the broader market, which experienced $198 billion of net outflows over the period.

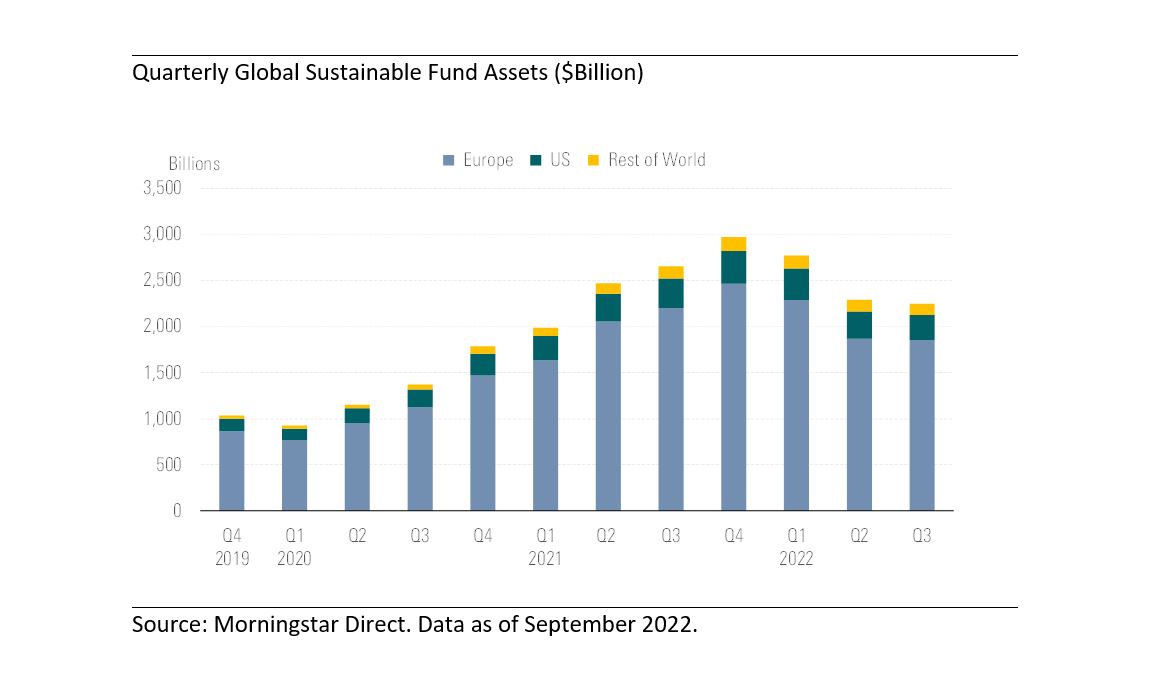

Meanwhile, global sustainable fund assets slipped slightly to $2.24 trillion at the end of September, from $2.28 trillion in June. This 1.6% decline was the third consecutive drop since the first quarter of 2020. Nevertheless, sustainable fund assets held up better than the overall global fund market, which saw assets shrink by 7.5% in the three months through September.

A Resilient Europe

The resilience of sustainable funds was best evidenced in Europe, where in the last two quarters – as well as in 2020 at the start of the pandemic—sustainable funds registered inflows, while conventional peers experienced outflows.

