It's safe to say the crypto kitty is out of the bag.

Over the past seven years, cryptocurrencies have rocketed from about $5.2 billion in market capitalisation for the top 100 coins to nearly $1.7 trillion as of January 2022.

Cryptocurrencies now represent the fourth-most popular type of investment among investors, behind only stocks, mutual funds, and bonds. Bitcoin alone has a market cap that would rank in the top 10 largest companies in the S&P 500.

There are a couple of key things to understand about the cryptocurrency universe up front: the different kinds of cryptocurrencies and how they're powered by different blockchains.

Although bitcoin is the best-known cryptocurrency, there are numerous others available. The second-largest cryptocurrency is ether, whose main difference from bitcoin is its purpose: where bitcoin's construction is quite simple and is meant primarily to serve as an alternative currency, ether's also contains the code to trigger sales and purchases when certain criteria are met (known as "smart contracts"). And then there are "altcoins," a category that includes all the other cryptocurrencies, such as ripple and litecoin.

These cryptocurrencies are powered by the underlying technology of blockchains, which register every transaction and cannot be altered. The permanence of this mechanism is, for example, how nonfungible tokens, or NFTs, obtain their certificates of authenticity. And different blockchains support different kinds of cryptocurrencies: Bitcoin, for instance, lives on the bitcoin blockchain; ether exists on the ethereum blockchain.

As the cryptocurrency market has grabbed the attention of the rest of the investing world and shaken off some of the early scepticism around its viability, we decided to take a deeper look at the forces driving its improbable rise. That effort culminated in the publication of Morningstar's 2022 Cryptocurrency Landscape, the first of its kind.

