Caught on camera discussing the COP26 climate summit earlier this month, the Queen said it was “irritating” when “they talk, but they don’t do.” At the time, she was talking about our political masters, but her comment applies as much to the business world.

Across the globe, companies are committing to “net zero” carbon emissions as a means of combating climate change.

The world’s two largest public companies, Microsoft (MSFT) and Apple (AAPL), for example, are both aiming for carbon neutrality by 2030.

British pharmaceutical giant AstraZeneca (AZN), meanwhile, says it will “ensure its entire value chain is carbon negative” by the same date. Japan Airlines (9201), like many in the world of aviation, is targeting net zero by 2050. So too are energy majors, including Total (TTE), BP (BP.), and Shell (RDSB).

Uncomfortable Truths

Climate-focused investors should not take these pledges at face value. Setting out long-term goals and an emphasis on the “net” side of the equation can give a company a public relations boost while avoiding the difficult work of seriously reducing emissions.

Consider the following:

- An Accenture study recently found that just 9% of European companies are on track to meet 2050 emissions reductions targets;

- In May 2021, a court in the Netherlands told Royal Dutch Shell that its net zero commitment – which was agreed under shareholder pressure – was inadequate;

- Australian gas supplier Santos faces a legal challenge over whether its net zero plans for 2040 are "clear and credible".

As a new report from Morningstar on the transition to a climate resilient planet shows, investors today face a difficult task.

Firstly, they must separate the companies paying lip service from those taking measurable steps to cut emissions and create a low-carbon economy. That's the mandate of the European Union’s (EU) Sustainable Finance Action Plan, which targets a 55% emissions reduction by 2030.

Climate Indexes

There are some solutions. New Morningstar equity indexes, for instance, use climate research from Sustainalytics to help investors achieve the EU requirements while getting broad market exposure.

The indexes can guide investors that want to align their portfolios to a 1.5-degree Celsius warming scenario, funnel capital to companies taking real action on climate change and get beyond empty “net zero” pledges.

Nevertheless, it is still hard to keep up with all the dire climate reports. Here are just a few:

- In August 2021, the United Nations’ Intergovernmental Panel on Climate Change issued a “Code Red to Humanity” in a report, and warned that limiting the global temperature rise to the 1.5-2 degree Celsius range “will be beyond reach” without “strong and sustained” emissions reductions;

- The World Meteorological Organization estimates that weather disasters involving floods, wildfires, and heatwaves, have become four to five times more common, and have caused seven times more damage over the past 50 years;

- The Network for Greening the Financial System, which comprises 90 central banks, has warned global gross domestic product could fall 5% below its expected 2050 level if we fail to reduce greenhouse gas emissions.

Detailed Roadmap

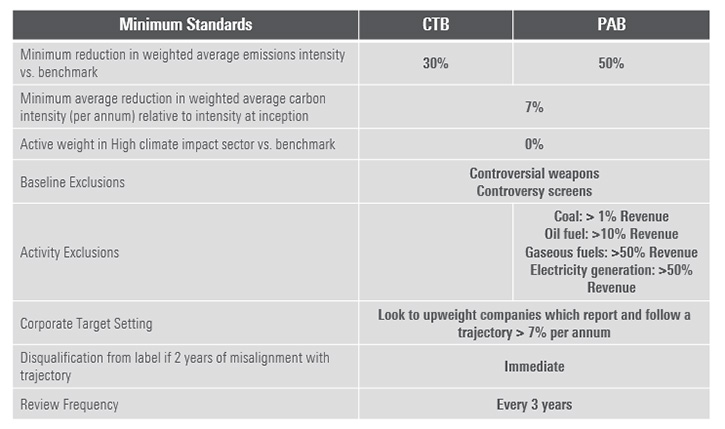

The EU’s Sustainable Finance Action Plan lays out a detailed road map for investors. Among many mandates, covering companies and their investors, are provisions for index providers. Investment strategies aiming to reducing carbon emissions must reference a climate benchmark badged in one of two ways:

- EU Climate Transition Benchmarks (CTB);

- EU Paris-aligned Benchmarks (PAB).

While the PAB is more demanding than the CTB, both standards require significantly reduced portfolio-level carbon intensity, the avoidance of high-carbon activities, and emissions reductions over time.

Morningstar’s EU Climate Indexes are based on several threads of Sustainalytics data:

- Scope 1, 2, and 3 emissions data, which are reported when available and estimated when not (Note: more than one third of companies in sectors where climate change is a material issue do not disclose emissions);

- Carbon risk ratings: these are forward-looking measurements that evaluate how well companies are transitioning to the low-carbon economy;

- Controversial product involvement data and environmental, social and governance controversy research.

Morningstar also cross-references the "Science-Based Targets" initiative, which helps companies gauge the extent and the timing of greenhouse gas emissions reduction programmes.

