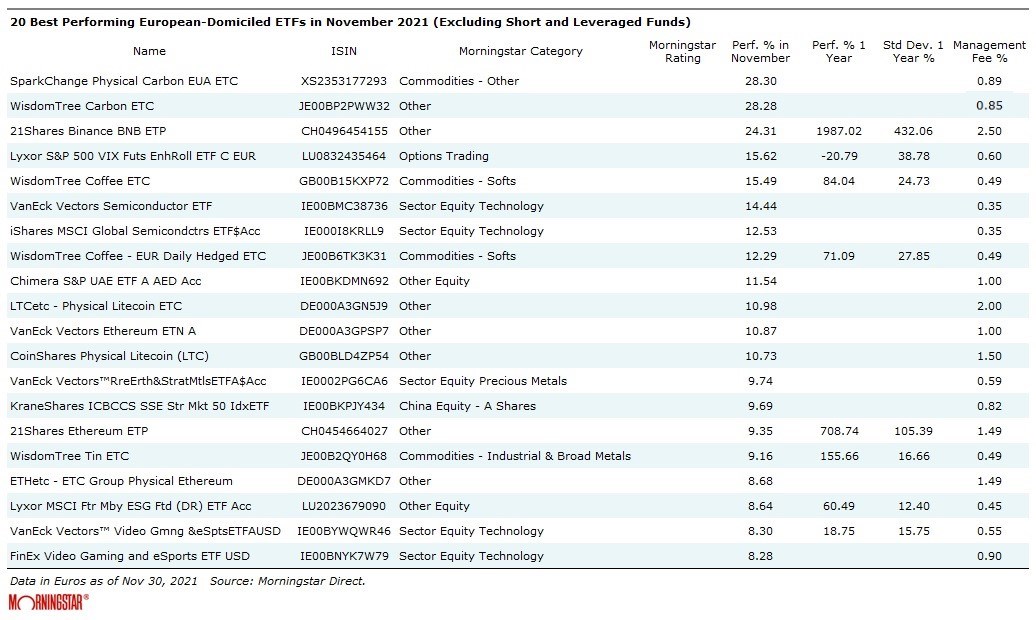

Our monthly round-up of the best and worst performing European exchange-traded products has been updated again. Carbon, coffee, semiconductor and cryptocurrency ETFs were in the ascendant, while travel and energy funds were hammered by the new coronavirus variant.

Leaders

The top 20 of exchange-traded products (ETPs) was led in November by SparkChange Physical Carbon EUA ETC (CO2), issued by HANetf in collaboration with SparkChange (a provider of specialist carbon investment products and data), followed by WisdomTree Carbon ETC (CARP). Both are designed to offer investors a means of accessing the European Union carbon dioxide emissions allowance market as they track the spot price of physical EUAs, the so-called “permits to pollute”. These are certificates whose purchase is made compulsory by the European Commission for those industrial plants that exceed the carbon emission limits allowed by Europe.

In third place was 21Shares Binance BNB ETP (ABNB), which has gained 1,987% over the last year. On November 16, the numbers of daily transactions on Binance Smart Chain almost hit 15 million, more than the blockchains of Bitcoin and Ethereum combined, and making it the first blockchain network to do so.

Last month also saw a spike of the VIX Index, which measures S&P 500 volatility. In the wake of concerns about the new Omicron variant and the now widespread belief that inflation is anything but atransitory (as admitted by reappointed Federal Reserve Chairman Jerome Powell), markets had to face a good deal of uncertainty. November 2021 was indeed the most volatile month for the US S&P 500 stock index since February 2020. Lyxor S&P 500 VIX Futures Enhanced Roll UCITS ETF C-EUR (LVO) gained 15.6%.

As reflected in the performance of the WisdomTree Coffee ETC (COFF), the price of coffee increased by more than 15 percentage points in November, reaching its highest point in ten years. Drought and lower-than-usual temperatures in coffee producing countries affected the harvest; in terms of supply, transportation issues and disruptions continued to play a role, as coffee is typically refined in areas outside the producing regions.