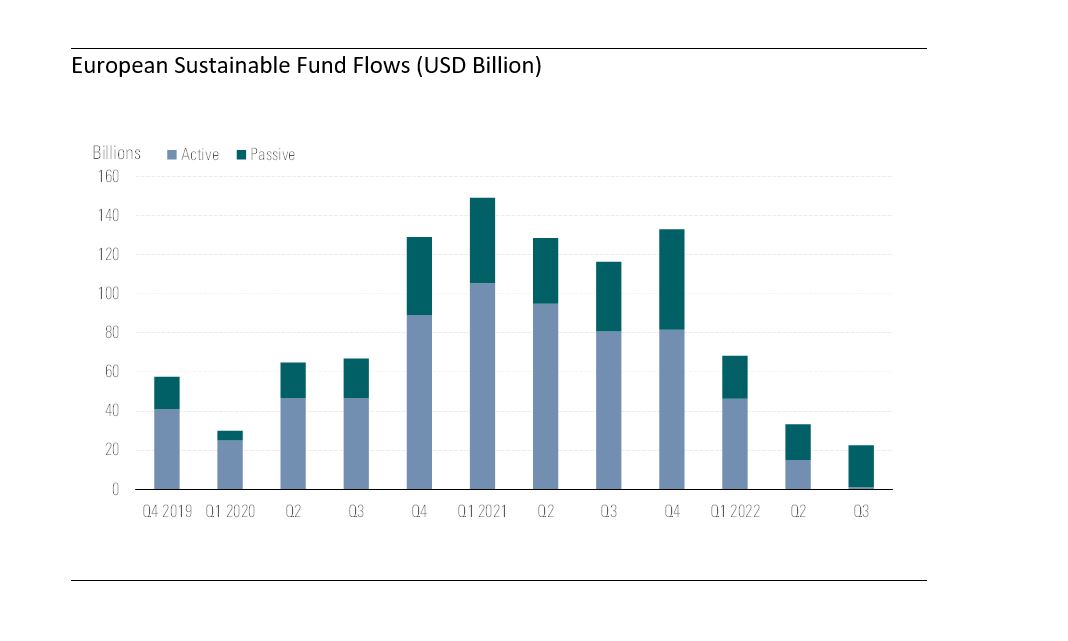

Passive funds were the biggest winners in Europe in the third quarter, with the quasi-totality (96%) of the net new money ($22.6 billion) landing into index funds and ETFs, while active sustainable products registered the worst quarter in at least five years.

BlackRock’s iShares had four ETFs in the list of top 10 bestselling funds, with the iShares MSCI USA ESG Enhanced ETF raking in $5.3 billion alone. BlackRock took in $7.6 billion in ESG fund flows in the third quarter, followed by DWS and Amundi.

Meanwhile, Europe’s sustainable assets were almost level with the previous quarter’s figure at around $1.85 trillion – while Europe’s wider fund universe saw assets drop 10%.

Overall, sustainable funds still accounted for close to 18% of European fund assets at the end of September, again level with the second quarter.

We expect this percentage to rise in subsequent quarters as investors’ demand for strategies that align with their sustainability preferences continues to grow, prompting asset managers to launch additional sustainable products and repurpose existing conventional ones. The Mifid II amendment, which came into effect in August that requires financial advisers to consider their clients’ sustainability preferences, has the potential to accelerate adoption of sustainable investments among retail investors despite macro headwinds.

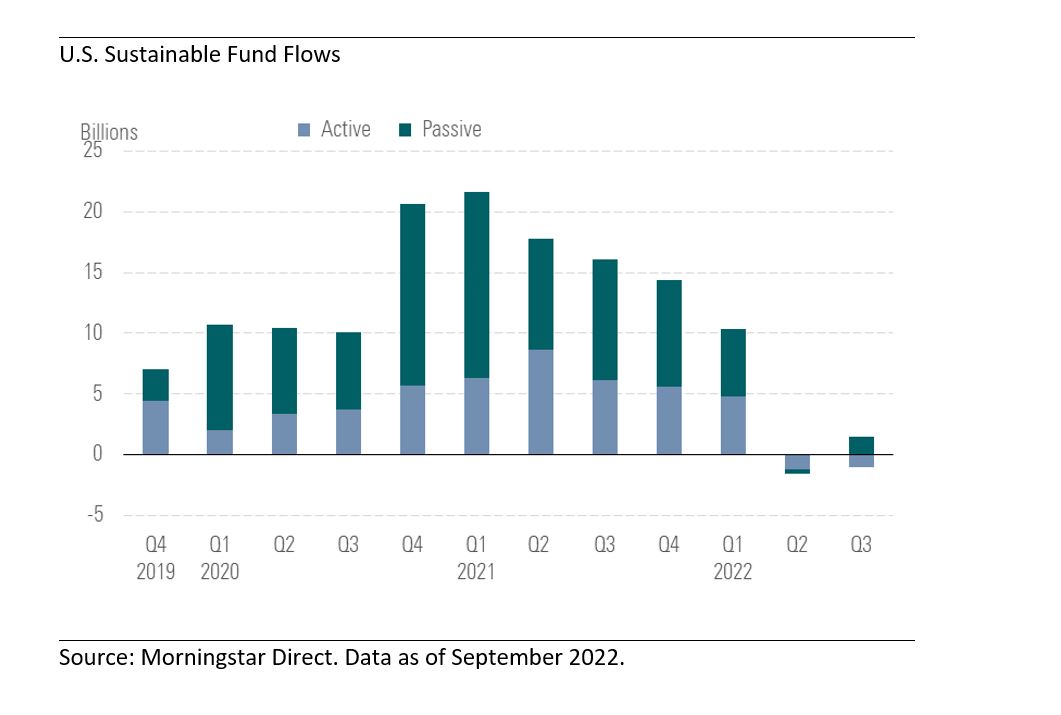

The US: Back in Positive Territory

Following its first quarter of outflows in more than five years, US sustainable funds were back in positive territory in the third quarter with inflows of $439 million. While a marked difference from the record flows of $21.6 billion recorded in the first quarter of 2021, this was still a positive figure when compared with the wider market that saw outflows of $86bn during the third quarter.

