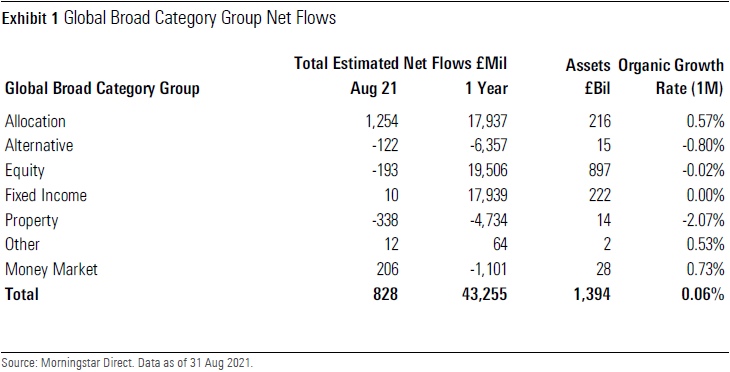

Fund flows have slowed down again in August, Morningstar data has revealed. In the past month, £828 million was added to funds in the UK, mainly due to the popularity of allocation funds.

This is down from £2.8 billion in July, a strong recovery after only achieving a net £167 million investments in June. The allocation category continues to be on a roll and was the one to ensure that funds didn’t see net outflows. August represents the 13th consecutive month of inflows above £1 billion for allocation vehicles with £1.3 billion.

The money market category also managed to attract investors, with £206 million in net inflows, but other than that, every other category saw negative or close to net zero activity.

Equity has struggled with attracting investors and saw outflows of £193 million this past month. Within the category, active and passive vehicles remained broadly similar, with active having an edge because of the continued interest in allocation. Sustainable equity funds also continue being far more popular than their environmental, social, and governance counterparts.

Fixed income funds only attracted £10 million, but we continue to see the trend of outflows from sterling bond funds into global bond funds. GBP inflation-linked bond, GBP corporate bond and GBP government bond categories saw the most redemptions, and global corporate bond and global flexible bond funds saw the highest net subscriptions.

Bhavik Parekh, Morningstar’s manager research analyst, adds that alternative and property funds remained in outflow territory. As per its May announcement, Aviva Investors UK Property was terminated, leading to a significant outflow – but other strategies also saw outflows.

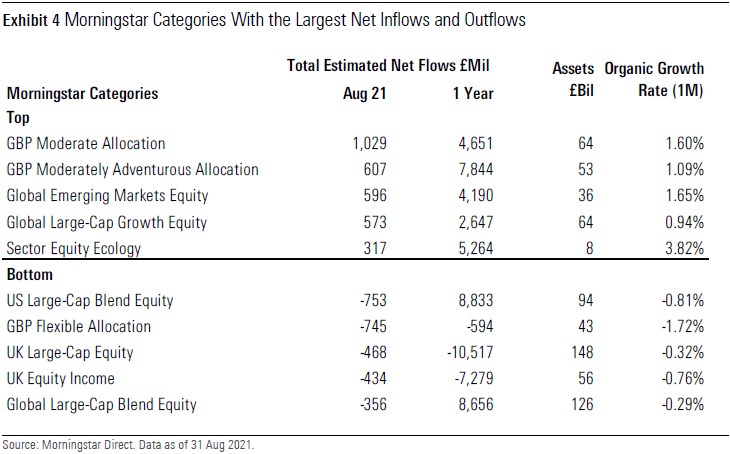

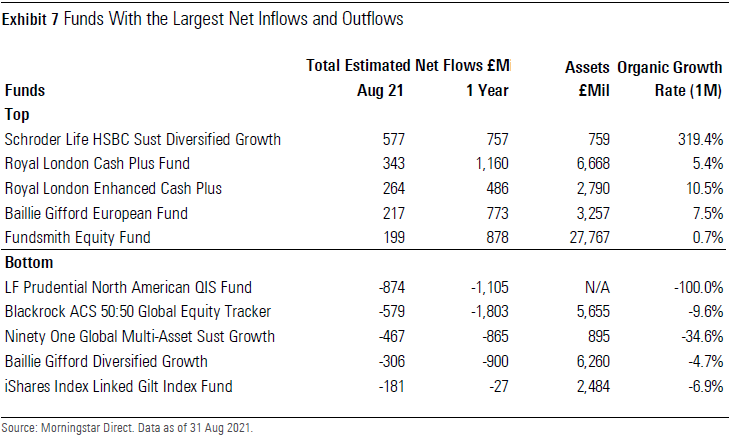

Of all categories, GBP moderate allocation and GBP moderately adventurous allocation were the most popular due to the overall interest in sustainable multi-asset vehicles. Schroder Life HSBC Sustainable Diversified Growth is a perfect example. The pension offering was launched this year, exemplifying the trend of pension assets shifting to sustainable vehicles – and it attracted £577 million in August. Elsewhere, LF Ruffer Absolute Return was another popular allocation option, with net inflows of £112 million.

Global emerging markets also did well, two trackers and two active options in particular. One of these were JPM Emerging Markets, managed by Leon Eidelman and Austin Forey, the 2021 Morningstar Fund Manager of the Year. It attracted £122 million. Fundsmith Equity saw £200 million inflows in August and is now at almost £28 billion in size. Sustainable offerings Liontrust Sustainable Future Global Growth and Baillie Gifford Positive Change also saw subscriptions over £100 million each.

The sector ecology category, which only houses sustainable vehicles, saw £317 million in subscriptions into mainly two funds: (BlackRock) ACS Climate Transition World Equity and Ninety One Global Environment. Only about 15 UK-domiciled funds are in this category, but despite its small size it is the fastest organically growing category in 2021.

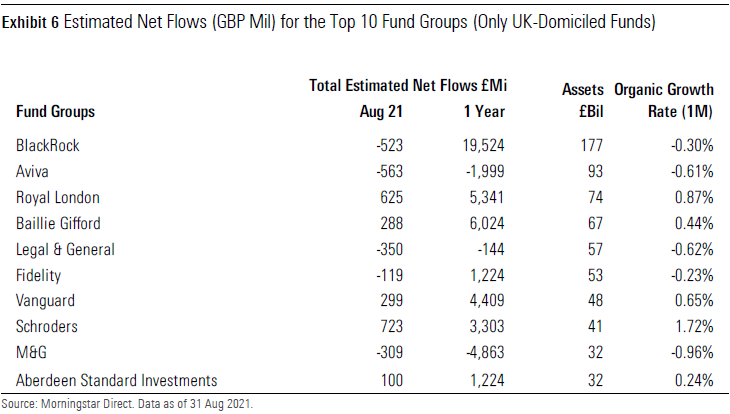

In August, BlackRock saw its highest net outflow since February 2019, the main problem fund being the BlackRock ACS 50:50 Global Equity Tracker, which had a net redemption of £579 million. The strategy has a 50% weight in the UK, so the outflow was in line with the wider trend of shunning UK large-cap equities. However, the withdrawn assets were worth far less than BlackRock’s overall growth in assets from investment performance. And, the group is still miles ahead of its peers when it comes to overall flows for the year, currently standing at £19.5 billion. Number two, Baillie Gifford, has attracted £6 billion.

Schroders had the highest inflows of any fund group largely due to its allocation fund, but other equity and energy transition funds were popular too, and the fund group attracted £723 million. Royal London saw inflows worth £625 million, mostly into two money market funds but also into its sustainable range.