As troubled Chinese real estate developer Evergrande Group teeters on the brink of what could become China’s largest-ever debt restructuring, its effects are being felt across global bond and stock markets.

Behind the market volatility are fears that a default by the world’s most indebted company could send shock waves through China’s economy and beyond. Away from the initial panic, several emerging markets debt fund managers expressed more nuanced views of both Evergrande itself and the likely fallout of a potential Evergrande default

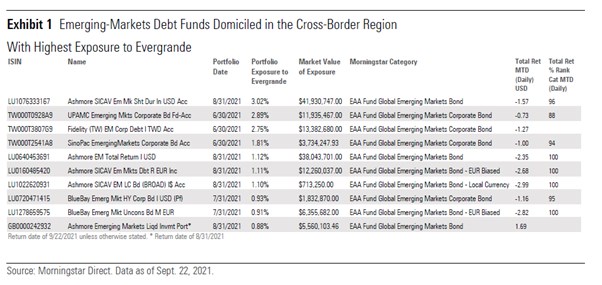

Exhibits 1 shows the emerging markets bond funds in Morningstar’s cross-border fund databases with the largest exposure to Evergrande’s bonds.

Among emerging markets fund managers whose strategies are rated by Morningstar, several had voiced misgivings about Evergrande for some time. The emerging markets teams at Pimco, Barings, and T. Rowe Price have avoided or have been significantly underweight in the company in their portfolios since at least mid-2020, when the Chinese government announced stricter debt limits for highly leveraged companies. Others were initially more optimistic, but as concerns grew, they fully exited China Evergrande in August 2021 (in the case of TCW) and September 2021 (HSBC). Still, these managers are far from pessimistic about the Chinese real estate sector as a whole or the possibility that a default by Evergrande could cause ripple effects across the broader markets.

The Bears

Pimco

Pimco’s global emerging markets debt group, headed by Pramol Dhawan, grew increasingly wary of Evergrande’s risks over the past two years. Dhawan and co-manager Yacov Arnopolin run Pimco Emerging Markets Bond, which has a Morningstar Analyst Rating of Bronze (sold in Europe and Asia as Pimco GIS Emerging Markets Bond). That portfolio held a small stake (20 basis points) in Evergrande’s bonds at the start of 2020, but the managers eliminated the funds’ exposure to the company over the course of the year as regulatory pressures mounted. That decision echoed the views of Pimco’s top Asian credit specialist Stephen Chang, who has kept exposure to Evergrande in his Pimco GIS Asia Strategic Interest Bond (rated Neutral) and Pimco GIS Asia High Yield Bond strategies well below the benchmark’s weight for the past two years while favouring its shorter-dated bonds. Still, the team is optimistic about the Chinese real estate sector’s long-term prospects, noting that housing demand in the country remains robust. As other sellers rush to offload the bonds of Chinese developers, Pimco’s managers say they are now looking for opportunities to invest in those that have manageable debt loads and that are active in China’s more stable coastal and urban housing markets.

Barings

Barings’ emerging markets debt team (which runs Silver-rated Barings Emerging Markets Sovereign Debt and Bronze-rated Barings Emerging Markets Local Debt) has not had Evergrande on its buy list for several years. Lead manager Ricardo Adrogué and his team prefer companies that they think have diversified sources of funding, access to international capital markets, and strong track records. While they have not avoided the Chinese real estate sector as a whole, they preferred to focus on companies benefiting from specific catalysts such as rental/recurring income or participation in urban renewal projects.

The team believes the Chinese government will seek to ensure an orderly restructuring of Evergrande, helping to calm markets – but it believes that offshore investors in the company’s USD-denominated bonds will be served last after homeowners, suppliers, and onshore creditors have been compensated. Ultimately, the team expects recent Chinese government policies aimed at reducing debt in the real estate sector to result in greater industry consolidation, with stronger, larger developers becoming more dominant as weaker, smaller developers eventually exit the sector.

Adrogué and his team don’t expect current events to result in longer-term losses for the Asian high-yield bond market, but they are bracing for some short-term discomfort. They expect some Asian borrowers to be shunned by international capital markets while uncertainty around Evergrande persists. Barings Emerging Markets Corporate Bond had a significant overweighting in both China (16% of assets versus 7% in its benchmark as of end-July 2021) and the real estate sector (13% versus 10%), with a large position in Hong Kong-based developer Kaisa Group Holdings.

