I thought my love affair with nudge economics was over. I can recall sitting in Leicester Square in 2016 reading Richard Thaler (pictured) and Cass R. Sunstein’s eponymous book and being pleasantly surprised by the quaint solutions to real-world problems. Fast forward six years or so and I rather feel it was all a phase.

To its credit, nudge economics was always results-oriented. The idea was not just to achieve consensus-driven goals, but to be able to measure success. Dramatically increasing the number of workplace pension savers via auto-enrolment was one, but there are other classics in the Nobel Prize-winning genre. Within seven years of deploying its Don’t Mess With Texas roadside signs, America’s largest state achieved a 72% reduction in roadside trash. Not bad, Texas.

But while you might argue that nudge was a great way to weld macro and micro with a view to solving problems, there are so many ways in which it missed the even bigger picture.

Millions more are saving into pensions in the UK as a result, essentially, of opt-out nudging, but the pounds-and-pence results won’t be nearly as attractive (or secure) as the workplace plans of years gone by. When inflation is biting and the only other identifiable solution to your pension saving problems is being born earlier than you actually were, you know there’s a problem.

Likewise, you might be impressed by Texas’s gleaming roadsides. But Don’t Mess With Texas was never designed to solve the issue of where waste goes. In 2020, the state sent 3,171 tonnes of “litter” (defined as “rubbish and putrescible waste”) to landfill. That’s a mere 0.01% of its total landfill disposal for the year. So far so good? Its “municipal waste” figures show a different story.

The Texan authorities define municipal waste as “solid waste, resulting from or incidental to municipal, community, commercial, institutional, and recreational activities, including garbage, rubbish, ashes, street cleanings, dead animals, abandoned automobiles, and all other solid waste other than industrial solid waste.” In 2020, Texas sent 23.4 million tonnes of that stuff to landfill - 23.4 million tonnes! Sorting out the roads looks a Pyrrhic victory. The cost was the bigger picture.

Rules To Live By

It’s information like that that makes me sceptical of behavioural fads and prize-winning economists. Words like “neoliberal”, “naïve”, or “cosmetic” spring to mind, as does Wiggum’s Razor, a neologism I selfishly keep mentioning to highlight the malign influence of people with good intentions.

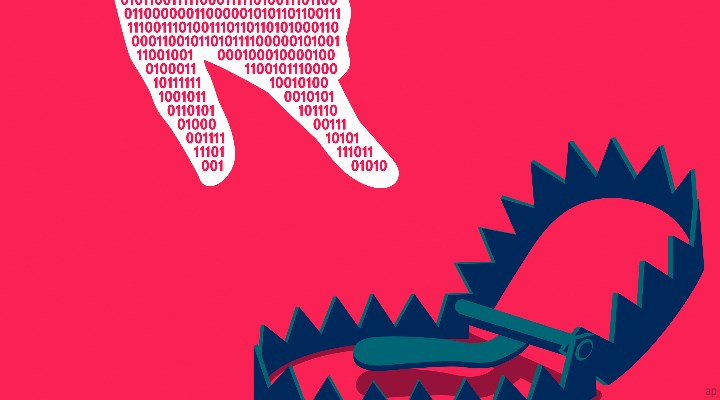

Why am I worrying about this again? Well, if the “good” nudges aren’t good enough, you’ll be shocked by the impact of the bad ones. For some reason I’ve started seeing them everywhere again.

Regular readers of this column may be surprised to learn I once subscribed to the Telegraph. It was easy enough to sign up for: one of those lovely free x amount of time before we bill you but give us your card details first deals. Easy peasy.

If you want to unsubscribe, however, it’s much harder. Now they want me to ring their call centre and speak to someone who will presumably attempt to either prevent me from achieving what I want, or sell me a different package. Many swearwords.

Don’t even get me started on airlines either. First comes the unrealistic estimate of how much it will cost to book, before layers of added charges and pages that deliberately goad you to believe things that are actually snaky sells (luggage insurance, wallet waterproofing, car park armour plating) are compulsory add-ons. There is so much cross-over with financial regulation here.

The good news is that lots of the larger financial firms are implementing changes to avoid egregiously manipulative customer journeys of this kind. It’s not perfect, and it’s hotly debated for sure, but you might argue that businesses outside of financial services could learn a thing or two from those within. Did you ever think you would hear me say that? Take a look at some of them.

Principle #1: Enter With Ease, Exit With Ease

This is the Telegraph example, but there are numerous others. The way to achieve this is to give people an exit that’s as close as possible in appearance or process to their entrance. If you signed up online, you should be able to cancel online. This should be the same with investments and fund supermarkets.

Principle #2: It Has To Pass The Nan Test

When I was at university we were always instructed to keep ‘the Nan test’ in the back of our minds when writing coursework. To be blunt: if your Nan can’t understand what you’re saying or doing, even more vulnerable folk don’t even stand a chance. This is a basic test of #kindness. There are still huge creases to iron out, but some big financial business have made major steps to address it.

Principle #3: Well in Advance

Forget "just in time" efficiency, companies are failing you if they don’t give you appropriate notice to make decisions before they change a product or its pricing (or both). By the same token, auto-renewals must be flagged in appropriate time to give you the opportunity to make an informed decision. Banks now have this down to a tee, though the paperwork is occasionally excessive and intimidating.

The Callback

You’ll note that none of the above ideas are really pure nudges in and of themselves. The nudge bit comes with the way information is presented, and, crucially, when that happens. That means that if the “cancel” page is buried three-clicks and a weighty legal paragraph deeper than the “subscribe” button on a website, they are doing it wrong. That’s an anti-nudge, and it’s that I take issue with.

To close, then, I begrudgingly admit we still need nudge. But it’s important to acknowledge the limits of its contribution. Used in the wrong way, it can do a lot of very quiet harm. Used in the right way, it may still struggle to be the salubrious silver bullet it was once lauded as.

So, nudge and I are consciously uncoupled, but amicably supporting each other. If that helps one more person avoid a fleecing at the hands of an asset manager or airline, let alone a newspaper subscriptions call centre, then so be it.

Ollie Smith is UK editor at Morningstar