One need not be a Boglehead to know that Vanguard launched the first publicly available index fund. (But not the first index fund, period. Five years before Vanguard 500 Index (VFINX) appeared, Wells Fargo had offered a similar fund to its institutional clients.)

However, few realise that Vanguard also pioneered “strategic-beta” index funds. In 1992, the company floated Vanguard Growth Index (VIGRX) and Vanguard Value Index (VIVAX), which became the first mutual funds to index securities that were sorted by investment factors (in this case, growth and value styles).

(One could argue Dimensional Fund Advisors had done so a decade earlier. However, as DFA claims that its funds are not indexed, but instead actively-managed, they do not qualify as strategic beta in Morningstar’s database.)

Although initially delighted – when the two funds commenced, he excitedly explained how the two halves of the S&P 500 had often diverged over the years, thereby giving Vanguard investors a meaningful choice – Jack Bogle later bemoaned his progeny. He came to believe that they led to poor investor choices by tempting customers into buying the fund that had the higher recent returns.

Happy Together

Since their inceptions, both funds have thrived.

The results are doubly surprisingly. First, the academic literature, which had inspired Bogle’s decision to create the two investment-style funds, indicated that value stocks were comfortably the better performers. Pretty much anybody who had studied market history expected that pattern to hold. It did not.

Second, those returns are generous! Even the weaker of the two funds, Vanguard Value Index, turned an initial $10,000 investment into almost $140,000. True, those figures are nominal, and inflation has a powerful effect over such a long period.

However, as price increases were subdued until very recently, investors also pocketed a hefty real gain. After inflation, that $10,000 investment in Vanguard Value Index was worth $73,000. (Vanguard Growth Index appreciated to $89,000, the difference once again demonstrating the power of compounding even small amounts over time.)

Hand in Hand

A third oddity was how closely the funds have since performed. The whole point of separating large-company stocks into two universes, after all, was in the belief that they would behave differently. Yet mostly they have not. For example, the following chart depicts a long stretch when two funds marched virtually together.

Late in that period, Vanguard Growth Index temporarily moved ahead, but losses during autumn 2018 knocked it back down again. Had Bogle been presented with that chart before the growth and value funds were launched, he would have hesitated over his decision if not outright changed it. Having two funds do what one fund can accomplish neither helps investors nor a fund organisation that by design must carefully watch its costs.