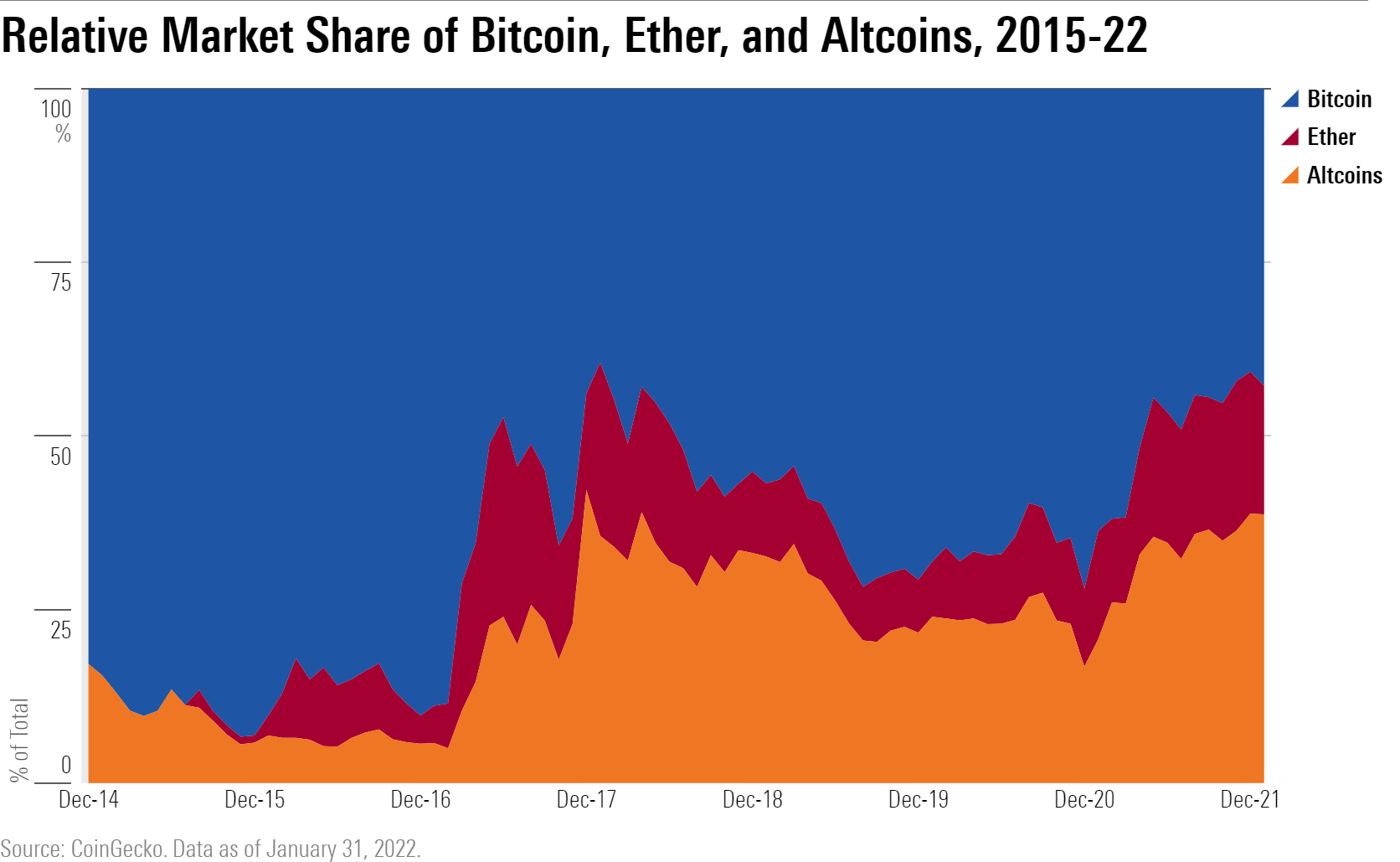

As Bitcoin Loses Market Share, Newer Entrants Drive Crypto Growth

We weren't surprised to discover that bitcoin accounted for most of the growth of the cryptocurrency market in aggregate during its early history, but it was surprising to see that bitcoin has rapidly lost market share to these other cryptocurrencies in recent years.

As shown in the chart below, from January 2017 through January 2022, a market-cap-weighted index of the 100 next-largest cryptocurrencies outperformed bitcoin by more than 75 percentage points annualized.[2] Even as it returned 103% on average each year, bitcoin's share of the cryptocurrency market tumbled from nearly 90% in December 2016 to less than 43% as of January 2022, as ether and altcoins have expanded.

Ether accounts for the first leg of that lopsided growth. And though altcoins are often overlooked, their market share has grown substantially over the past five years.

Ether has experienced sharp spikes and tumbles in its price as enthusiasts speculated on a wide variety of applications for the ethereum blockchain. Since January 2021, though, ether has hovered consistently between 15% and 20% of the market, while bitcoin's market share has continued to steadily decline from 70% to close to 40%, even as it posted a cumulative 32% return.

That's because so many users have flocked to ethereum that it has become cost-prohibitive to trade on that network.

Enter the unloved cryptocurrencies: altcoins. Encompassing all other cryptocurrencies that aren't bitcoin and ether, altcoins like solana have developed blockchains that undercut ethereum on transaction costs while still offering comparable applications (especially decentralized financial services) and have taken market share away from ether as a result.

Altcoins, for their part, are typically more specialised than either bitcoin, a cryptocurrency with hardly any derivative projects (that is, products whose value relies on an underlying asset), or ether, a cryptocurrency whose blockchain offers so much flexibility that programmers can use it for practically any derivative project.

For example, the altcoin terra exists on a blockchain that only creates stablecoin tokens, a class of cryptocurrencies that's backed by assets like the US dollar or gold. The altcoin polkadot, on the other hand, ferries information or assets between other blockchains.

Specialisation has blunted investor interest in the past, but as the cryptocurrency market matures, we expect that diversity between altcoins will become a key strength for the asset class, breaking apart the historically tight correlations we have observed between bitcoin and other digital assets.

