Mentioned: Meta Platforms Inc (FB), Snap Inc (SNAP), Pinterest Inc (PINS), Amazon.com Inc (AMZN), Walmart Inc (WMT), Alphabet Inc (GOOGL), Target Corp (TGT)

Mentioned: Meta Platforms Inc (FB), Snap Inc (SNAP), Pinterest Inc (PINS), Amazon.com Inc (AMZN), Walmart Inc (WMT), Alphabet Inc (GOOGL), Target Corp (TGT)

There's no shortage of news around Facebook (FB) for investors to consider these days, including that it has changed its name to Meta Platforms and will start trading under the ticker MVRS on Dec. 1.

While Facebook may have changed its name, the controversies that have dogged the company continue. It is facing regulatory scrutiny, antitrust lawsuits, and criticism about Facebook's use as a platform to spread false information about the U.S. presidential election and COVID-19. Shareholders are also pushing back through stepped-up proxy votes against company management.

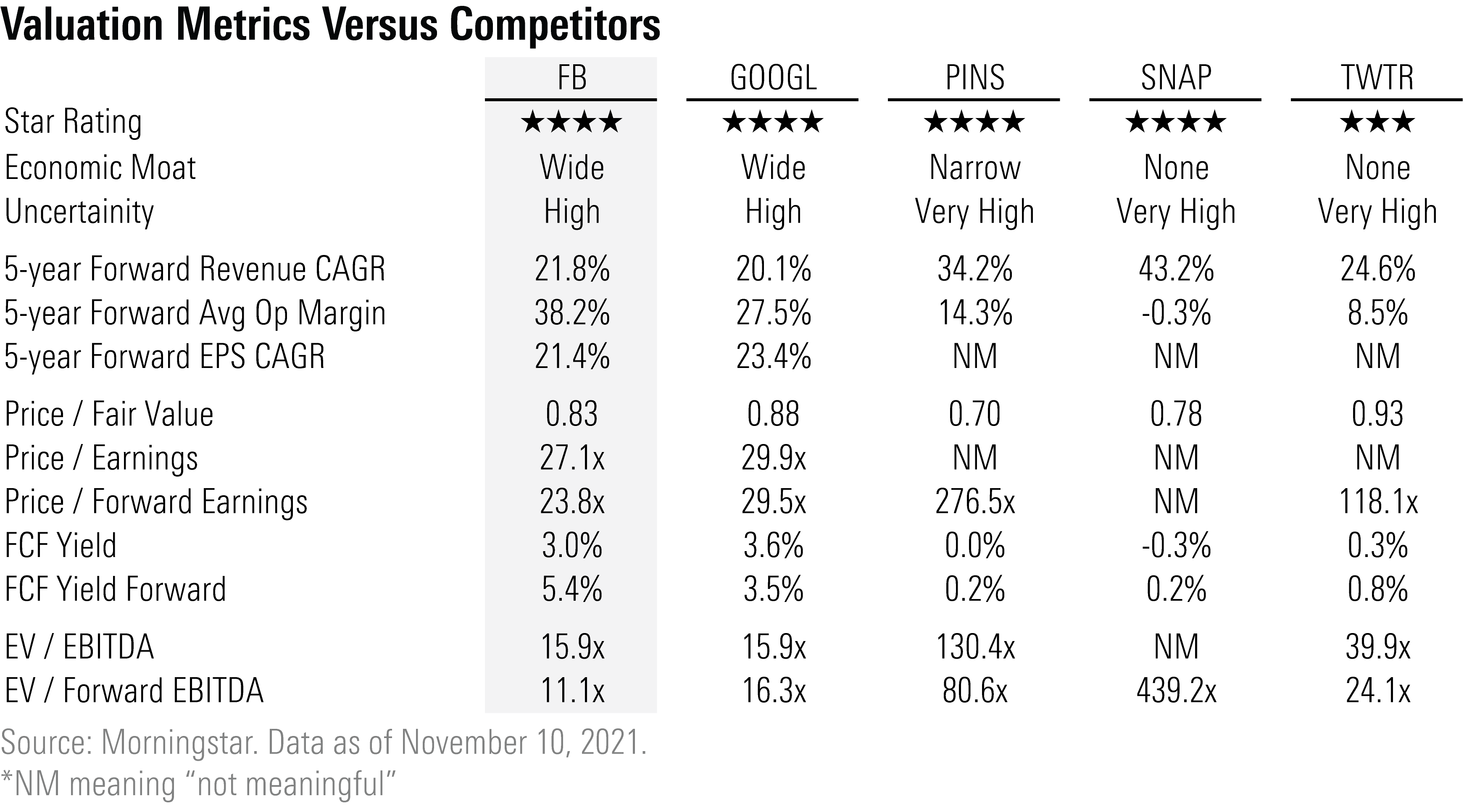

But based on Morningstar's bottom-up analysis, the stock is trading at a 16% discount to our fair value estimate, and we continue to think that it's the most attractive social-media stock under our coverage.