T. Rowe Price

In recent years, T. Rowe Price’s emerging markets debt team was cautious on Evergrande’s bonds but dabbled in the debt when valuations turned enticing. Lead portfolio manager Samy Muaddi runs Neutral-rated T. Rowe Price Emerging Markets Bond (sold in Europe as T. Rowe Price Emerging Markets Bond I USD), which held no Evergrande debt at the start of 2020 but bought a modest amount at cheap valuations after the coronavirus-driven sell-off late in the first quarter of 2020. Roughly six months later, the team sold its remaining position, as the analysts grew wary of Evergrande’s ability to maintain onshore financing. Despite a negative outlook on Evergrande specifically, Muaddi and his team have incrementally added to China property names that appear more fundamentally sound but have sold off excessively given Evergrande-motivated headlines. This investment cohort believes that Chinese regulators will tolerate the impending Evergrande default as a “controlled detonation.” The group considers the deleveraging of the Chinese property sector more broadly a positive development for future investments there.

HSBC

Alfred Mui, HSBC’s head of Asian credit and part of the team behind Neutral-rated GIF Asia Bond, has likewise viewed Evergrande with caution. In his Asian high-yield strategy HSBC GIF Asia High Yield Bond, Mui kept exposure to Evergrande and its affiliates well below the benchmark's weights since the start of 2021. (Evergrande and its subsidiary Scenery Journey Ltd. accounted for 7.05% of the JACI High Yield Index in January 2021, compared with 4.74% in the fund.) Mui’s team fully exited its Evergrande stake in early September, commenting that the company’s push to raise cash by disposing of assets faces logistical hurdles, while its ability to generate revenue through its regular business lines could be stymied by liquidity challenges.

Though HSBC’s analysts don’t think the firm is in danger of losing the support of Chinese banks, they expect Evergrande to undergo a multiyear debt restructuring, which they say will likely favour local investors over international creditors, making the recovery value for its dollar-denominated bonds too low to be worth the costs of involvement. Still, Mui’s team remains upbeat about the Chinese real estate sector as a whole. The team notes that the current market dislocation has pushed yields into the double digits on 40% of all bonds issued by below investment-grade Chinese property developers, a unique opportunity for bottom-up-driven bond-pickers to find value.

Meanwhile, they expect the Chinese government to slow its monetary tightening push in the systemically important real estate sector in light of the Chinese economy’s slowing growth momentum, providing additional support to the market segment. Still, the team points out that Evergrande is not the only overleveraged Chinese property developer in the market and will likely not be the last to face insolvency. The team cautioned that the Asian banking sector, which is significantly exposed to the real estate sector, could encounter pitfalls ahead.

TCW

TCW’s emerging markets fixed-income team started 2020 with a more constructive view of Evergrande than peers, but it grew concerned and trimmed its positions throughout 2020 and the first half of 2021. Gold-rated TCW Emerging Markets Income (sold in Europe as TCW Funds Emerging Markets Income), which is comanaged by Penny Foley, David Robbins, Javier Segovia, and Alex Stanojevic, accounted for more than 1.0% of the portfolio in Evergrande as of April 2020, but the team trimmed that position to 0.48% by the end of 2020 and fully exited it by August 2021. By August 2021, the team was convinced Evergrande would likely need a comprehensive debt restructuring, noting that there isn’t a clear precedent for a massive $304 billion restructuring that would involve hundreds of projects. TCW is waiting for the Evergrande situation to stabilise before moving into select higher-quality (investment-grade and higher-quality high-yield) Chinese property developers that sold off in contagion.

The Bulls

Other fund managers have viewed Evergrande in a more positive light in recent months. London-based fixed income boutique Bluebay, home of Bronze-rated Bluebay Investment Grade Bond, started off the year with sizable Evergrande overweightings in several of its funds, including BlueBay Emerging Markets High Yield Corporate Bond (a 3.6% stake in December 2020) and BlueBay Emerging Markets Unconstrained Bond (2.9%). While the team trimmed those positions through July 2021 to roughly 90 basis points in each portfolio, the stakes were still among the largest held by any global emerging markets debt fund in Morningstar’s database.

The emerging markets teams at BlackRock, UBS, and Ashmore have likewise tied their luck to Evergrande’s debt, though the motivation and timing of each has differed.

BlackRock

When prices for Evergrande’s bonds plummeted in August and September, BlackRock’s emerging markets debt team, led by Sergio Trigo Paz, saw an opportunity. The group manages a number of global emerging markets bond strategies, including Bronze-rated BGF Emerging Markets Bond. The team has maintained a cautious stance toward Chinese government and corporate debt, reflected in underweightings in the country across its strategies, since the start of 2021. Nonetheless, as Evergrande’s bonds reached distressed levels in mid-September, the group added the company’s debt to five of its strategies, including a 0.50% off-benchmark stake in BSF Emerging Markets Short Duration and a 1.13% off-benchmark stake in BSF Emerging Markets Flexible Dynamic Bond. The team argues that, with Evergrande’s chances of a distressed exchange or takeover by a state-owned company considerable, the recovery value of the bonds is likely to exceed their current price of roughly 30 cents on the dollar.