The Exceptions

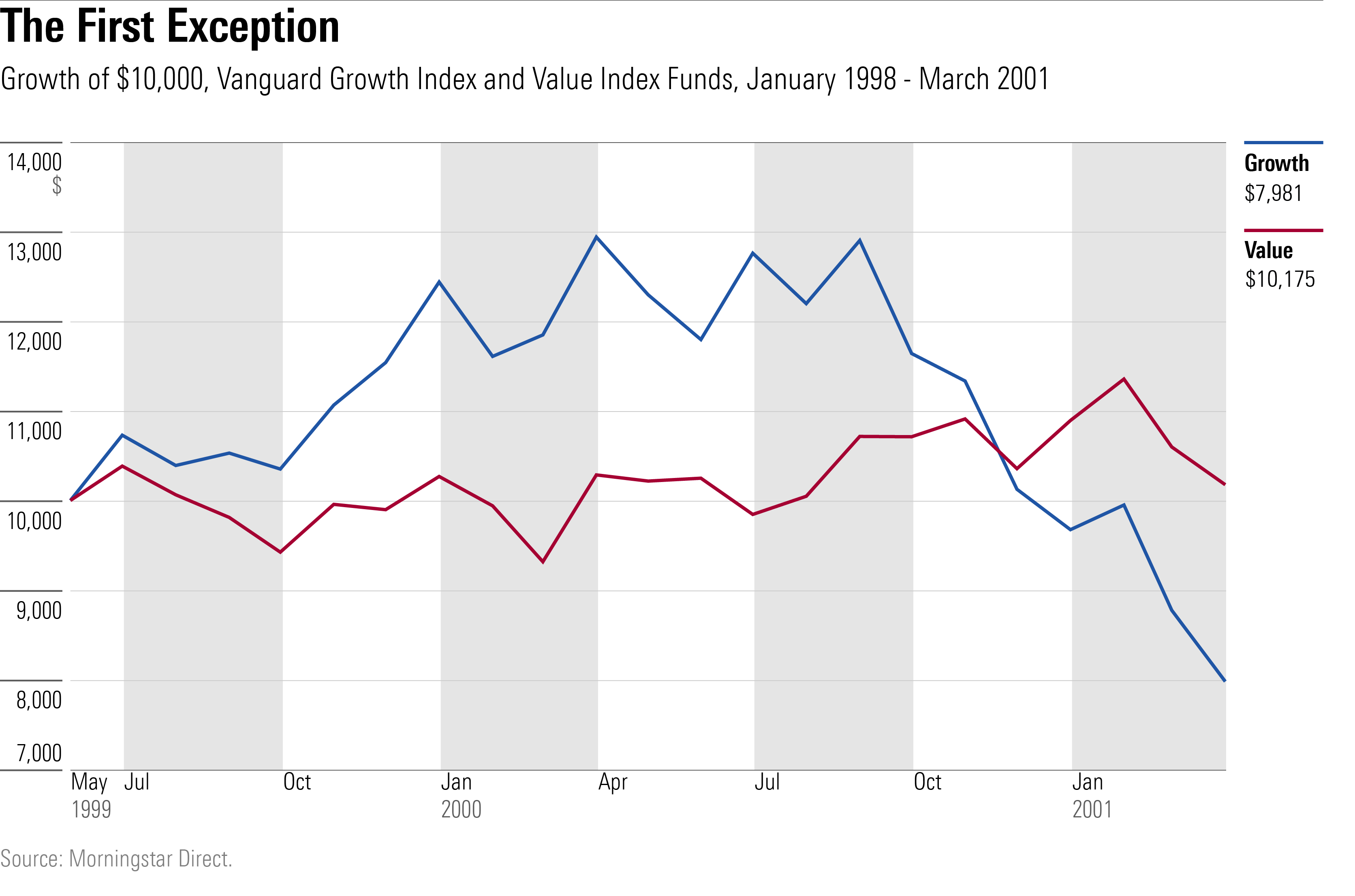

Twice, though, the growth and value funds performed as Bogle intended, by giving their shareholders distinctly different experiences.

The first occasion occurred early in the funds’ history. After trailing its sibling out of the gate, Vanguard Growth Index surged as the new millennium approached. Through 1998 and 1999, the fund gained a cumulative 25%. Meanwhile, Vanguard Value Index went nowhere. Things reversed once the next century commenced. Vanguard Growth Index plummeted, quite spectacularly, while Vanguard Value Index once more stayed the course.

Distressingly, Vanguard investors had observed a similar pattern, placing $9 billion of new assets into Vanguard Growth Index during 1998 and 1999 while allotting only $1.4 billion to Vanguard Value Index.

The company grew so worried that its customers were buying the growth fund for the wrong reason that it temporarily accompanied its prospectuses with a warning letter. As Jack Bogle uneasily admittedly, Vanguard’s anxiety about the fund’s shareholders was justified. By December 2001, the fund had not only shed its previous gains, but it was suffering net redemptions.

After performing similarly during both the 2008 global financial crisis—although Vanguard Growth Index held up better, its margin of victory was modest – and then, as we have seen, over the ensuring decade, the two funds’ fortunes have once again diverged. Although not as dramatic as when starting the new millennium, the discrepancy has been large enough to notice, particularly in recent months for Vanguard Growth Index.

