The dramatic numbers at Switzerland's most famous investment bank have it all. In the third quarter, its losses amounted to CHF 4 billion, much higher than expected.

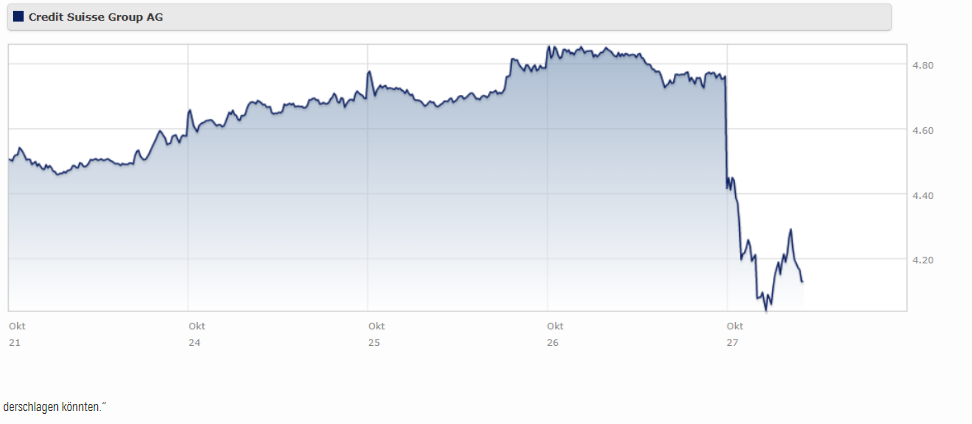

This includes the costs for the restructuring the group. Since the beginning of the year, the minus figures now total CHF 5.9 billion. Before taxes, the loss was CHF 342 million. Accordingly, its stock was down a little over 12% by early afternoon yesterday.

Only a radical restructure can help Credit Suisse (CSGN) out of the jam now. By 2025, 9,000 jobs will be made redundant. Of the CHF 4 billion capital increase planned, Saudi National Bank will contribute CHF 1.5 billion.

"The third quarter and year-to-date of 2022 were significantly impacted by the continued difficult market and macroeconomic conditions. This led to weaker results, particularly at our investment bank," says Ulrich Körner, Credit Suisse's group chief executive.

The focus of the new business model is on wealth and asset management. "In addition, we will fundamentally restructure the Investment Bank, strengthen the capital base and accellerate our cost transformation," he added.

According to the strategy paper that has now been published, the company's investment banking is to be divided into four areas:

- The markets division will handle the strongest and most important aspects of Credit Suisse's trading business. Its institutional customer wing will remain fully intact. This area of stock, foreign exchange and interest trading is closely coordinated with the business areas for wealthy private customers.

- A new unit for M&A and IPO consulting is now on the books, and external investors should also be able to participate in the division: "the future CS First Boston aims to raise outside capital and a preferred long-term partnership with the new Credit Suisse," the paper says.

- The Capital Release Unit (CRU) is to take care of securitised products, with a view to "freeing up capital by winding down non-strategic, low-yield and high-risk businesses."

- A securitisation business will also be opened up to external investors. Significant parts of the Securitized Products Group (SPG) are going to an investor group led by Apollo Global Management and with the participation of PIMCO.

Morningstar Analyst: Step in The Right Direction

According to Morningstar analyst Johann Scholtz, the planned measures look like steps in the right direction at first glance. However, details are still missing.

"Some investors would have hoped for an even more decisive break with investment banking. CS also likely wanted to clarify future ownership of the First Boston spin-off and the capital injection for the securitisation business," he says.

"Current market conditions and CS's lack of bargaining power prevented this, however. I think it was wise to hold on to those assets and try to get better value for them later on.

"I think the client outflows from wealth management we saw in the third quarter results confirm the speculation surrounding CS was negatively impacting the operations of its crown jewels, and that the CS had no choice but to announce a rights issue."

Little or No Room For Error

In an updated analyst note published today Friday 28 October, Scholz added that the group's Boston carveout looked "purely cosmetic".

"Even after the material dilution and considering the underwhelming guidance, Credit Suisse seems to offer value, but we would urge caution," he says.

"This is the umpteenth supposed line in the sand drawn by Credit Suisse. Credit Suisse guides that the capital raise will take them to a 13.5% common equity tier one or CET ratio by 2025, just above the 13% the major credit rating agencies require Credit Suisse to maintain. This leaves little or no room for error for Credit Suisse. Unfortunately, its recent history inspires little confidence that no other skeletons are lurking in the closets at 8 Paradeplatz that could reduce its CET1 below 13%.

"Credit Suisse intends to resurrect the old Credit Suisse First Boston or CSFB brand to house the capital markets and advisory business. Over time Credit Suisse wants to attract outside capital to the CSFB business, and it would also consider a separate listing or IPO. As it stands, CSFB remains wholly owned by Credit Suisse, and Credit Suisse will continue fully consolidate its results. The CSFB carve-out seems purely a cosmetic exercise currently with no financial impact."