There were about 49 percentage points between the best- and worst-performing European exchange-traded products (ETPs) in December, with returns for the month ranging from 16.8% to -32.7%, Morningstar data shows.

The Leaders

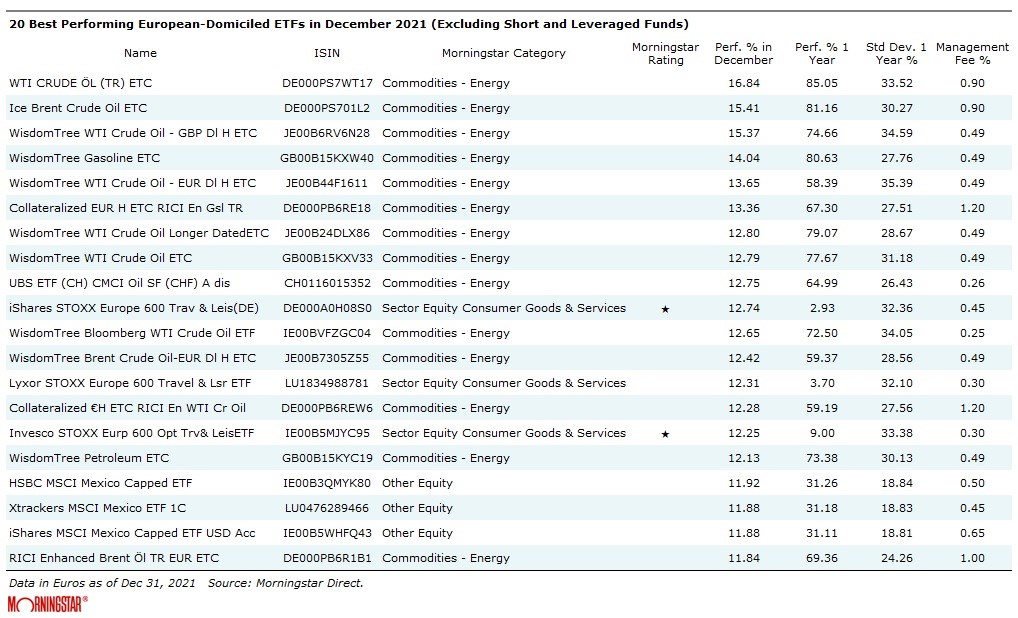

The Top 20 of ETPs is led in December by BNP Paribas’ WTI CRUDE ÖL (TR) ETC (BNQB), a Germany-domiciled tracker of the total return performance of the rolling WTI Light Sweet Crude Oil Futures. The first nine places in the ranking are occupied by funds exposed in various ways to oil movements.

Throughout the year, oil prices were generally driven by a recovery in post-pandemic demand and currently tight supply, although this could be reversed soon, according to the latest IEA Oil Market Report. In December, the energy sector rebounded from a steep slide in the last week of November, in the wake of the pessimism surrounding the discovery of the new Covid-19 Omicron variant, which has since been partially reversed.

The same could be said of the three ETFs in the ranking – from Invesco (SC0R), Lyxor (TRV) and iShares (EXV9) – which replicate the STOXX Europe 600 Travel & Leisure index, dedicated to the travel and tourism sector and particularly affected in November by fears of further closures and restrictions following the resurgence of coronavirus infections.

With around a 12% gain in December, there is also space for three ETFs exposed to Mexican equities (HMEX, XMES and CMX1). Propped up by strong oil prices, Mexican stocks delivered a year-end rally that helped close their best year since 2009. The Morningstar Mexico NR Index rose last year by 29.4%. That compares to a performance of 26.7% reached by the Morningstar Global Markets NR Index.