Look at the Pledges

While a company is more likely to decarbonise its operations, supply chains, and products and services if it makes public commitments, investors should equally scrutinise the pledges themselves.

Some net zero commitments, for instance, invoke the promise of carbon removal technologies whose future is very uncertain. The very concept of carbon neutrality can involve shifting emissions around through divestments and offsets that may reduce an individual company’s footprint but do nothing to combat climate change. “Net zero” obviates the difficult work of real emissions reduction, much like a weight loss plan might do if it did not include any exercise or a healthy diet.

Morningstar EU climate indexes employ a few exclusions, but rely principally on a tilt methodology to assign companies above and below market weight based on carbon intensity, carbon risk, and whether they offer green solutions.

Here are some index constituents that do very well, well, and not so well based on this methodology.

King Kone

Finnish elevator manufacturer Kone is aligned with the 1.5 degree celsius scenario. It receives maximum index weight for these reasons:

- Its emissions intensity is much lower than the industry median, and it demonstrates a steady year-on-year reduction trend;

- It has a carbon risk rating of ‘Low’ from Sustainalytics;

- Kone uses renewable energy for part of its operations, in line with good practice (5%-10%), reports its Scope 3 emissions, and considers environmental impact at each stage of development;

- It has shown commitment to the ‘green buildings’ agenda, in a bid to increase energy efficiency and safety;

- It has also set empirical targets for a 50% cut in emissions, as well as carbon neutrality by 2030.

Winning Whirlpool

US home appliance manufacturer Whirlpool receives above-market index weight, for these reasons:

- It participates in more than 45 programmes in different states, provinces, and countries to recycle or reuse appliances;

- Though its operations are quite carbon-intensive, it remains at ‘negligible’ carbon risk because of its management strategies. The company has reduced energy intensity by roughly 12% since 2015, and achieved a 20% reduction in its absolute emissions.

- Whirlpool has committed to the Science Based Targets initiative and has formulated a goal to reduce greenhouse gas emissions from its manufacturing plants by 50% by 2030.

Volkswagen’s late entry

German car giant Volkswagen receives below-market index weight because:

- Though it is attempting a comeback from its 2015 emissions scandal, it continues to rely on diesel models, and has made a relatively late entry to the electric vehicle race, which threatens its ability to meet EU emissions targets;

- It has a carbon risk rating of "high" from Sustainalytics, as its revenues from electric vehicles are lower than competitors like Tesla.

- It has also disclosed it is facing at least $120 million in fines for missing its 2020 EU emissions reduction targets. Its Porsche unit has also been investigated by the German authorities for allegedly falsifying fuel consumption figures.

Shelling out

Royal Dutch Shell is one of the world’s largest energy companies and receives a well-below-market index weighting, because:’

- Like Volkswagen, it has a carbon risk rating of “high”. Although it has begun diversifying into hydrogen energy, energy storage, and renewables, none of those represents a significant streams of revenue for the company;

- Shell’s business strategy remains focused on the production of hydrocarbons, and it anticipates over $10 billion of near-term spending on integrated gas and upstream projects, compared with $2 billion to $3 billion plans for renewables spending;

- While Shell has committed to reducing the carbon intensity of its business (including emissions from the use of its products) by 100% by 2050, and has an interim reduction goal of 45% by 2035, this trajectory is not aligned with a net-zero target. It is reliant on “future technologies” to meet its goals.

- A Dutch court has also ordered further emissions reductions, exposing Shell to more climate litigation and climate governance incidents.

Climate Indexes to What End?

The COP26 conference is taking place against the backdrop of a world that is wrestling with the catastrophic consequences of climate change and struggling to take action.

For investors, climate benchmarks are important tools. They can guide a climate-sensitive strategic asset allocation, provide yardsticks for active strategies, and underly passive investments.

investors want to be at the forefront of the transition to a 1.5 degree Celsius scenario and direct capital toward climate solutions. Others are looking to mitigate climate-related risk, or just meet regulatory requirements.

Morningstar’s EU Climate Indexes significantly lower portfolio-level carbon intensity. The Global Markets Paris-Aligned Benchmark displays carbon intensity more than 50% lower than its parent index, while the Climate Transition Benchmark is 30% less carbon intensive.

Meanwhile, the climate indexes have delivered marketlike risk and returns over their back-test period. They provide broadly diversified equities exposure and do not deviate substantially from market weights from a sector or regional perspective.

As climate risk is increasingly accepted as financial risk, the goals of lowering carbon intensity and delivering a successful investment experience will likely converge. Investors need the ability to separate empty “net-zero” promises from those made by companies combatting positioning themselves for a world less dependent on fossil fuels.

Dan Lefkowitz is strategist, index products, for Morningstar’s indexes business, which licences indexes commercially for the business

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)