BlackRock’s head of Asian fixed income Neeraj Seth and his comanagers at Bronze-rated Asian Tiger Bond are likely less satisfied with their timing. As Chinese economic growth picked up in late 2020 and early 2021, Asian Tiger Bond’s managers boosted their exposure to high-yield Chinese issuers, including an overweighting in Evergrande. This exposure detracted from the fund’s performance in the first seven months of 2021, but undeterred, Seth and his colleagues further boosted their Evergrande exposure in August 2021 as prices fell; at the end of that month, the fund held 0.82% in the company, compared with the benchmark’s 0.47%.

UBS

UBS is one of the larger holders of Evergrande debt, particularly in its Taiwan-domiciled fixed-term bond funds (2.7% of assets in UBS (TW) Emerging Asian Markets Bonds 2026 as of the end of June 2021) and the Asian high-yield portfolios (close to 1.5% of assets in UBS (Lux) BS Asian High Yield). Total exposure to China Evergrande debt totaled USD 283 million across multiple UBS portfolios (based on portfolio data ranging from June to August 2021). As the issuer’s struggles came to light, the investment team opted for lower exposure in its actively managed funds but has decided to keep exposures unchanged in its fixed-term bond funds, arguing that the bonds are now trading at or below typical historical recovery values. The team is confident that construction activity will resume and that government intervention, while not necessarily resulting in a full bailout, should be sufficient to allow Evergrande to continue operating. The managers also believe that this credit event should remain relatively contained, with no significant spill-over effects on the broader Asian high-yield market. Indeed, the Luxembourg-domiciled UBS (Lux) Key Selection SICAV - Credit Income Opportunities (USD) was one of the funds with the largest total exposure to Chinese nongovernment debt in our list (18.7% of assets as of June 2021).

Ashmore

London-based emerging markets giant Ashmore Group remains one of the largest holders of Evergrande bonds, with $146 million held across several portfolios (based on portfolio data collected by Morningstar from June to August 2021). In particular, Ashmore Emerging Markets Short Duration Institutional had the largest individual stake in Evergrande (5.2% of assets as of end June 2021), with multiple other open-end funds posting exposures greater than 1% of assets.

The team sees the recent extension of an interest payment deadline for Evergrande by China’s top regulator as a sign that an orderly debt restructuring is a more likely outcome than liquidation. The firm expect some level of market contagion but is still not very concerned about a domino effect on the overall Chinese real estate market. It also doesn’t expect that China’s regulatory tightening within the real estate sector (that is, the introduction of the “three red lines policy”) will create difficulties for less indebted Chinese issuers.

Ashmore Emerging Market Short Duration, its UCITS counterpart, and Ashmore Emerging Markets Corporate Income ESG have some of the highest exposures to Chinese corporates within the emerging markets debt Morningstar Category. Such bold bets are not unusual given the team’s aggressive investment style. Country exposures in the team’s funds tend to deviate significantly from the index, and the team has historically dabbled in distressed debts such as Argentina and Venezuela, with mixed success. Ashmore Emerging Markets Corporate has also been one of the most volatile funds in its peer group, with a standard deviation almost double its index’s over the team’s tenure.

BlueBay Asset Management

BlueBay Asset Management also continues to own China Evergrande in several portfolios: As of September 20, there was a roughly 40-basis-point overweighting in BlueBay Emerging Market High Yield Corporate Bond and an absolute position of 0.67% of assets in the benchmark-agnostic BlueBay Emerging Markets Unconstrained Bond. The team believes that current pricing for these bonds (around the mid-20s) fully reflects the default probability, and it has thus gradually started adding China Evergrande exposure to the portfolios. The team also believes that weaker local credits like Guangzhou R&F and CENCHI are likely to come under further stress owing to tight financing conditions, but it believes other high-yield names such as Kaisa, Zhenro, and Agile remain well-supported. The team is ready to add back to some of these issuers as soon as the managers see signs of market stabilization.

A Rocky Road for Chinese Corporate Bonds

With Evergrande’s stumbles reverberating loudly across the Chinese USD bond market, investors in funds that had bet big on Chinese corporates are likely to feel some pain in the near term.

While some of the recent headlines may make investors want to reach for the panic button, it’s important to remember that periods of market volatility are a normal part of investing. However, emerging markets corporate bonds are particularly prone to idiosyncratic and geopolitical risks. Investors should therefore favour funds that boast experienced, capable management teams following repeatable investment processes, including sensible concentration limits for individual issuers and a robust risk control framework.

This report is authored by Morningstar analysts Shannon Kirwin, Patrick Ge, Mike Mulach, Saraja Samant