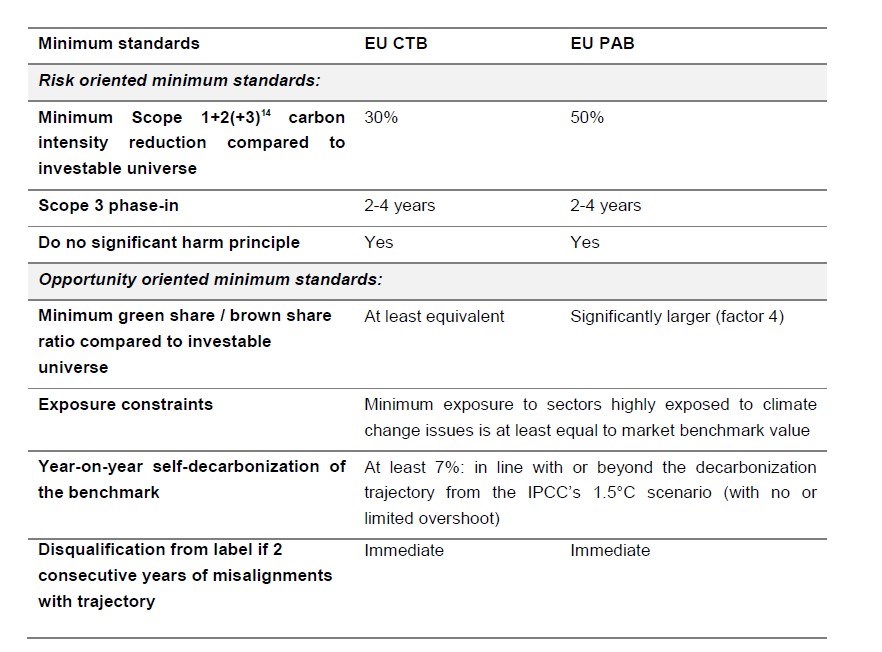

In late 2019, the European Union (EU) adopted a new regulation. It introduced two types of climate benchmark: the EU Climate Transition Benchmark (EU CTB), and the EU Paris-Aligned Benchmark (EU PAB).

The benchmarks have four main objectives:

- To allow a significant level of comparability of climate benchmarking methodologies, while leaving index providers with an important level of flexibility in designing their methodology;

- To provide investors with an appropriate tool aligned with their investment strategy;

- To increase transparency on investors’ impact, specifically with regard to climate change and the energy transition;

- To disincentivize greenwashing.

EU Climate Benchmark ETFs

The universe of climate-aware funds has seen steady growth in recent years. Product development reached record highs in 2020, with 52 new products coming to market, and it kept growing this year.

Notable launches in 2020 and 2021 were a number of Paris-aligned funds such as Amundi Euro iStoxx Climate Paris Aligned PAB, Franklin STOXX Europe 600 Paris Aligned Climate ETF, and the Lyxor S&P Europe Paris-Aligned Climate ETF. Similarly, Amundi MSCI World Climate Transition is an example of a fund aligned with the EU Climate Transition Benchmark. According to Morningstar data on 15 October 2021, there are about 30 such exchange-traded funds (ETFs) available for European investors.

What Are the Underlying Assets?

For the PAB, underlying assets are selected in such a manner that the resulting benchmark portfolio's greenhouse gas emissions are aligned with the Paris Agreement’s long-term global warming target of 1.5 degrees Celsius. The CTB likewise means underlying assets are selected, weighted or excluded to create decarbonized portfolios in accordance with the European regulator’s own minimum standards.

In its 2019 Interim report, the EU’s Technical Expert Group on sustainable finance explained that “investors using these new types of benchmarks not only intend to hedge against climate transition risks, but also have the ambition to direct their investments towards opportunities related to the energy transition.”

It continued:

“The two types of climate benchmarks are pursuing a similar objective but differentiate themselves in terms of their level of restrictiveness and ambition. EU PABs are designed for highly ambitious climate-related investment strategies and are characterized by stricter minimum requirements, while EU CTBs allow for greater diversification and serve the needs of institutional investors in their core allocation”.

Climate-Aware ETFs Features

Most climate-aware ETFs in Morningstar’s database replicate an EU PAB and are equity ETFs. We counted only two fixed income. They usually contain the benchmark’s type in their name. For example, in August this year, HSBC launched its HSBC MSCI Europe Climate Paris Aligned UCITS ET, and its MSCI USA Climate Paris Aligned UCITS ETF. Both replicate the MSCI Europe and USA PAB.

In term of fund size, the largest ETF in this segment of the investing world is the €1.9 billion Amundi MSCI World Climate Transition CTB. It replicates the MSCI World Climate Change CTB Select Index, which reweights securities based upon the opportunities and risks associated with the climate transition, in a bid to meet the EU CTB label minimum requirements. The index aims to reduce its greenhouse gas emissions intensity by at least 30%, and is designed to meet a year-on-year 7% decarbonisation target.

The Morningstar Low Carbon Designation

According to our data, 10 of 31 European ETFs replicating EU climate benchmarks gained a Morningstar low carbon designation. The designation is an indicator that the companies held in a portfolio are aligned with the transition to a low-carbon economy.

To receive the designation, a portfolio must meet two criteria:

- A 12-month trailing average Morningstar Portfolio Carbon Risk Score of below 10. The score is the asset-weighted carbon-risk score of the equity or corporate-bond holdings in a portfolio averaged over the trailing 12 months, and relates to long positions only. To calculate a portfolio’s carbon risk scores, Morningstar uses Sustainalytics’ carbon-risk ratings. The scores range from 0 to 100, and lower scores are better. To receive the score, at least 67% of portfolio assets must have a carbon-risk rating from Sustainalytics. The percentage of assets covered is rescaled to 100% before calculating the score;

- A 12-month trailing average exposure to fossil fuels less than 7% of assets, which is approximately a 33% underweighting to the global equity universe. A portfolio’s fossil-fuel exposure is a key driver of its overall carbon intensity.

The designation is calculated quarterly.

j

j

Lower Carbon Risks and Fossil Fuel Involvement

The EU Climate benchmarks’ ETFs have a lower carbon risk than their peer groups and a fossil fuel exposure well below 7%. BNPP Easy Low Carbon 100 Europe PAB® ETF, for instance, is the only fund with zero fossil fuel involvement. Lyxor Net Zero 2050 S&P500 Climate PAB, meanwhile, has the lowest carbon risk score among the ETFs with Low carbon designation (all carbon metrics are calculated as of 30th June 2021).

We expect that more EU Climate benchmarks’ ETFs will be awarded the designation in the upcoming months, as the availability of data and the coverage increase. Many such funds were launched recently and have not yet met the requirements for the calculations.