The Laggards

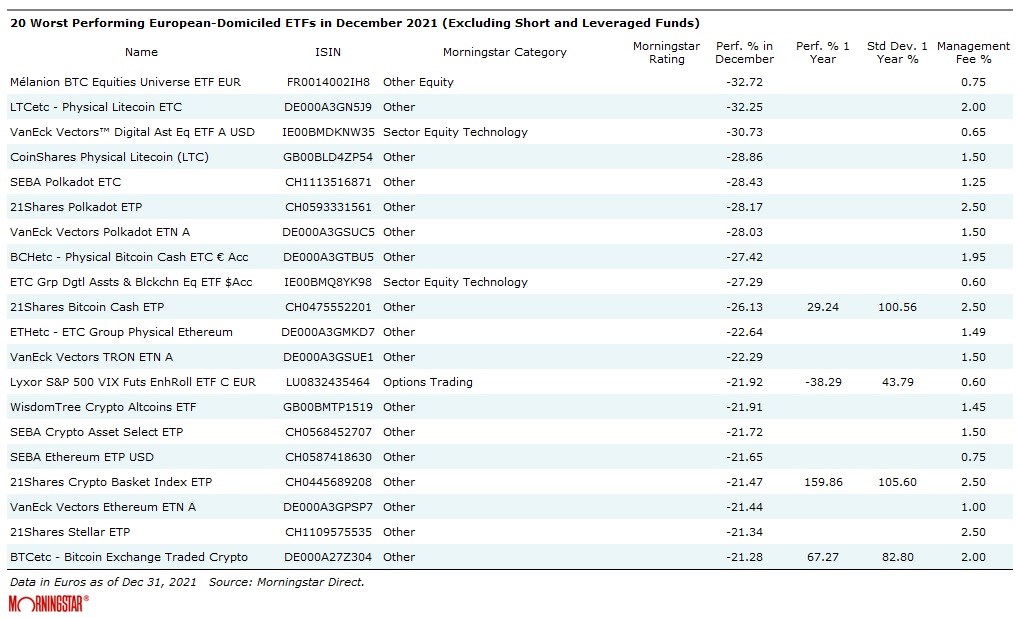

The biggest losers last month were products exposed to digital assets--most of them to cryptocurrencies like Litecoin, Polkadot, Bitcoin cash, Ethereum, and Altcoins. Mélanion BTC Equities Universe UCITS ETF EUR (BTC) topped the list of the laggards, losing 32.7%. This France-domiciled fund was launched in October 2021 and tracks the Melanion Bitcoin Exposure Index, which comprises companies with sensitivity to Bitcoin, weighted according to it.

The only exception to the digital assets’ universe was Lyxor S&P 500 VIX Futures Enhanced Roll UCITS ETF, which shed 22%. This tracks the S&P 500 VIX Futures Enhanced Roll Index, a benchmark that offers exposure to the expected implied volatility of the S&P 500. Also known as the “fear gauge”, this index is often seen as a reflection of perception of risk.

The Tops

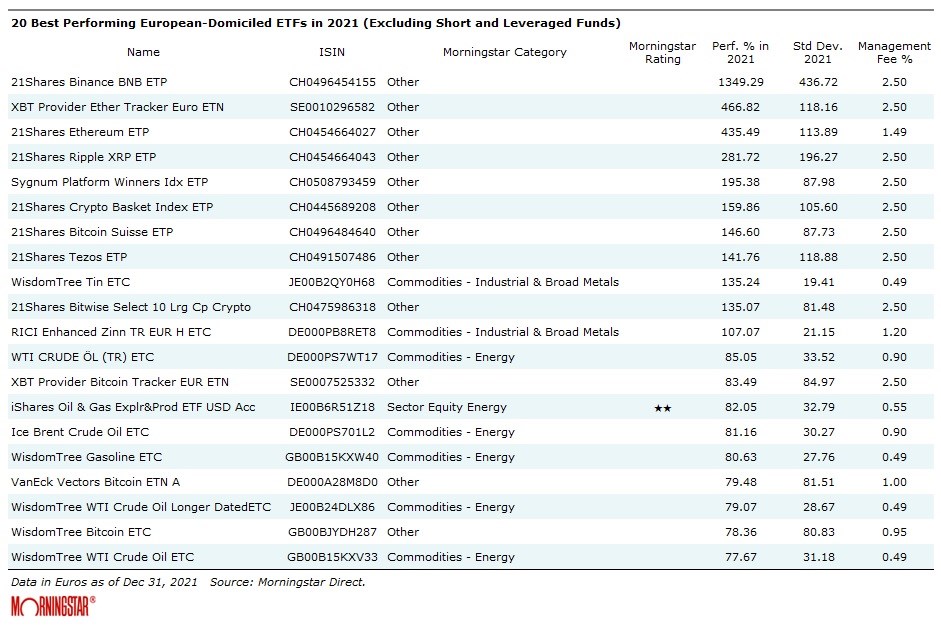

Looking back to 2021 in its entirety, however, the tables turn: cryptocurrencies are by far the best performing asset class. In our 2021 winners’ ranking, 12 out of 20 products were exposed to cryptos.

The best performing ETF in 2021 in Europe was the 21Shares Binance BNB ETP (ABNB), which gained an outstanding 1,349% last year. Such numbers can be tempting to new investors, but it is always wise to remember that what goes up can go down very quickly (especially in the world of crypto).

A good parameter to measure the volatility of such instruments is the standard deviation, which shows how an investment has exceeded or lagged the average performance. For example, the 21Shares Binance BNB ETP shows 437 points of standard deviation over the last year, while a tracker following the S&P 500 index typically has a standard deviation of 11 points in the same period. (Morningstar analyst Amy Arnott has looked in detail at Bitcoin and volatility in this article).

2021 was also an exceptional year for industrial metals as well, driven by a post-lockdown and post-pandemic economic recovery and a supply side that was unable to cope with that pace.

In this environment, WisdomTree’s Tin ETC (TINM) gained a remarkable 135%. Tin hit an all-time high this year and was the best performer across the base metals space. The appreciation of tin prices has primarily been due to extremely bullish supply-demand dynamics.

On the supply side, the Covid-19 pandemic has impacted key tin-producing countries like Indonesia and Malaysia, while tin has also benefited from strong firm demand from the electronics industry.

