Electric vehicles are poised for massive growth over the next decade, but that doesn't mean that every EV startup is a safe investment. Investors should weigh the risks of buying into new companies in the space.

US President Joe Biden recently announced plans to sign an executive order that targets electric vehicle sales in the United States. The executive order would call for electric vehicles (including hybrids) to make up 40% to 50% of new auto sales by 2030. The announcement, along with congressional plans to boost charging infrastructure, could help pave the way for growth and adoption in the U..

Established automakers like Tesla (TSLA), BMW (BMWYY), Ford (F), and General Motors (GM) have already started positioning themselves to take advantage of global EV growth by expanding their EV offerings for the long term. Growing electric vehicle adoption will also create opportunities for companies throughout the EV supply chain, including charging, batteries, and semiconductors.

And start-up companies are also getting into the mix, but these new entrants may carry high company-specific risks that could hurt investor returns even if EV adoption continues to grow.

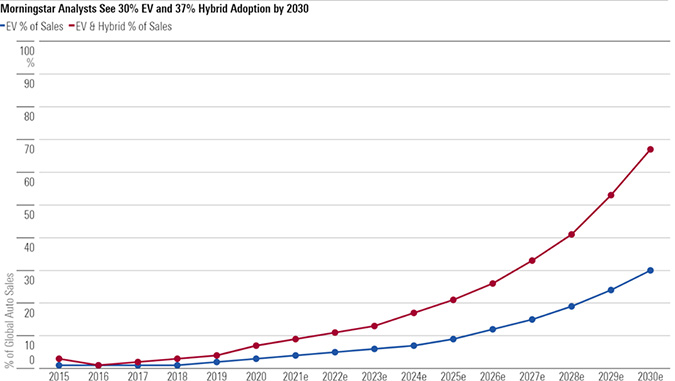

Morningstar analysts expect significant growth in the electric vehicle space over the next decade. In the 2021 Electric Vehicle Observer, they forecast that by 2030, some 30% of global auto sales will be electric vehicles and 37% will be hybrids. This rapid EV adoption will be driven by expanded charging infrastructure being built throughout China, Europe, and the US; falling costs for entry-level cars; and performance parity between EVs and internal combustion engines.

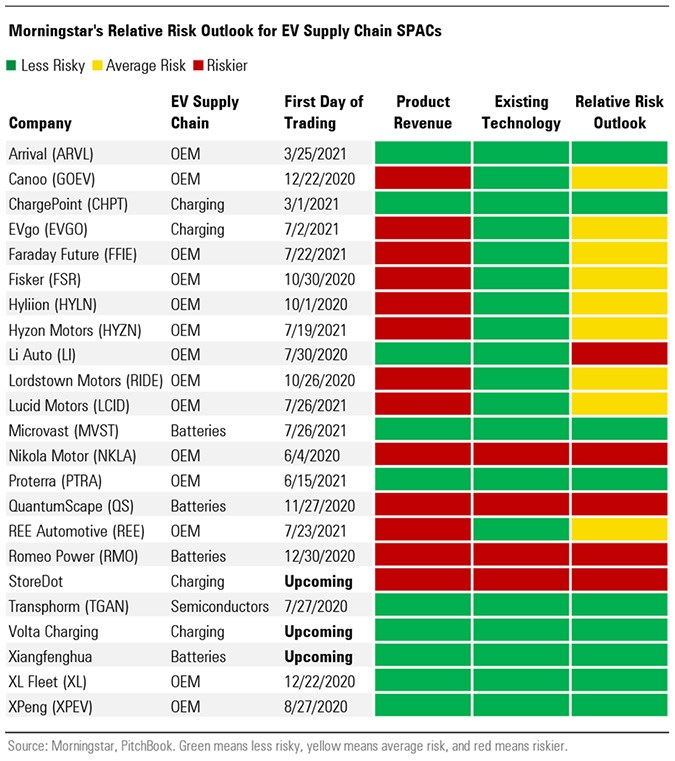

How to Assess Relative Risk

Morningstar senior equity analyst Seth Goldstein believes special-purpose acquisition companies, or SPACs, are one of the riskiest ways to play growing this trend. While these newly public companies tend to generate market enthusiasm, they also tend to be in early growth stages. Some of these companies need significant growth to reach profitability, while others are still developing products that may never commercialise.

Overall, company-specific risks could outweigh their exposure to electric vehicles, Goldstein says, and investors may not benefit from growing EV sales when they buy into SPACs or other new entrants.

Morningstar doesn't cover any private or newly public EV companies, but our equity analysts have constructed a simple framework to help evaluate a company's risk compared with its early-stage peers.

The framework includes three factors:

- Product Revenue. Has the company successfully commercialised a product and begun to sell it?

- Existing Technology. Is the company a new entrant in an existing market or banking on a technological breakthrough to generate revenue?

- Relative Risk Outlook. How does a company's risks compare with those of other SPACs?

When looking at product revenue, Morningstar analysts exclude pre-orders because a development product may never reach commercialisation. Take Lordstown Motors (RIDE), for example. The company went public via a SPAC in October 2020 before delivering any electric vehicles to market. In June 2021, the company revealed to the US regulator that it didn't have enough capital to start commercial production and warned that it may not be able to stay in business through 2022 if it fails to raise additional capital. This was despite Lordstown Motors' earlier claims that it had received over 100,000 pre-orders for its vehicles. According to PitchBook, a Morningstar company, Lordstown Motors is in talks to receive $400 million through a private placement as of July 26, 2021.

While brand new technology may drum up enthusiasm around a company, it also means the risk of failure is higher. For example, QuantumScape (QS) is attempting to produce and sell a solid-state battery. This technology has never been successfully commercialised in autos. As a result, EV adoption could rise, but investors in QuantumScape may not benefit if the company is unsuccessful in making its solid-state battery.

Overall, a company attempting to create a new technology that has never been commercialised is riskier than a new entrant into an already existing market. In that same vein, Morningstar analysts generally view SPACs as riskier than more mature firms that are already generating revenue and have reached profitability.

The table below shows the relative risk of EV companies that have recently gone public or will go public via SPAC in terms of product revenue, existing technology, and their relative risk outlook:

While these companies aren't under formal coverage, Morningstar analysts view Arrival (ARVL), ChargePoint (CHPT), Microvast (MVST), Proterra (PTRA), Transphorm (TGAN), Volta Charging, Xiangfenghua, XL Fleet (XL), and XPeng (XPEV) as relatively less risky than the rest of the group. These companies, which cover various areas of the EV supply chain, have all successfully commercialized their products and reached profitability, but questions remain about their long-term viability. Still, these companies may be worth looking into as the EV market continues to expand.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)