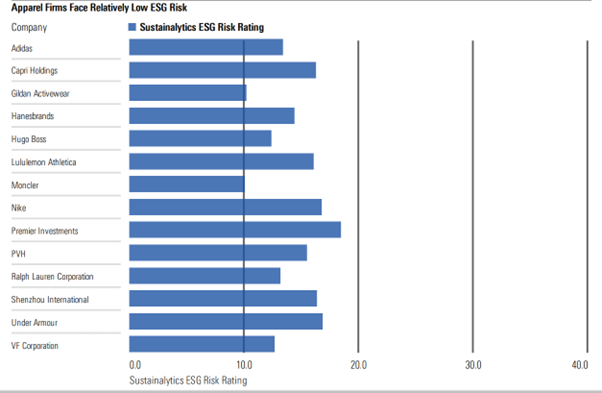

Environmental and human rights concerns remain a risk to the fashion and apparel industry. Recently though, producers have generally managed these risks well, for instance by securing alternative sourcing. Most companies aside from fast fashion brands are assigned a low ESG Risk Rating by Sustainalytics (the threshold for a Medium ESG Risk Rating is a score above 20).

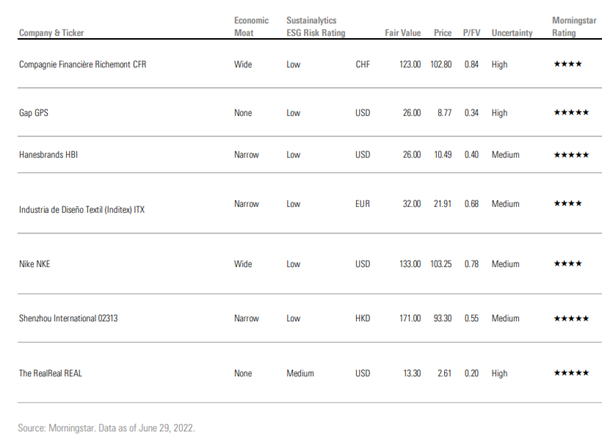

The new Morningstar report “Apparel & Fashion: Environmental and Human Rights Concerns Abound, but Risk-Adjusted Upside Looks Attractive” identifies several undervalued stocks within the fashion space - across the entire spectrum of mainline, luxury, and retail apparel companies. Some of the top picks include narrow-moat Hanesbrands (HBI), wide-moat Richemont (CFRHF), and no-moat Gap (GPS).

Apparel manufacturers: environmental risks

The apparel industry is one of the world’s largest polluters. For one, the production of cloth accounts for 10% of annual global carbon emissions. The trend toward fast fashion adds further pressure as such garments tend to use more synthetic fibers like polyester or polyamide, which are CO2-intensive to produce. In response to this, fast fashion leaders have tried to build more sustainable supply bases and outlined targets for the use of recycled material. H&M for instance targets 30% recyclates across its lineup by 2025, compared to 18% in 2021.

Water is another great concern in the manufacturing segment, both is terms of water usage and waste. Around 20% of wastewater worldwide comes from fabric dyeing and treatment, while textiles contribute 35% of microplastic pollution in the oceans.

As pressure mounts from regulators and the general public to mitigate the environmental footprint of industrial activity, fast fashion companies are also increasingly exposed to regulatory risks. The EU, for example, is proposing requirements for increased durability, reduction of microplastic release during the washing of garments, labeling related to the sustainability and recyclability of clothing, and a ban on the destruction of unsold apparel.

As a combination of these factors, costs are set to increase, and some companies are better positioned to cope with higher production expenses than others. “In our view, companies with brand-led intangible asset economic moats, resulting pricing power, and potential volume leverage are best placed to share pain with their suppliers to weather this risk. This consists of about two thirds of our relevant apparel coverage, including several wide-moat names outside the fast fashion arena such as Richemont, Hermes, LVMH, and Nike”, says Adam Fleck, CFA, Director of Equity Research ESG, who authored the study.

Modern slavery and apparel manufacturing

Human rights and modern slavery continue to plague the fashion industry, despite its heightened focus on stamping out the practice in recent years.

Often garnering headlines, human rights issues are actually the most material risk facing apparel companies, according to Sustainalytics. While this primarily relates to supply chains and not company-owned facilities, much of the reputational risk remains with the firms whose brands are affixed to a label. Of the 36 companies in Morningstar’s apparel, luxury, footwear, and retail coverage, 25 have faced a controversy related to human rights.

Global brands' exposure to exploitative wages and forced labour have affected production in develping nations such as Haiti and Bangladesh. Most recently, China’s treatment of the Uyghur population in the Xinjiang region has given rise to tit-for-tat boycotts that hit Western brands' sales in the country. China accounts for roughly 25% of global cotton production, and about 80% of that quantity stem from Xinjiang.

In response, the U.S. introduced the Uyghur Forced Labor Prevention Act. The European Commission is meanwhile set to propose an instrument to combat forced labor in the EU. The regulation aims to punish firms that don’t have full transparency over their supply chains, increasing the importance of audits and monitoring.

“Although we anticipate companies can manage these risks over the long term, we expect short-term volatility in costs and supplier relations to remain”, concludes Fleck.

Luxury sector: Risk of counterfeits

In general, luxury brands face low ESG risks, and nearly all companies in our coverage – with the exception of Burberry – carry a Low ESG Risk Rating.

Still, the trend to online buying and resales, over market places such as Poshmark or The RealReal, could bring new risks related to counterfeits. According to an OECD study, the trade of counterfeit and pirated goods amounted to 2.5% of world trade in 2019.

In response, companies such as LVMH, Prada, and Richemont are turning to blockchain technology to authenticate products. Similarly, online market places are also investing in their own in-house authentication services. The main weakness of those efforts is that a large portion of counterfeits are intentionally purchased.

Top Stock Picks

Companies with strong economic moats are best placed to navigate this environment. Here is a look at our top picks.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)