The Flops

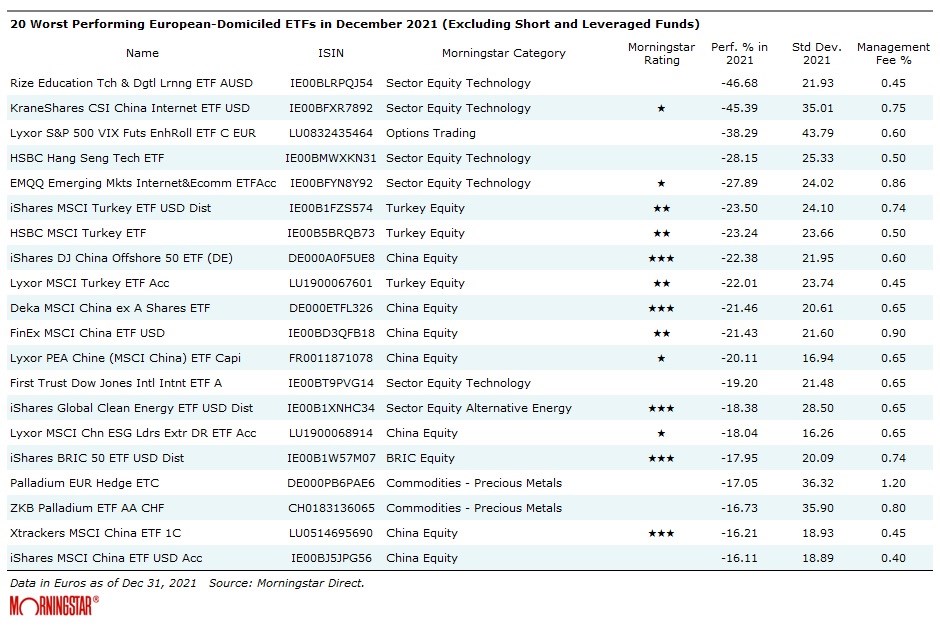

Conversely, Rize Education Tech and Digital Learning UCITS ETF (LERN) was the worst performing ETF of 2021, losing almost 47%.

It seeks to invest in companies that potentially stand to benefit from the increased adoption of digital and lifelong learning technologies such as personalisation and adaptive learning, video content, gamification and immersion technology, all of which are changing the way people learn.

Monthly (or even yearly) top and flop performers often coincide with very volatile and therefore risky products. Ideally, those should play a satellite role in your portfolio.

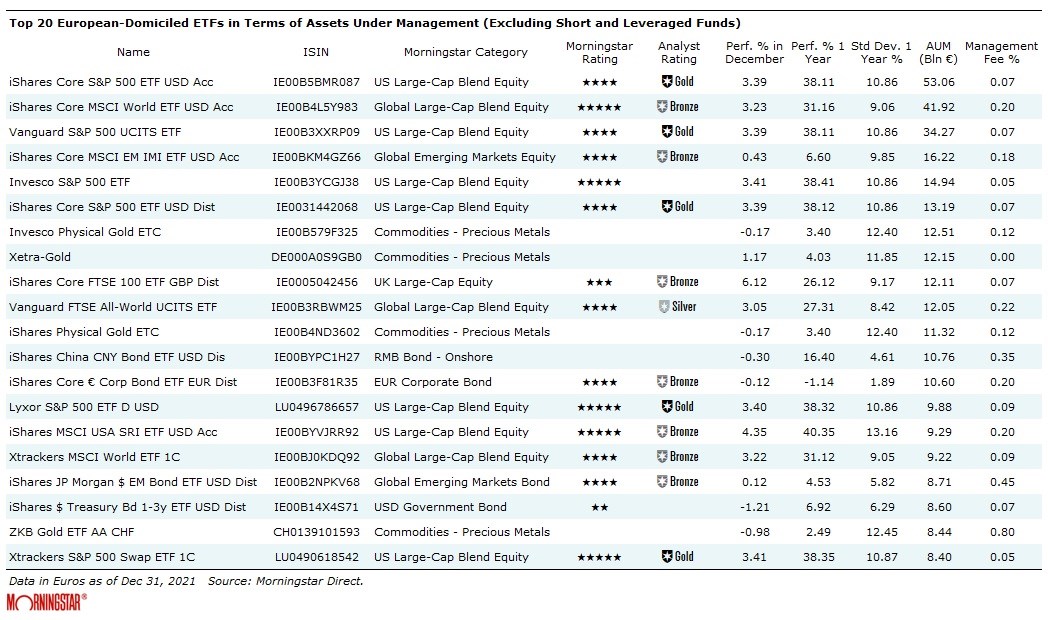

Below, you can see an overview of the biggest European-domiciled ETPs in terms of assets, which could be more appropriate to consider among core holdings. Performances in 2021 go from the 40.35% returned by iShares’ MSCI USA SRI UCITS ETF USD (SUAS), to its Core € Corp Bond UCITS ETF EUR (IEAC), which lost 1.14%.

A Note on Methodology

We have looked at key trends in the eleventh month of the year, excluding inverse and leveraged funds. Being purely passive products, these instruments reflect the evolution of the markets without the bias (good or bad) of an active manager