In sixth and seventh positions there are two thematic trackers exposed to the semiconductor sector, the VanEck Vectors Semiconductor UCITS ETF (SMH) and the iShares MSCI Global Semiconductors UCITS ETF USD Acc (SEMI). Demand is incredibly strong for these types of chips, which are essential for products like smartphones and cars. As long as supply remains tight, the stocks of companies that manufacture or trade semiconductors are likely to continue to have plenty of room to grow.

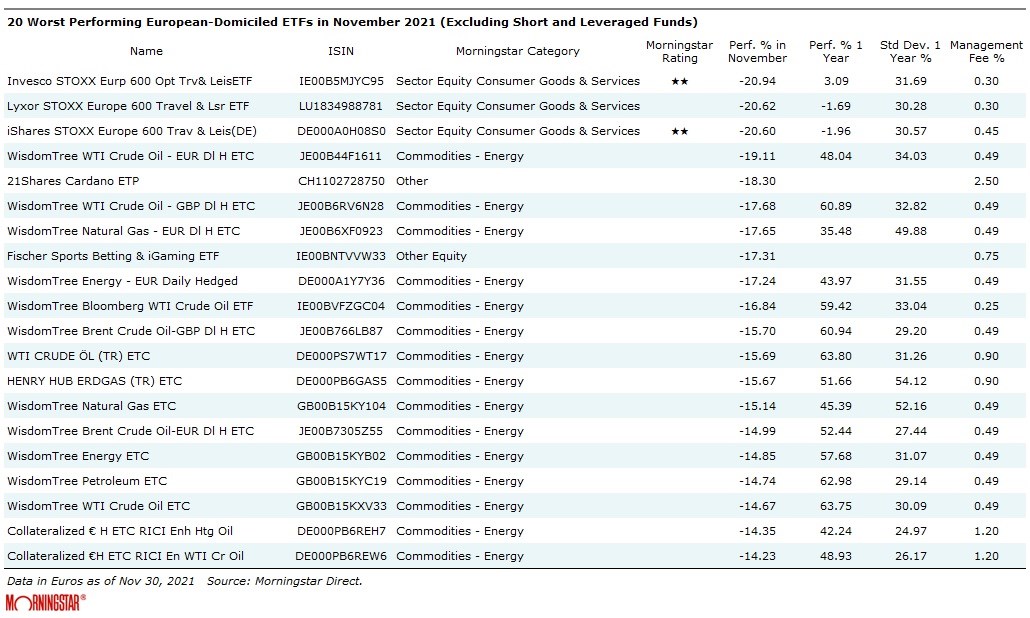

The Laggards

The biggest losers last month were trackers – from Invesco (SC0R), Lyxor (TRV) and iShares (EXV9) – of the STOXX Europe 600 Travel & Leisure index, exposed to the transportation and tourism sector, and particularly affected by fears of possible new lockdowns and restrictions following the resurgence of coronavirus infections that has been hitting Europe in recent weeks.

Among the laggards, we counted no less than 15 funds with varying exposure to the energy sector. The declines were driven, once again, by the discovery of the Omicron variant, which caste an ever-longer shadow over global growth forecasts.

Furthermore, the US and other major oil-consuming nations – such as China, Japan, India, South Korea and the UK – have decided to draw on their emergency oil stocks, a sign of growing concern among policymakers about rising crude prices and more generally about the contribution of energy prices to the run-up in inflation.

According to the International Energy Agency, which monitors global oil supplies on behalf of the world’s leading economies, there have been three co-ordinated stock releases since the agency was founded: before the Gulf War in 1991, after Hurricanes Katrina and Rita damaged oil facilities in the Gulf of Mexico in 2005, and in response to supply disruption caused by war in Libya in 2011.

A Note on Methodology

We have looked at the key trends in the eleventh month of the year, excluding inverse and leveraged funds. These instruments, being purely passive products, reflect the evolution of the markets without the bias (good or bad) of an active manager.