Meta Platforms will consist of two business segments: its legacy family of apps, including Facebook, Instagram, WhatsApp, and Messenger, and its new segment Reality Labs, which will drive the firm's long-term metaverse strategy with augmented and virtual reality hardware and software. The metaverse describes an immersive, online world consisting of augmented and virtual reality. In this virtual environment, users will be able to interact with any other users anywhere in the world. The virtual surroundings and environment can be adjusted based on the users or participants' preferences and use case.

Regulatory and Antitrust Risks

Meta and its social-media competitors have been under the spotlight from regulators across the world. This scrutiny is concentrated on the collection and use of data that is gathered across their platforms as well as the market power exercised by these rapidly growing enterprises.

While the outcome of potential regulatory actions could have a negative impact on the economic value of advertising on Meta's platform, such regulatory changes would also affect its competitors. In a downside-case scenario where we lowered our advertising compound annual revenue growth rate to 12.0% from our base case of 21.8%, our valuation falls from $404 to $239; however, depending on the specifics of any potential regulatory changes, the impact could be much lower. In fact, we think potential regulatory actions could possibly even benefit Meta's valuation by bolstering the barriers to entry in the social-media space.

Regulatory Risks

Potential regulatory and legal changes threaten to limit access to data, including compilation and storage, sharing, and utilization of information concerning online user behavior across sites, apps, and devices. This data allows ad tech firms and advertisers to target individual users with relevant and likely higher-return-generating ads.

The most likely regulatory risks that may affect Meta would be new restrictions on the amount, type, and usage of the data it collects and whether such data can remain private and secure. In our view, restrictions on data will not reverse the network effects that underpin Meta's wide Morningstar Economic Moat Rating, and we expect that any future limitations on data access or usage would apply to all firms in this space. Plus, we are confident that Meta's large user base and the continuous usage of its apps will attract advertisers. Marketers will have other platforms to purchase ad inventory from, but given that restrictions on data may reduce returns on targeted advertising, the large audiences that Meta attracts will continue to bring demand for its ad inventories.

In response to public pressure, Meta and other online firms have already begun to take actions in anticipation of further regulatory measures. For example, some platforms are beginning to give more control of personal data and its usage to their users.

Antitrust Risks

We don't foresee a forced breakup of Meta based on antitrust issues. In fact, in our view, the global digital advertising market remains competitive. While Meta and Alphabet (GOOGL) are the market leaders, other online firms such as Amazon.com (AMZN), Snap (SNAP), and Pinterest (PINS) are gaining traction. In addition, there is a wide variety of third-party ad-tech firms that compete in this space, and even retailers such as Walmart (WMT) and Target (TGT) are investing in operating their own digital advertising platforms and should also be considered as competitors.

We think that the continued growth across these competitors indicates that digital advertising remains a healthy and competitive market. With the market composed of so many firms with varying roles, we think agencies like the Federal Trade Commission and the Justice Department, along with lawmakers and justices, will have difficulty defining market dominance and monopolistic practices by one or two companies. Yet, even if a forced breakup were to occur, shareholders could actually benefit, as our sum-of-the-parts analysis for Meta is $492 per share.

How Does Facebook Make Money?

Simply said, Facebook derives the preponderance of its revenue and earnings from advertising with only a small amount (approximately 2%) from its payments business. The success of the advertising business is based on the combination of the long-term structural shift in advertising spending to online platforms and Facebook's vast collection of user data. Facebook is the world's largest social network, and it recently reported that 3.58 billion people have accessed at least one of its apps per month.