With Great Returns Come Great Volatility

From ether's historic 9,500% streak in 2017 to solana's 11,100% tear in 2021, much of the interest in cryptocurrencies has been a self-fulfilling prophecy. Investors see astounding gains and enter the market, resulting in further upward pressure on prices. But every breathtaking rally has ushered in an equally punishing crash on the other end, and cryptocurrencies lack a fundamental anchor like the par value of a bond or a stock's discounted cash flows. Ether lost almost 90% of its value between December 2017 and December 2018, while solana shed more than half its value between November 2021 and January 2022.

Surveyed in aggregate, the volatility of cryptocurrencies has no parallel to any other measurable asset classes.

From January 2015, when regular pricing data starts, through January 2022, the MVIS CryptoCompare Digital Asset 100 Index posted a standard deviation that was well over double that of the second-most volatile index we identified and more than five times as volatile as the MSCI ACWI Index.

Incredibly, this measure includes stablecoins, which often link to a fixed peg. That means that unpegged cryptocurrencies in aggregate likely fluctuate even more than this figure suggests.

Crypto Performance is in a League of Its Own

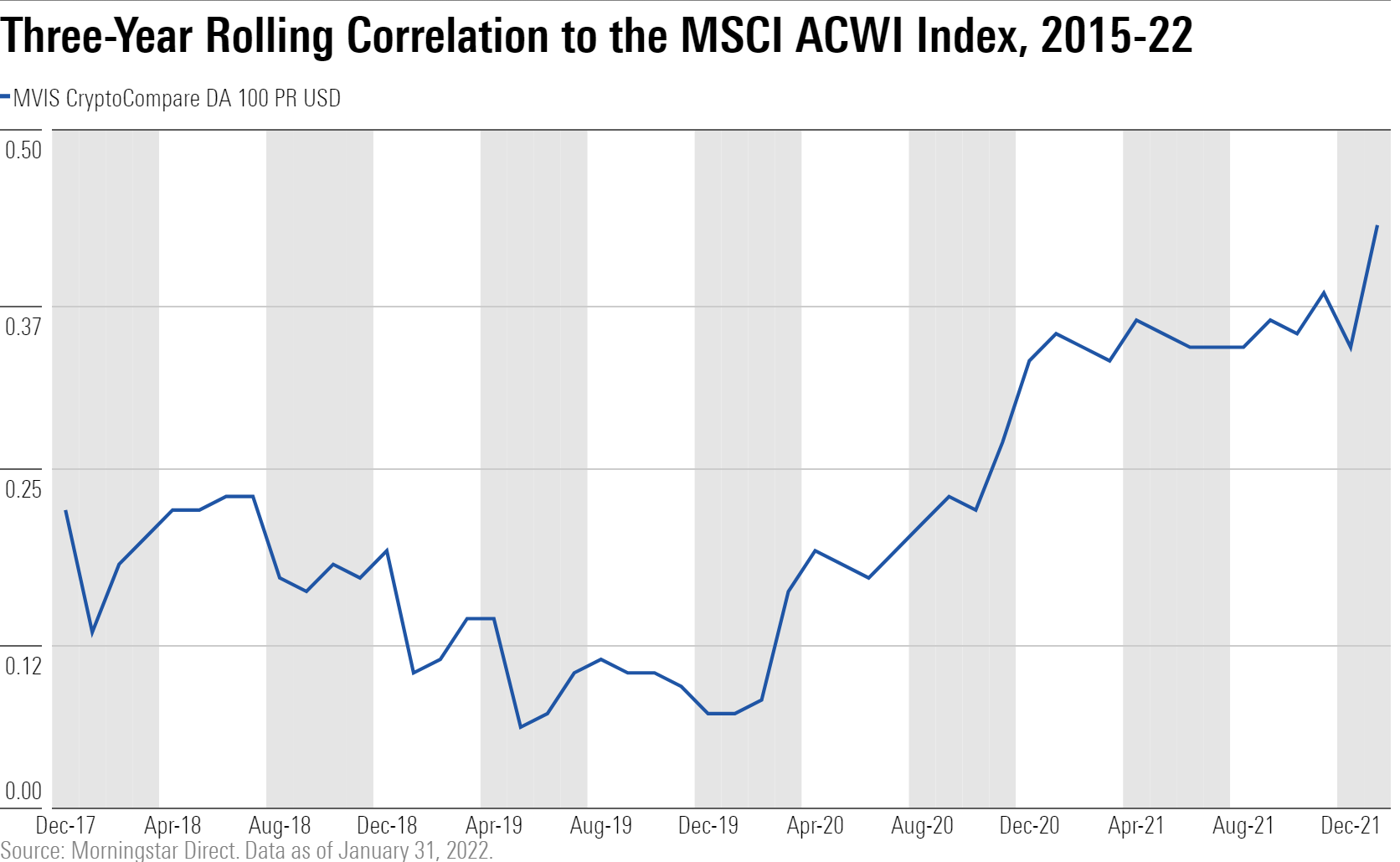

Even outside of its volatility, the cryptocurrency market doesn't behave like any other investments, sparking the interest of institutional investors looking to boost their exposure to uncorrellated returns.

Over its history, the crypto market's price returns have the most in common with international developed-markets stocks, but with a correllation of just 0.28 there's still quite a lot of daylight between the pair compared with other asset classes.

That said, the correlations of cryptocurrencies to risky assets have drifted upward in recent years, especially after the stock market crashed in 2020.

It's important to examine those figures in context, though. Cryptocurrencies are far from alone in experiencing tighter correlations to the global market cap. In fact, the sensitivities of several key subsegments of the bond market rose in lockstep with cryptocurrencies during this same period.

This isn't surprising. Correlations for all asset classes tend to spike during periods of market stress when liquidity compresses, and those relationships usually unwind once there are fairer winds. Higher correlations tend to persist for as long as the measurement window captures the stress event and then roll off. In relative terms, cryptocurrencies still have virtually no correlation to stocks.