Investor Decisions

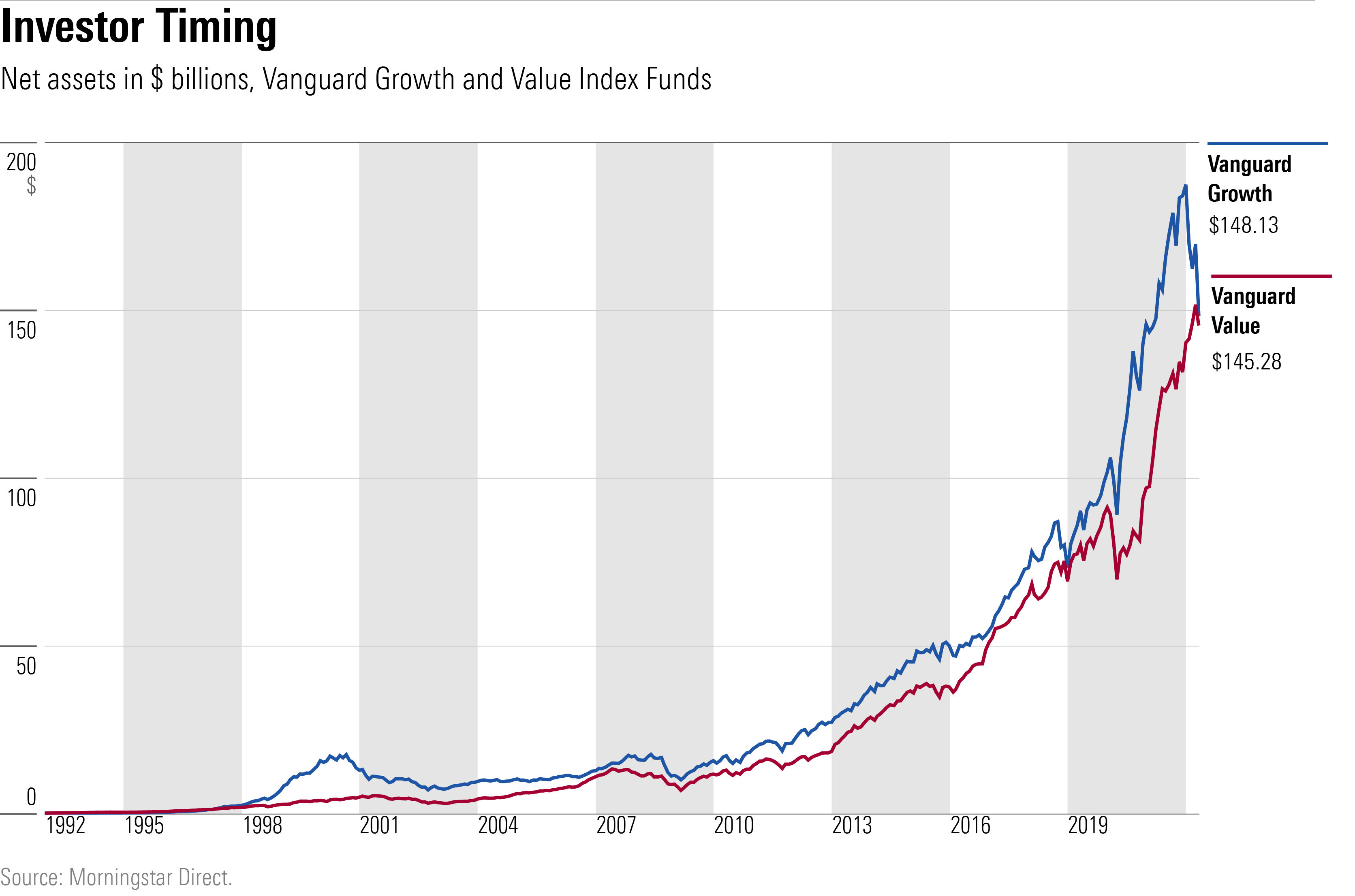

This time, however, shareholders appeared to have anticipated Vanguard Growth Index’s fall. As the fund rocketed, from spring 2020 through autumn 2021, Vanguard’s clients stopped buying it. Instead, they favored lagging Vanguard Value Index. During that period, investors awarded the value fund with $21 billion in net new assets while allocating only $200 million to the growth fund. Vanguard’s customers might have been early, but they certainly did not chase their performance tails.

Indeed, cash flows into the funds have been remarkably consistent. As the next chart illustrates, the two funds not only have performed mostly in tandem, but their assets have largely followed suit. Aside from Vanguard Growth Index’s short-lived bump in the late 1990s, and the recent taste for Vanguard Value Index, investor conduct has not been an issue. Each fund has received steady but moderate inflows.

No Regrets

Since the new millennium, shareholders of the growth and value funds have not repeated their follies. Bogle’s concern about their effect on investor decisions has therefore been moot. That said, although strategic-beta funds have since become an industry rage, they remain a side attraction at Vanguard. If Bogle had not introduced the two funds, the company would have fewer assets, but it would still be by far the world’s largest fund organization.

Ultimately, Bogle had no reason to regret his second index-fund innovation. Vanguard’s investors have behaved better than he feared. Neither, however, will these two funds place high on his legacy. As it turned out, they were something of an evolutionary cul-de-sac.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own