As technology has advanced, consumers have got used to having everything on demand. From news to next day deliveries, our lives have become more instant. But has this affected the way we invest?

Until only a few years ago, to change the funds you hold and the amount in them would take a matter of weeks. Now, we can download an app and change details within minutes (although the funds won’t be sold immediately, of course). If we need to know information on a fund’s performance, it is there to see within seconds.

For AJ Bell head of investment research Ryan Hughes, the development of technology has started to change the way we think about investing.

He says: “I’m a believer that this constant bombardment of information is having an impact on our brain’s ability to think clearly about the long term and this becomes very relevant when looking at investments. For an industry that bangs on about the important of long-term investing, there is an unhealthy focus on short-term performance whether it is good or bad from all aspects of the industry from asset managers, the media, advisers and investors.”

This is, however, more of an issue for investors rather than fund managers. Many of whom still use the same strategy they would have used 10 years ago. Fund Calibre managing director Darius McDermott says this is absolutely not an issue for fund managers – at least the ones he speaks to. “There are still [managers] that invest in a company for an average of 10 years. Morningstar 5-star rated JP Morgan Emerging Markets Trust is a prime example of those that really take their time even researching an idea. The Matthews Pacific Tiger team also takes around three to 13 months on each idea."

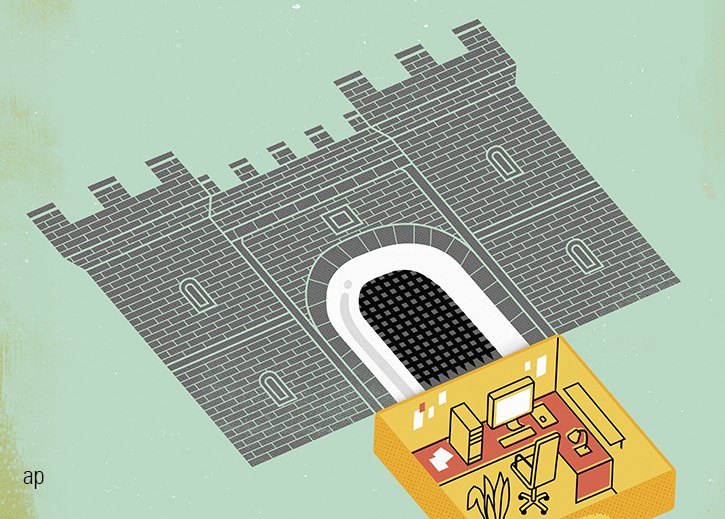

On-Demand World

Hughes, however has had a different experience. He says: “When talking to fund managers, many say they have a long-term mindset and then in the next breath tell me their average holding period is between one and three years. If I think back to when I started interviewing fund managers over 20 years ago, there has been a distinct shortening of the typical time period fund managers talk about when three to five years was much more common and access to information must be a key contributor to that fact.”

McDermott says the problem is that with an on-demand world, everything is readily available. “And most other aspects of life we can see results quickly – going to the gym and getting fit, for example, you start seeing results in a few weeks. And this is filtering through to investments. We now have apps where you can trade instantly and you are encouraged to do so repeatedly.”

“Last year, some Robinhood users were trading 5,000 a month. To put that into context, Mick Dillon who is co-manager of Brown Advisory Global Leaders says he trades about once a fortnight.”

Markets are moved by these day traders on a daily basis. McDermott says these traders care if a stock is going up or down between breakfast and lunch. “Most people should really ignore that and think about where a company will be in five years’ time. Life is too busy already to be constantly monitoring a phone for stock movements. But it’s hard not to be influenced by the daily noise – even if really it is irrelevant to your own investment goals.”

He believes the industry has “a job to do” to encourage calmer, more thoughtful long-term investing.

And more information does not necessarily help make better decisions, Hughes says, unless you have the ability to process that information effectively. “Even then, identifying what is relevant information rather than just noise becomes critical.”

What Role do Asset Managers Play?

It is also worth noting that short-term thinking doesn’t just come from the fund managers or investors though. Hughes says it can also be led by the asset management companies. “The constant push to have a marketing story risks creating a poor culture that encourages short-term risk taking which, while potentially helpful in delivering a short term sales boost, is in all likelihood going to lead to poor investor outcomes when market sentiment shift,” he says.

Recent years has seen the likes of Fundsmith, Lindsell Train, Baillie Gifford and Troy all talk about the importance of investing and thinking for the long-term, which has almost certainly been backed up by each company’s returns.

“Perhaps it’s no coincidence that fewer companies are now choosing to list on the stock market where the constant demand from investors to hit quarterly earnings estimations stifles the ability to think strategically for the long term,” Hughes adds.

Looking back 30 years ago, to find a company’s report you would have to go to a library to access the reports (unless you were the early dial-up users – even then you would spend a good hour trying to download the information). Today, you can access the same information in seconds. McDermott says “It’s hard to get an edge on the analytical side of investing today – you have to get an edge by thinking more long-term and about investor behaviour.”

As technology continues to evolve and play a larger part of our lives, short-term investing is only going to continue. Looking into long-term investing has a vital part to play in achieving proper returns and discover some patience.