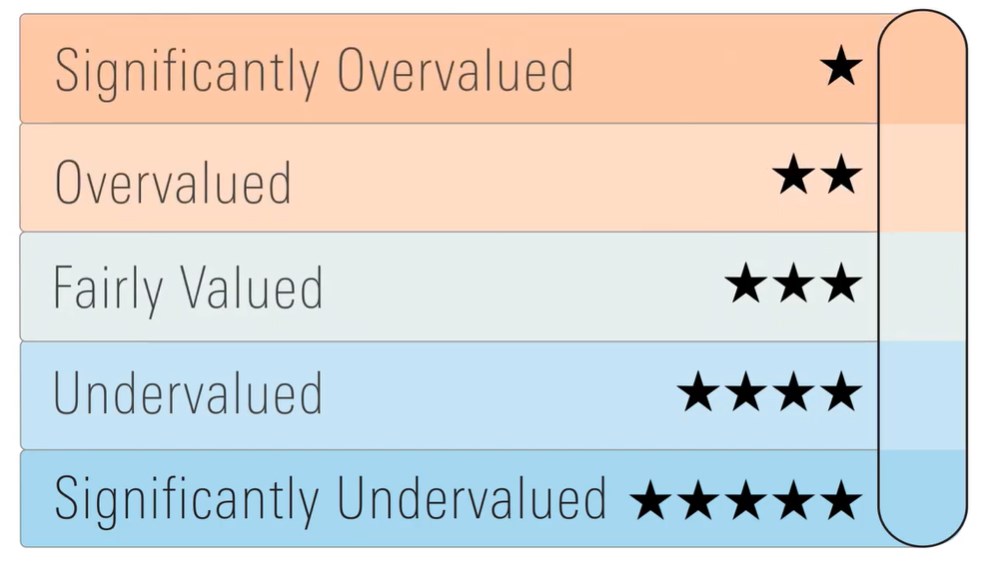

At Morningstar, we calculate the Price to Fair Value (P/FV) of the world's most important stocks using the Morningstar Fair Value Estimate. Based on these estimations we can deduce whether a given stock is expensive or cheap. If the P/FV of a stock is above 1, it is considered overvalued; if the P/FV is below 1, it is considered undervalued.

Another way to assess whether stocks are expensive, cheap or correctly valued is through the Morningstar Rating for Stocks, which has an advantage over the P/FV in that it incorporates a level of uncertainty in the estimations. Two companies can have a very similar P/FV, but that does not necessarily translate into the same Morningstar rating.

Therefore, looking at the number of stocks getting 4 and 5 stars (stocks considered as a buy-in green in the chart below) and the number of stocks with 1 or 2 stars (considered as a sell - in red) can find a better clue as to whether the stock market is cheap or expensive.

Is the Stock Market Cheap or Expensive?

August has been a negative month for stocks. The Morningstar Global Markets index, which reflects the performance of world stock markets, lost 3.5%.

This month, the percentage of stocks with 4 or 5 stars from our entire database (around 1500 companies covered by our Equity analysts team) decreased from 54% at the start of the month to 52% at the end (the maximum was reached in June with 60%).

Meanwhile the percentage of stocks with 1 or 2 stars, this has stayed at 16% (the minimum was also reached in June with 11%). We can say that the global markets, according to our analysts, are still relatively cheap.

Canadian Stocks and US Stocks are Both Mostly Cheap

If we compare the ratings between the United States and Canada, we can say both countries are similarly discounted. In Canada, stocks appear to be slightly cheaper, with 21% of stocks trading in the 1 and 2-star range, compared to 18% in the US.

As for 4 and 5-star stocks, they represent 49% of our Canadian universe compared to 48% in the United States.