Digital advertising spending has rapidly outpaced the increase in ad spending in legacy channels. We forecast that average spending on digital ads will grow approximately 16.5% per year through 2025, whereas total ad spending will only grow by about 9.3%. While the rate of digital spending has well outpaced that of traditional advertising, we project that advertisers will continue to shift an even greater portion of their spending to online advertising. Consumers are increasingly spending more time online at the expense of traditional entertainment options. Between spending more time online and the ability to track user engagement, online platforms offer a greater amount of user data. Advertisers are able to use this data to increase the effectiveness of their targeted advertising campaigns and measure the performance of their advertising more accurately.

In addition, advertisers want their ads to be placed where they have the most impact on purchasing decisions. We forecast that the rate of e-commerce sales will continue to outpace overall retail sales, which further drives advertisers to place the ads online where these purchases occur. E-commerce sales spiked during the pandemic, and while the rate of increase will likely subside in 2021, we continue to expect e-commerce sales to grow at an average rate of over 8% for the next five years. Finally, new business formation has surged over the past few quarters as the economy recovers from the depths of the pandemic. New businesses need to efficiently create awareness and generate demand, especially from local and targeted audiences, making digital channels that can specifically target those audiences especially attractive.

What Are the Assumptions That Underpin Our Valuation?

We forecast that over the next five years, Meta's revenue will increase by a 21.8% compound annual growth rate, or CAGR. This growth can be broken into two parts: increase in the number of users and growth in the average revenue per user.

Over the next five years, we project that the average number of monthly users will increase by a 7% CAGR to approximately 3.8 billion. Considering that a significant amount of the populations in developed markets such as the United States and Europe are already utilizing at least one Meta platform, we forecast that growth in these areas will be relatively low going forward. Over the next five years, we forecast that the user base in the U.S. will grow less than 1% per year and about 2% per year in Europe. However, we expect that growth in Asia will increase by over 6% per year over the next five years, and across the rest of the world, users will grow by over 11% per year. By the end of 2025, we forecast that there will be 263 million users in the U.S. and Canada, 458 million in Europe, almost 1.6 billion in Asia, and another 1.5 billion spread out across the rest of the world. To put that in context, the current global population is approximately 7.8 billion.

In our view, the main driver of Meta's revenue growth potential is advertisers’ willingness to purchase ads on Meta's social platforms. We think increase in user base, which is driven by the firm's network effect moat source, will continue to attract more advertisers and more ad spending, resulting in higher user monetization. Over the next five years, we project that average revenue generated per user will grow by a 13% CAGR. Breaking down the growth per region, across the U.S. and Canada, Europe, Asia, and the rest of the world, we forecast CAGRs of 16%, 18%, 22%, and 17%, respectively. Note that the total global CAGR is lower than the individual regions as the average revenue per user is significantly lower in Asia and the rest of the world, which have the high growth rates.

As Meta Platforms invests in the augmented and virtual reality space over the next few years, we forecast that the firm's operating margin will decline to 34.3% in 2022 from 39.8% in 2021. However, after this initial bout of capital spending and when Meta begins to monetize these investments, the operating margin is projected to rise up to 40.0% in 2024. Likewise, we expect the growth rate for earnings per share to slow in 2022 but ramp up thereafter, and our projected five-year CAGR for earnings is 21.4%.

Wide Economic Moat

We rate Meta Platforms with a wide economic moat based on the network effects derived from its massive user base and the intangible assets consisting of the vast collection of data that users have shared on its various platforms. The network effect continues to strengthen as more users sign up to Meta's family of apps and both engagement and usage time continue to grow. According to eMarketer, on average, users are on Facebook and Instagram a combined 65 minutes per day. With this usage, Meta accumulates data on every user in order to provide unique and attractive advertising opportunities.

What Are the Main Risks to Our Base Case?

- The implementation of new regulatory restrictions has the greatest ability to negatively affect Meta's valuation in the short term. Limitations on what user and usage data Facebook collects and how that data can be utilized could limit the effectiveness and value of ads placed on Meta's platforms.

- Most social-media consumers utilize more than one social network. If a competing, or new, network offers users a more desirable experience than Meta's family of apps, Meta could experience a decrease in usage and engagement as users reallocate more of their social-media time to a different platform.

- Meta's valuation is predicated on our forecast for the continued increase and value of online advertising as compared with traditional advertising. If the volume and/or effectiveness of online advertising fail to meet our projections, Meta's valuation would suffer. For example, in our bear-case scenario, we lower our five-year revenue CAGR to 12.0% from 21.8% and reduce the operating margin assumption to 32.0% from 38.2%, resulting in a $239 fair value estimate for Meta, significantly below our base-case $404 valuation.