Still, while the uptick in correlations may feel like a blip for an investor accustomed to the rough-and-rowdy financial markets, it does suggest that unpegged cryptocurrencies are a poor replacement for fiat money.

Unlike financial securities, safe havens like cash do not tend to act like the rest of the market when it falls. Just the opposite: fiat currencies are designed to hold up best during market stress, because of consumer confidence won over centuries of injecting liquidity when economies become overdrawn.

All That Glitters: Does Bitcoin Move With Gold?

Which brings us to another asset that the market has compared to bitcoin: gold. Hailed as "digital gold," bitcoin's fixed supply and decentralised nature have attracted attention from those who believe that it could act as a viable competitor to the bars stored in bomb shelters by doomsday preppers.

The argument does have intellectual merit, but in the near term, Morningstar analysts agree bitcoin is unlikely to dim gold's luster. People have used the metal to conduct business since at least 600 BC, while bitcoin has only existed for 14 years.[3]

Gold's alternate use cases buffer the metal during periods of market stress so that it doesn't depend solely on market sentiment to create liquidity. We believe that relative to gold, bitcoin lacks enough outside applications to outweigh the impact of market events on its price, limiting its usefulness as a store of value.

Plus, the first transaction denominated in bitcoin didn't happen until 2010, which means we only have 11 years of pricing data to study. During the one market correction in our time horizon, gold's correlation to equities stayed low, while bitcoin's followed the cryptocurrency market on an upward drift.

What We Expect Now

At $1.7 trillion in total market capitalisation, cryptocurrencies can no longer hide in the shadows of Reddit forums. The asset class' stunning growth warrants as much caution as it does excitement.

While cryptocurrencies have spawned entire parallel economies from scratch in just 14 short years (no mean feat) today, cryptocurrencies' decentralised infrastructure still sets up meaningful barriers against real-world use cases.

As a result, cryptocurrencies are still a brand-new, heavily concentrated, and highly volatile investable security. Rather than a swift takeover, we expect that integration with existing systems across financial services and other sectors will likely determine future adoption rates in the space. If that path unfolds, the opportunities for investors will increase at a rate matched only by the potential risks.