One of the arguments put forward by advocates of actively managed funds is that in periods of strong market rallies, as we have experienced in recent years, it is difficult to beat passively managed funds (index funds or ETFs).

This is what our Active/Passive Barometer has shown year after year, where we compare actively managed funds with the average of passive funds.

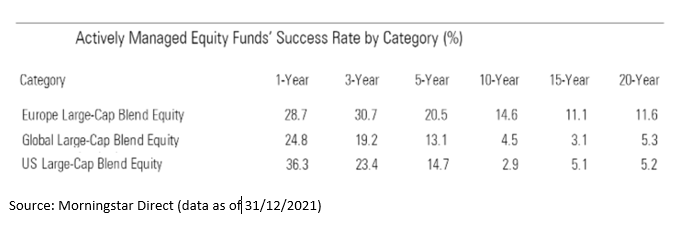

For the major fund categories (Europe Blend Equity, Global Blend Equity and US Blend Equity) the survival rate – the percentage of active funds beating passive funds – in all of the periods analysed (one year, three years, five years, 10 years, 15 years and 20 years) has always been well below 50%.

But what happens in bear markets - are active funds able to beat passive funds? The main argument in favour of actively managed funds is that they can be more defensive than passive funds by allocating part of their portfolio to cash, something that passive funds cannot do (an equity fund could very well have 20% of its portfolio in cash, which is not the case with index funds or ETFs).

Active funds can also rotate their portfolios towards more defensive companies to a much greater extent than passive funds can do. The latter also rotate their portfolios but more gradually. In the chart above, we see, for example, how the weight of the technology sector in the S&P 500 has been falling in 2022, simply because the sector has performed worse than the index as a whole.

ETF Comparisons

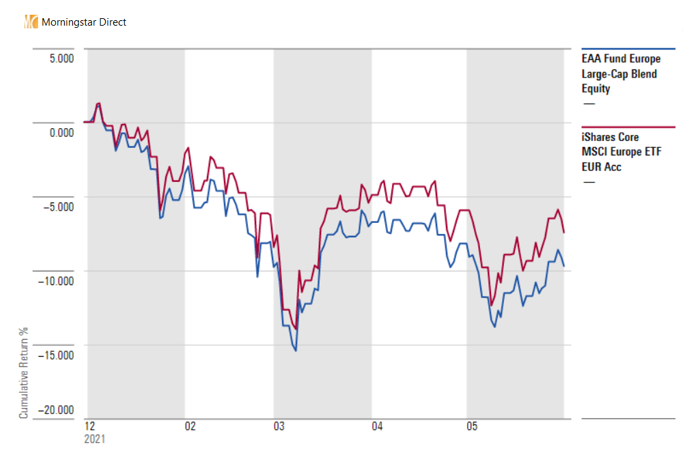

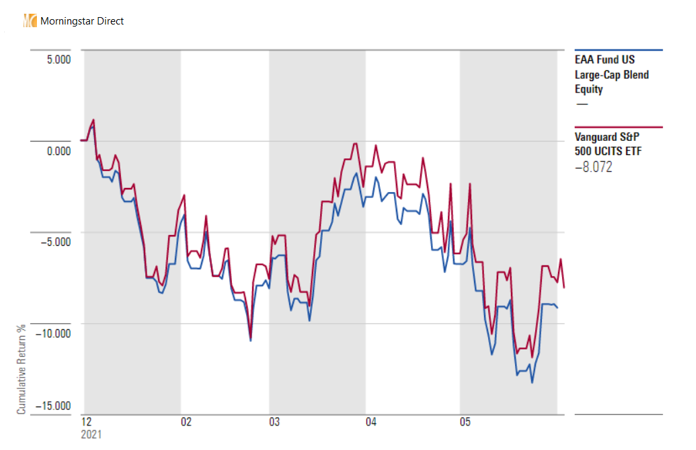

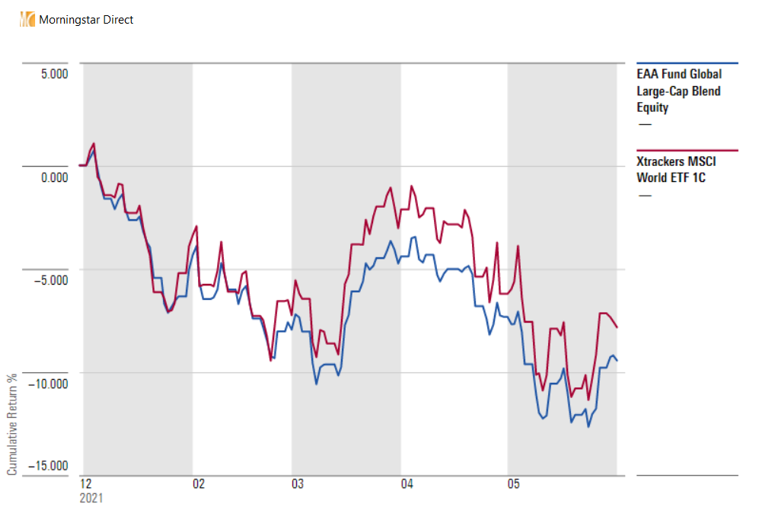

We can check whether this argument is valid by comparing how the averages of the three categories (Europe Equity Blend, Global Equity Blend and US Equity Blend) have performed in the first five months of this year against ETFs that replicate equivalent indices. It is true that this is a short period, but one in which the markets have fallen sharply and, in theory, has given managers time to reduce their risk levels if they have deemed it appropriate.

In the case of the Europe Large Cap Blend Equity category, we have compared the category average (in blue) against the iShares Core MSCI Europe ETF EUR Acc (in red). From January to May the average has fallen by 9.2% in euros versus -6.6% for the ETF.

For the US Large Cap Blend Equity category, we compared the category average (in blue) against the Vanguard S&P 500 UCITS ETF (in red). In the first five months of the year, the average has fallen by 8.8% in euros versus a 7.5% drop for the ETF.

Finally, for the Global Large Cap Blend Equity category, we compared the category average (in blue) against the Xtrackers MSCI World ETF 1C (in red). In the first five months of the year, the average has fallen by 9.2% in euros versus a 7.6% drop for the ETF.

The conclusion is clear: active funds have not done better than their passive counterparts in this latest market downturn. They are of course more expensive than passive funds but the differences in returns outweigh the differences in costs between them.

In the next article we will analyse the performance of "true" active funds to see if they have really done better than passive funds.