Passive funds continued to be popular with US investors, with sustainable index funds and ETFs raking in $1.5 billion, while active sustainable lost more than $1 billion during the third quarter. Actively managed sustainable funds have endured a rough 2022, suffering outflows in four out of nine months so far. However, this pales in comparison to non-sustainable active funds, which have lost roughly $67 billion each month (on average) so far this year.

Nonetheless, in terms of product launches, all but one of the 15 new funds brought to market were actively managed. On average over the past three years, active funds have accounted for 73% of US sustainable fund launches, but the third quarter’s 93% exceeded that trend.

In terms of assets under management, falling markets and tepid demand for sustainable funds drove assets in these funds to $272 billion, their lowest point since the first quarter of 2021.

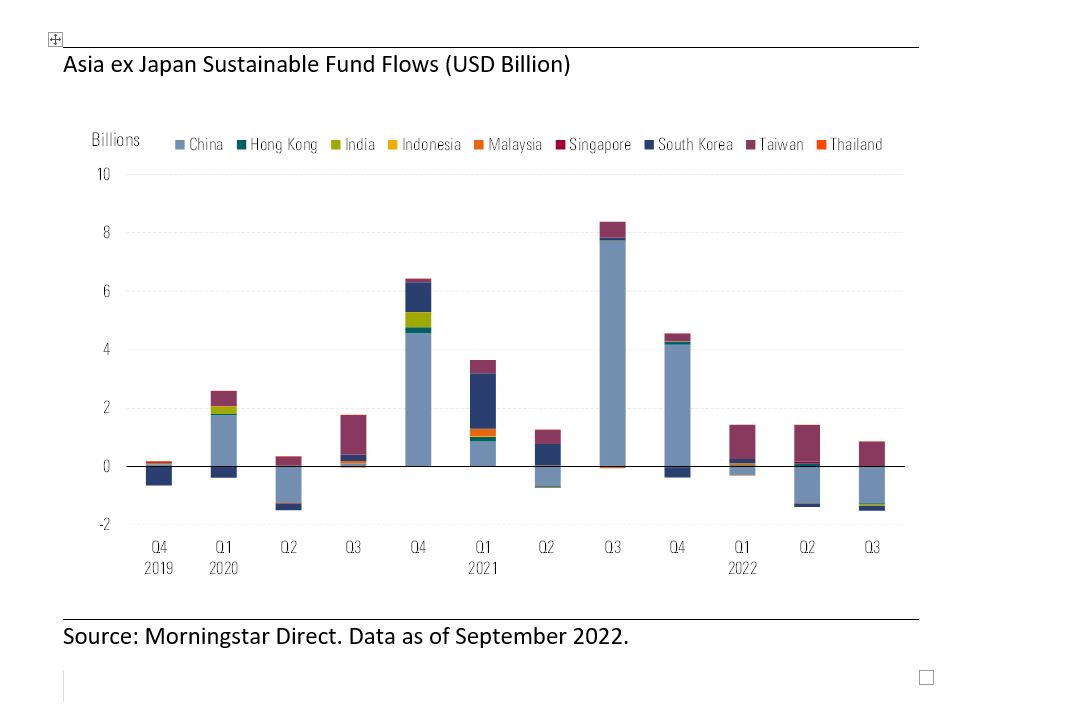

Asia ex-Japan: A Lion's Share

Excluding China, the Asia ex-Japan region recorded net inflows of nearly $600 million into sustainable funds during the third quarter, a drop from the $1.3 billion in net inflows seen in the second quarter.

Taiwan continued to take the lion’s share of Asia’s flows with $856 million over the third quarter. Singapore and Thailand saw negligible inflows while India and Hong Kong saw outflows of $59 million and $24 million respectively. However, South Korea saw the largest outflows for the region at $177 million.

Assets were roughly flat at $49 billion with equity funds making up the bulk at 60%, while fixed income assets continued to decline in the region representing just 5.4% of the overall figure at the end of September.

However, product development remained strong, with 34 new sustainable fund launches in Asia ex Japan, including 24 in China, six in South Korea, three in Taiwan, and one in Malaysia.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)